Jobs recovery bolsters case for Bank of Canada to hike soon

Kevin Carmichael: 55,000 jobs gain puts employment back to where it would have been if the pandemic crash hadn’t happened

Article content

The “complete” recovery from the COVID-19 recession that Bank of Canada Governor Tiff Macklem said he wanted to orchestrate is within view.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

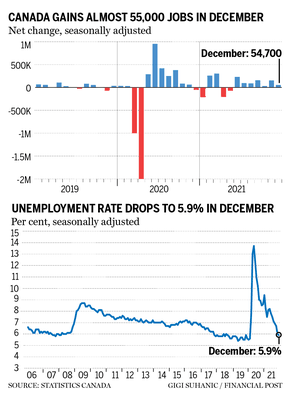

Employers created another 55,000 positions in December, putting total employment back to where it would have been if the trend hadn’t been interrupted by an epic economic collapse in March 2020, according to data released by Statistics Canada on Jan. 7. The jobless rate dropped to 5.9 per cent, somewhat higher than before the pandemic, but now comfortably in a zone that many economists associate with full employment.

Macklem has spent the past 18 months explaining that the labour market is too complex to be summed up by those two headline figures. He and his deputies have been using an array of more granular indicators to obtain a more qualitative assessment of the strength of the labour market. Many of those are now back at pre-pandemic levels, enhancing the case for an interest-rate increase soon, perhaps even at the end of the month when policy-makers next gather to update their assessment of the economy and recalibrate policy.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Statistics Canada’s “underutilization rate,” a gauge that Macklem has said he’s watching particularly closely, dropped to 12 per cent last month, the lowest since the start of the pandemic. The number — which measures the proportion of people in the potential labour force who are unemployed; want a job but have not looked for one; or are employed but working less than half of their usual hours — was 11.4 per cent in February 2020. However, Statistics Canada noted that the pre-pandemic reading was unusually low; monthly rates ranged from 11.5 per cent to 12.2 per cent in 2018 and 2019.

The participation rate — the percentage of the population aged 15 and older that is working or looking for work — was 65.3 per cent in December, matching its pre-pandemic level. The participation rate of the “core” working population, which Statistics Canada defines as people who are between 25 and 54 years old, was a record 88.3 per cent. Subsets of the labour market that were disproportionately sidelined during the early stages of the recession, including women and Indigenous workers, have now recovered, according to the latest hiring data. Full-time employment is leading the charge, further evidence that the economy has returned to a solid footing.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

-

Canada’s trade surplus swells to 13-year high, signalling economy stronger than expected

-

Burning Questions: Is Ottawa finally about to get serious about housing bubbles?

-

Macklem in year-end interview promises to rein in inflation, but not choke the recovery

To be sure, employment is about to receive a setback. Statistics Canada’s latest Labour Force Survey was completed before Quebec, Ontario and other provinces initiated new health restrictions to slow the spread of the Omicron variant. Anecdotal evidence of a COVID-induced soft patch could prompt the Bank of Canada to leave interest rates unchanged at its Jan. 26 policy announcement.

The next scheduled opportunities to raise interest rates for the first time since the start of the pandemic are March 2 and April 13. The Canadian economy is getting better at pushing through waves of COVID-19 infections, so there is little reason to bet that the pandemic will knock the Bank of Canada off its course to remove stimulus as soon as possible. The data argue against waiting.

• Email: [email protected] | Twitter: carmichaelkevin

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.