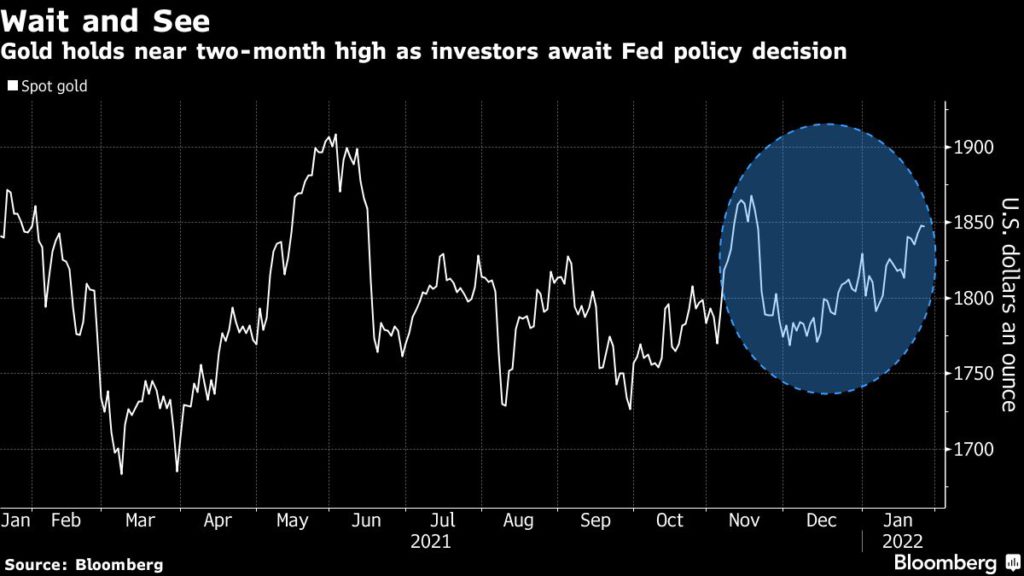

Gold price holds 2-month high ahead of Fed announcement

[Click here for an interactive chart of gold prices]

Later in the day, Fed chair Jerome Powell and his fellow policymakers are expected to signal their first interest-rate hike since 2018, setting the stage for a March move to cool inflation.

The Federal Open Market Committee is all but certain to hold its benchmark rate near zero after the two-day meeting ending Wednesday, while sticking to a plan to end its bond-buying program in March.

Bullion has risen more than 4% since the end of November amid headwinds in equity markets as investors hone in on the possibility of an error by the Fed. The risk of a Russian invasion of Ukraine and a cut in the International Monetary Fund’s world economic growth forecast for this year are also aiding the safe haven asset.

“Gold is simply becoming a Fed policy mistake hedge,” Nicky Shiels, head of metals strategy at MKS PAMP SA, wrote in a Bloomberg note. “An accelerated Fed tapering will cause financial conditions to tighten further and gold to outperform equities, to a point.”

Gold is acting like a “flight to safety trade” in a wait-and-watch scenario until after the Fed announcement, Bob Haberkorn, senior market strategist at RJO Futures, said in a Reuters report earlier.

Investors now await cues on how aggressive the Fed would be for the rest of the year and if it would signal more hikes to tackle inflation, Haberkorn added.

“Despite the Fed likely set to announce the start of a US rate hike cycle this week, gold keeps holding up well. Support for the yellow metal comes from high inflation and elevated market volatility,” UBS analyst Giovanni Staunovo commented in the same report.

“Unless the Fed surprises with an even more hawkish statement, gold (could) stay supported,” said Staunovo, adding that historically, gold outperforms equities when market volatility increases.

Recently, there has been an increase in gold demand from investors. Exchange-traded funds have added more than 5 tonnes of bullion so far this week, building on the 33 tonnes taken in the week before, Bloomberg data suggests.

(With files from Bloomberg and Reuters)