2 “Strong Buy” Dividend Stocks With Great Buyback Programs

It’s no secret that we’re seeing a market correction right now, and no real surprise, either. From war drums on the Russia-Ukraine border to rising inflation to the prospect of at least three Fed rate hikes coming sooner rather than late — all are likely to weigh on investors’ sentiment.

The recent downturn in the market is giving investors an incentive to move toward two of the value segment’s popular choices, stock in companies offering dividends or corporate buybacks. Both bring value to the investment, in different ways.

Dividends, of course, are direct cash payment to shareholders, and everyone loves cash in the pocket. Buybacks provide a more subtle path to value; by reducing the ‘shares outstanding’ through a buyback, a company can increase the earnings per share of the remainder. And some companies are offering investors the best of both these worlds.

We’ll take a look at two of these, using data pulled from the TipRanks database. These are Strong Buy stocks, with above-average dividend payments and plenty of upside potential. Let’s take a dive into the details, and see how they measure up with buybacks.

OneMain Holdings (OMF)

The first stock we’re looking at, OneMain, is a financial services company targeting a ‘downscale’ clientele. The company makes consumer financing available for customers with a relatively high level of risk factors resulting in poor credit histories – but not necessarily indicating inability to manage credit. For this base, which has difficulty accessing the mainstream of the credit and banking industry, OneMain offers a range of services that include personal loans, insurance, and consumer finance.

That this is a lucrative market is clear from OneMain’s consistently high revenues – between $1.2 and $1.27 billion per quarter for the past two years. The company has also been consistently beating the estimates on the bottom-line. In its last quarterly report, for 3Q21, OneMain showed adjusted earnings of $2.37 per share, once again beating the Street’s call – by $0.07.

OneMain has an active buyback program, which saw the company spend $186 million to repurchase 4.6 million shares in the calendar year 2021. The authorized repurchase amount that year was $200 million – but in mid-December, the company announced that, going forward, the repurchase authorization has been boosted to $300 million.

Along with share repurchases, OneMain provides support for stockholders through the dividend. The regular payment is 70 cents per share, annualizing to $2.80 and giving a yield of nearly 5.5%, solidly above the ~2% average among S&P-listed companies. OneMain has a long history of keeping the payment reliable, and of adding supplemental dividends every other quarter.

Among the bulls is Piper Sandler’s 5-star analyst Kevin Barker who takes a bullish stance on OMF shares.

“We believe the market is over-penalizing OMF’s stellar track record of producing wider operating margins and declining credit losses for the past several years. If we were to see a stabilization of credit trends and/or a lower targeted NCO guide, we would expect OMF to rapidly re-rate closer to other consumer lending peers in the 7.0-8.5xP/E range. Therefore, we see the stock as very attractive while trading at 4.9x FY23E P/E,” Barker noted.

In line with these comments, Barker gives OMF shares an Overweight (i.e. Buy) rating, along with a $75 price target suggesting an upside of 47% for the next 12 months. (To watch Barker’s track record, click here)

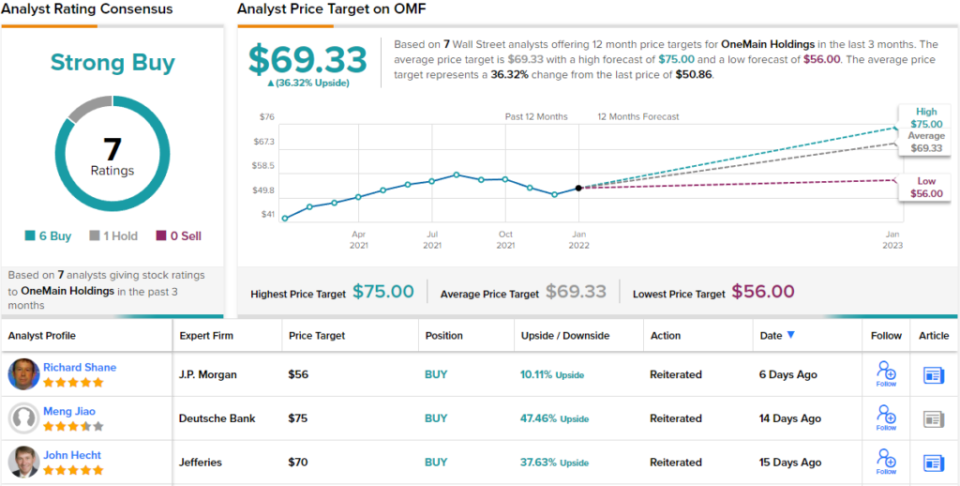

Overall, it’s clear that Wall Street is in general agreement with the bullish view on OneMain. The stock has 7 recent share reviews, which break down 6 to 1 in Buys over Holds to support the Strong Buy consensus view. Shares are priced at $50.86 and their $69.33 average price target implies an upside of 38% from current levels. (See OMF stock forecast on TipRanks)

Cadence Bank (CADE)

For the second stock, we’ll stay in the financial sector. Cadence Bank is a regional banking company, with over 400 branch locations across the Southeast, Missouri, and Texas. In its current incarnation, Cadence is the result of a merger between BancorpSouth and Cadence Bancorporation, a transaction completed at the end of October last year. The merged entity has over $47.8 billion in total assets, with $40.7 billion in deposits and $26.5 billion in total loans.

Cadence Bank offers the usual full range of commercial and consumer financial services, including checking and savings, mobile and online banking, mortgages, credit lines, and insurance. High-net worth customers can also access wealth management services such as private banking and trust planning.

Cadence has not released a quarterly financial report since its merger transaction, but the company is continuing the dividend it paid out as BancorpSouth. At 20 cents per common share, this payment annualizes to 80 cents and gives a yield of 2.5%. Cadence has an institutional history including 11 years of dividend growth and reliable payments.

In December – well after the merger completed – Cadence announced a Board decision to continue with the share repurchase program. Last year, Cadence bought back 6 million shares under the program; the new authorization permits the company to repurchase up to 10 million shares by December 30 of this year.

Assessing the situation for Cadence after its merger transaction, analyst Brad Milsaps from Piper Sandler writes: “We were encouraged that both companies posted positive loan growth in 3Q21, and our hope would be that the combined entity could continue this trend. However, with any deal there is likely to be some run-off as we assume a static legacy-Cadence balance sheet, which could turn out to be high if there is more runoff and/or targeted reductions of certain loan exposures. That said, the share buybacks completed in 4Q21 and the potential for additional repurchases next year could provide some offset to greater than expected run-off.”

Overall, Milsaps is bullish on the stock, and gives CADE an Overweight (i.e. Buy). His $40 price target implies room for a one-year upside of ~25%. (To watch Milsaps’ track record, click here)

This stock has picked up 8 Wall Street reviews in recent months, and these include 6 to Buy against just 2 to Hold, for a Strong Buy consensus view. CADE shares have an average price target of $36.63, which suggests an upside of 18% from the current share value of $32.12. (See CADE stock forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.