Weekend reads: Robinhood’s bad news — and a bit of good news

It’s been a year since Robinhood Markets Inc. HOOD,

This week, Robinhood had good news when a federal judge tossed a negligence lawsuit brought by Robinhood customers who claimed losses from being unable to purchase shares of meme stocks back in January 2021.

Then came some bad news for investors in its stock. Late on Jan. 27, Robinhood reported a fourth-quarter net loss of $423 million, while missing analysts expectations for revenue, as trading activity declined.

Shares of Robinhood were already down 35% for 2022 before they declined again on Jan. 28.

More Robinhood and related coverage:

Apple’s great numbers

As investors neared the end of a volatile week for the stock market, Apple Inc. AAPL,

More Apple coverage:

How to handle stock-market volatility

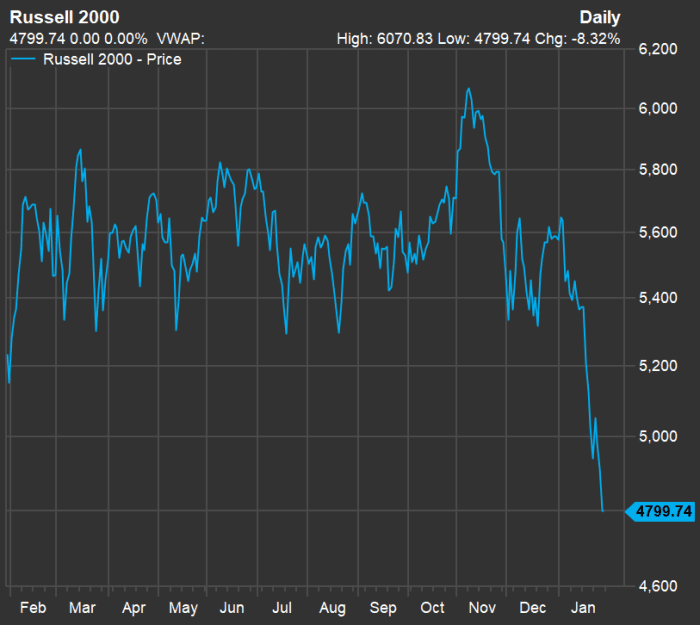

Above is a one-year chart for the Russell 2000 Index, which entered bear-market territory on Jan. 27 after declining more than 20% from its intraday high reached Nov. 8.

Fear of a prolonged period of rising interest rates has been especially tough for technology stocks that trade high relative to earnings, and policy statements this week from the Federal Open Market Committee underlined economists’ expectations of four increases this year for the federal funds rate. When discussing the end of the Federal Reserve’s bond purchases, which have held long-term rates down, Fed Chairman Jerome Powel said on Jan. 26 that a reduction in the central bank’s balance sheet would come “sooner and faster” than it had in past economic cycles.

Mark DeCambre summarized stock-market performance during previous cycles of rising interest rates, and the results may surprise you.

Here’s a sampling of coverage and opinion about the volatile stock market:

How to prepare for rising interest rates

Investors aren’t the only people concerned about rising interest rates. Jacob Passy, Elisabeth Buchwald and Andrew Keshner have advice about how to handle mortgage loans, credit cars, auto loans and savings deposits as interest rates begin to rise.

A sobering look at the economy

Rex Nutting digs into recent economic data and finds that while the Fed hasn’t raised rates yet, the stimulus to spending is already gone.

Can you put away 10% of your earnings?

If you think it is impossible — or too much of a sacrifice — to save 10% of what you earn, you better read this article by Chris Mamula.

McDonald’s looks to new or seasonal menu items

McDonald’s Corp. MCD,

This may be the time for you to shop around for Medicare Advantage plans

Open enrollment season is here for Medicare Advantage. As part of her Retirement Hacks column, Alessandra Malito lists factors to consider before March 31.

Related: Medicare Advantage vs. Medicare Supplement: Which is best?

What is happening with SPAC IPO deals?

During the pandemic bull market, investors warmed to SPACs — special purpose acquisition companies, or blank-check companies — formed to acquire companies looking to go public. A SPAC deal has fewer reporting requirements than a traditional initial public offering, and can be completed quickly. But this activity has slowed lately, with several deals pulled this week, as Ciara Linnane reports.

Tech stocks for a rebound, selected by artificial intelligence

William Watts shares a list of eight technology stocks that appear ready to bounce back after significantly declines, based on number crunching by Toggle, an AI platform that incorporates market action and macroeconomic events.

More on tech stocks:

- You can still find a haven in tech stocks: These 20 offer the safety net of highly stable profits

- 24 software stocks, including Microsoft, expected to rise by double digits over the next year

A bullish view on stocks

Michael Brush believes stock price declines in the face of rising interest rates are overblown because of the strength of the U.S. economy. He selects three stock picks for investors looking to move money into the market.

The skinny on Jeff Bezos and his $200 million naming-rights deal

Big donations like the one involving Amazon.com CEO Jeff Bezos and the taxpayer-funded Smithsonian Institution for the National Air and Space Museum are typically trumpeted by recipients, but the legally binding contracts that surround the gifts are usually kept private. MarketWatch’s Leslie Albrecht lifts the curtain on this one.

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.