U.S. Futures, Stocks Drop on Risk From Hawkish Fed: Markets Wrap

(Bloomberg) — U.S. equity futures and Asian stocks slid Thursday as Federal Reserve Chair Jerome Powell’s signal of a March interest-rate liftoff and the possibility of unexpectedly aggressive tightening whipsawed markets.

Most Read from Bloomberg

An Asia-Pacific share gauge sank to the lowest in some 14 months, with South Korea and China set for bear markets and Australia down 10% from an August peak. Contracts on the S&P 500, technology-heavy Nasdaq 100 and European stocks retreated. The Fed fallout wiped out a Wall Street rally Wednesday.

Powell reinforced the Fed’s determination to quell the highest inflation in a generation amid a robust economic recovery from the pandemic. The central bank also said it expects the process of balance-sheet reduction will commence after it has begun raising borrowing costs.

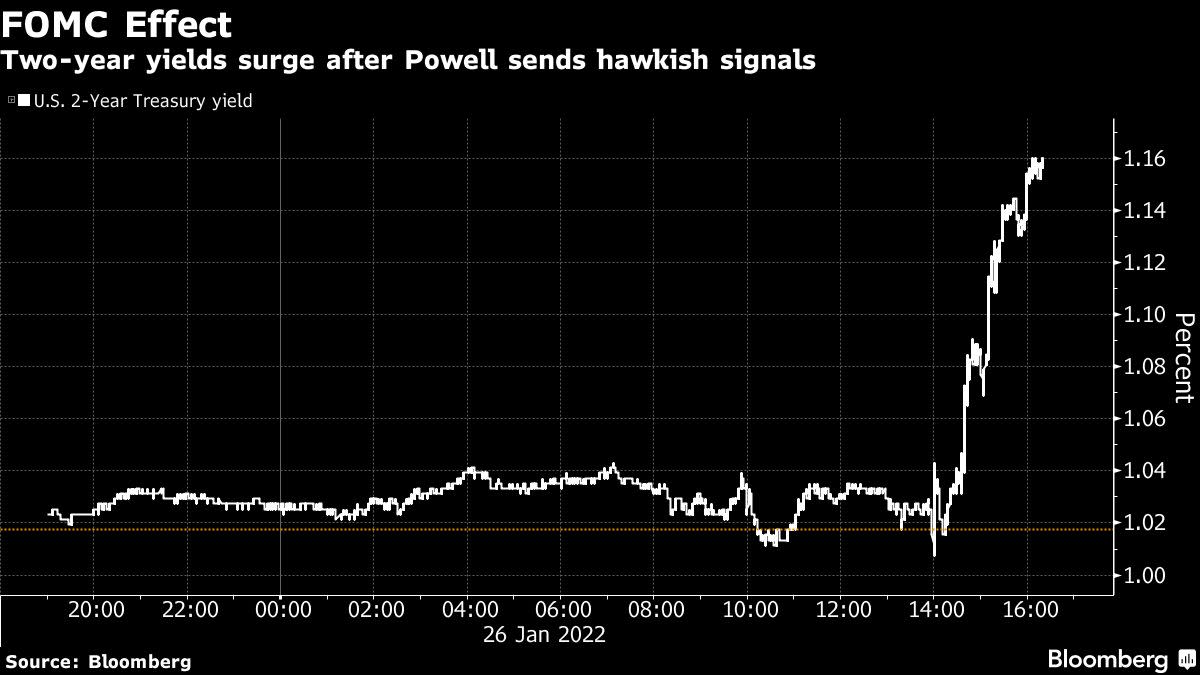

Two-year Treasury yields — acutely attuned to Fed policy — jumped in the U.S. session and were at the highest levels since the pandemic’s emergence. A key part of the yield curve was around the flattest since early 2019, hinting at concerns for growth as the Fed dials back economic support.

Global bonds succumbed to losses, including in New Zealand and Australia. The dollar was at a one-month high, while commodity-linked currencies weakened. Oil dipped, gold extended a decline and Bitcoin — whose fortunes have been tightly correlated with stocks of late — wavered around the $36,000 level.

The Fed’s flip to a hawkish stance has roiled stocks and bonds this month. Investors fear that price pressures and receding stimulus will squeeze the economy and company profits. Markets have ramped up pricing of Fed hikes, pointing to a 94% probability of five quarter percentage-point moves in 2022.

The FOMC meeting “played out more hawkishly than we expected,” Steven Englander, global head of G-10 FX research at Standard Chartered Bank, wrote in a note “The FOMC statement was largely as anticipated, but Fed Chair Powell emphasized upside risks to inflation, pointing to a steady pace of policy withdrawal.”

Investment Rethink

Powell endorsed rate liftoff in March and opened the door to more frequent and potentially larger hikes than anticipated. Strategists and investors were left reassessing the market outlook.

For instance Jian Shi Cortesi, a portfolio manager at GAM Investment Management in Zurich, argued a better monetary backdrop in Asia could support the region’s equities.

“Inflation pressure is lower in many Asian markets, and interest rates will not need to be hiked as much as in the U.S,” she added.

Meanwhile, the earnings season continues after an uneven start that has sapped investor sentiment. Shares in Samsung Electronics Co. — South Korea’s biggest company — fell after profit missed estimates.

Electric-vehicle maker Tesla Inc. set a record for profit but warned of supply chain problems. Tech giant Intel Corp. fell on a disappointing forecast.

On the geopolitical front, the U.S. delivered a written response to Russia on the crisis in Ukraine, with Secretary of State Antony Blinken saying it sets out “a serious diplomatic path forward” even though it rejected some of the Kremlin’s key demands.

What to watch this week:

-

South African Reserve Bank rate decision Thursday.

-

U.S. initial jobless claims, durable goods, GDP Thursday.

-

Euro zone economic confidence, consumer confidence Friday.

-

U.S. consumer income, University of Michigan consumer sentiment Friday.

For more market analysis, read our MLIV blog.

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 1.3% as of 12:09 p.m. in Tokyo. The S&P 500 fell 0.2%

-

Nasdaq 100 futures shed 1.5%. The Nasdaq 100 rose 0.2%

-

Japan’s Topix index lost 2%

-

Australia’s S&P/ASX 200 index fell 1.6%

-

South Korea’s Kospi index lost 2.8%

-

China’s Shanghai Composite index fell 0.8%

-

Hong Kong’s Hang Seng index fell 2.1%

-

Euro Stoxx 50 futures dropped 2.3%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was at $1.1227

-

The Japanese yen was at 114.57 per dollar

-

The offshore yuan was at 6.3431 per dollar

Bonds

Commodities

-

West Texas Intermediate crude was at $86.80 a barrel, down 0.6%

-

Gold was at $1,816.60 an ounce, down 0.2%

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.