The Fed’s January two-day policy meeting is due to start on Tuesday.

March delivery contracts were exchanging hands for $4.41 a pound ($9,702 a tonne) on the Comex market in New York, down 2.4% compared to Friday’s closing.

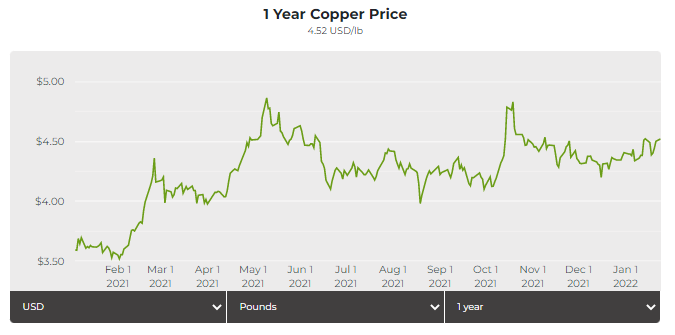

Click here for an interactive chart of copper prices.

The most-traded copper contract on the Shanghai Futures Exchange lost 1.1% to 70,480 yuan ($11,131.64) a tonne.

Copper’s fall from grace among fund players is clear to see in sliding volumes across all three major trading venues – LME, CME and the Shanghai Futures Exchange (ShFE).

Activity on the LME’s copper contract shrank by 7.0% last year, making it the second poorest performer among the London market’s core base metals suite.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/GRHWR4YQTFJNZDHD6CGDJWFVDE.png)

Goldman Sachs remains firmly in the bull camp, targeting copper to hit $12,000 per tonne on a 12-month basis.

The bank is forecasting a supply-usage deficit of 197,000 tonnes this year.

Citi, however, thinks that copper is due to a significant price correction, targeting an 8% decline over the next one or two months.

Core to the bank’s view is an expectation that Russian shipments of copper will accelerate after the expiry of a temporary 10% export tax.

Citi estimates Russia accumulated around 150,000 tonnes of copper stocks in the four months after the tax was introduced in August. That metal should hit the market over the first quarter of this year, lifting depleted LME stocks and simultaneously depressing market sentiment, the bank argues.

(With files from Reuters)