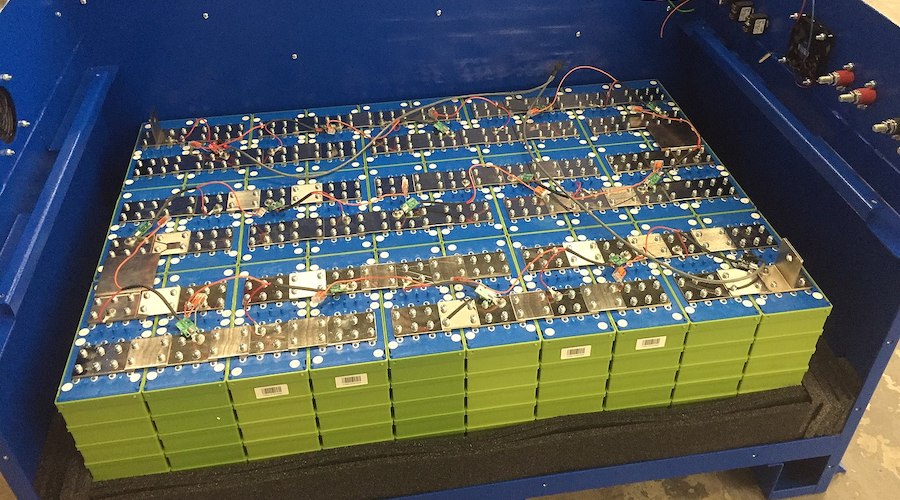

Chinese LFP battery industry increases lithium carbonate demand, drives prices up – report

According to Fastmarkets, offers for battery-grade lithium carbonate continue to rise in China, mainly due to the increased demand from the ramp-up of lithium-iron-phosphate battery production this year and consumers restocking before the Chinese New Year holiday.

The dossier notes that spot units of battery-grade lithium carbonate have been scarce in China, with several major Chinese lithium producers already sold out.

“On the supply side, some Chinese lithium producers are in maintenance and [their facilities] are being shut down in January or during Beijing Winter Olympics,” the document reads. “Despite the current high prices for battery-grade lithium carbonate, market participants are still bullish. They expect prices to rise even further in the first quarter of 2022 amid tight supply and firm demand.”

Citing a Chinese lithium trader, the price reporting agency also mentioned that the scarcity of technical-grade lithium carbonate – the typical feedstock for battery-grade lithium carbonate production – in the spot market is being widely felt with some producers not being able to fulfil their long-term contracts.

Fastmarkets’ price assessment for lithium carbonate 99% Li2CO3 min, technical and industrial grade, spot price range exw domestic China was $43,900-45400 per tonne on Thursday, up by $1,500 a week earlier.

“The scarcity of battery-grade lithium carbonate and its rapidly rising price also buoyed that of battery-grade lithium hydroxide in China, with limited supply proving additional support,” the report reads.

Fastmarkets’ price assessment for lithium hydroxide monohydrate, LiOH.H2O 56.5% LiOH min, battery grade, spot price range, exw domestic China was $37,600-29,200 per tonne on Thursday, up by $780-1,565 per tonne a week earlier.

“The price gap between battery-grade lithium hydroxide and carbonate is wide enough for converting lithium hydroxide into carbonate,” the dossier states. “As such, the price of lithium hydroxide of the same grade was also driven up, since demand increased with such conversions taking place.”

Fastmarkets’ assessment of lithium carbonate 99.5% Li2CO3 min, battery grade, spot price ddp Europe and US was $34-36 per kilogram on Thursday, up by $2 per kg from $32-34 per kg a week earlier. Similarly, the firm’s assessment of lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price ddp Europe and US was at $35.00-36.00 per kg on Thursday, up by $2.50 per kg from $32.50-33.50 a week earlier.