A few more stock pullbacks, and then a big one, are coming, warns this manager. Here’s how investors should prepare.

A recent string of wins for stocks markets — the best percentage gains since 2020 for major indexes — is some improvement on the grim start we got to 2022. (Tech is ready to absolutely dazzle again for Wednesday, thanks to Alphabet.)

But yes, it’s early and yes, the veterans are wary. Among them, chief investment officer at CIBC Private Wealth U.S., David Donabedian, who in our call of the day tells investors to expect a “single-digit” return year, with “three or four” smaller pullbacks, then a big one.

“We enter 2022 with relatively high valuations, a 7% inflation rate in the U.S. and the three greatest catalysts for the great bull markets coming out from March 2020, through 2021,” Donabedian told MarketWatch in an interview on Monday. He said those catalysts — monetary and fiscal policy and an earnings boom — will be less friendly this year.

“We’re going to have to get very used to at least 5% pullbacks in the market, and at some point in the year, we’re probably going to get a full-blown correction because that’s just how markets work” around policy shifts from the Federal Reserve, said the manager.

“We reminded clients coming into the year that it’s normal to have at least one 10% correction in the S&P SPX,

With that in mind, he has been positioning portfolios for more cyclically sensitive sectors that entered 2022 with relatively low valuations. Smaller companies, which got pummeled in January, have been on his radar.

“Small-caps have extraordinarily low valuations relative to large-caps and I basically said to our relationship managers, ‘If you don’t have small-cap exposure for your clients you’re underweight.’”

Drilling down further, Donabedian said he’s seeing opportunities in the biotech space. And while they own some of the megacap techs, he doesn’t see them as “table-pounding buys,” plus those types of fairly highly valued stocks aren’t the best for a Fed-tightening scenario. He’s passing on beaten-down meme names, which he tosses in with crypto, special-purpose acquisition companies and other “speculative investments.”

He said investors need to understand that the environment ahead isn’t going to be a “rising tide lifts all boats” market, as the Fed slowly raises the cost of money and pulls liquidity out of the market. Well-managed companies will thrive, but those that aren’t won’t, he said.

“There’s a Warren Buffettism about when the tide goes out, you see who’s swimming naked. There’s something to be said for that. It’s a less-forgiving macro environment for companies,” said Donabedian.

Other ways of protecting client money is by doubling down on a push for inflation protection in their equity portfolios, and one way is via a “diversified pool of commodities,” that will see a direct benefit for higher inflation. Other advice includes an underweight in traditional fixed income, but exposure to floating rate debt.

But the manager worries that investors really aren’t “adequately considering the implications of a permanently higher rate of inflation in the economy. And by that, I mean this is an issue that has been off the table, not even on the back burner.

“The new normal for inflation will likely be closer to 3½ percent and for four years, and I think here’s a little bit of a sense in the market of ‘Well good, that’s better than seven”, which is the current reading. But that’s a whole new world, in a number of ways and it implies that the Federal Reserve is going to have to do more to contain inflation than markets are currently expecting and that’s not just this year, that’s over a number of years,” he said.

Managing cost pressures will be a much bigger challenge and variable for companies, he said. “The end result of that will be more dispersion of returns within the market.”

The buzz

Read about the “persistent irrational optimism of U.S. investors revolving around Groundhog Day” from the Russian Ministry of Finance.

Airlines have canceled hundreds of flights as a winter storm smacks much of the U.S., with natural-gas prices NG00,

Facebook parent Meta META,

Alphabet shares GOOGL,

Hold my latte. Starbucks SBUX,

Elsewhere, Advanced Micro Devices AMD,

Ahead of Friday’s payrolls data, the ADP private-sector payrolls report showed 300,001 jobs were shed in January. Homeownership rates for the fourth quarter are also ahead.

The markets

Stock futures ES00,

The euro EURUSD,

And: As March rate increase looms, investors face ‘perilous’ backdrop of higher volatility

The chart

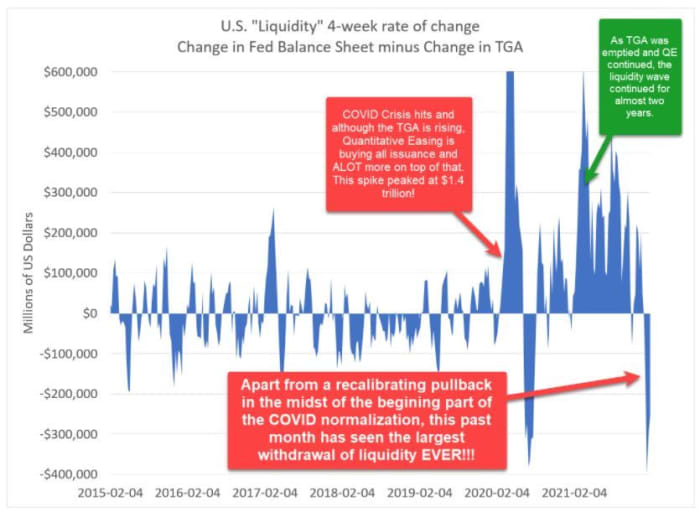

MacroTourist blogger Kevin Muir points to one possible reason for last month’s stock selloff — basically the emptying out of the Treasury General Account, the Treasury Dept’s checking account — last month. His chart shows how a massive withdrawal of $500 billion from Dec. 17, coincided with that pullback.

Read more here.

The tickers

These were the most active stock tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, |

Tesla |

| AMC, |

AMC Entertainment |

| GME, |

GameStop |

| AMD, |

Advanced Micro Devices |

| GOOGL, |

Alphabet |

| PYPL, |

PayPal |

| NIO, |

NIO |

| AAPL, |

Apple |

| NVDA, |

Nvidia |

| XELA, |

Exela Technologies |

Random reads

Going fast: Teacups marking Queen Elizabeth II’s ‘Platinum Jubbly.’

This 477-mile-long lightning bolt broke a world record.

An Italian student on Reddit wants to know why Americans struggle despite vastly higher minimum wages.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.