Turkish lira crumbles after S&P warns over Turkey

The beleaguered Turkish lira was crushed on Monday after Standard & Poor’s warned it may downgrade its B+ debt rating on Turkey.

One dollar USDTRY,

S&P cited the central bank’s cutting of interest rates while inflation has been rising for the negative outlook. “In our view, the current monetary easing and significant Turkish lira depreciation will further weigh on inflation, which could peak at about 25%-30% year-on-year in early 2022. Meanwhile, we project it will also lead to net general government debt increasing by an additional 8% of GDP in 2021, compared with our previous expectation,” the agency said.

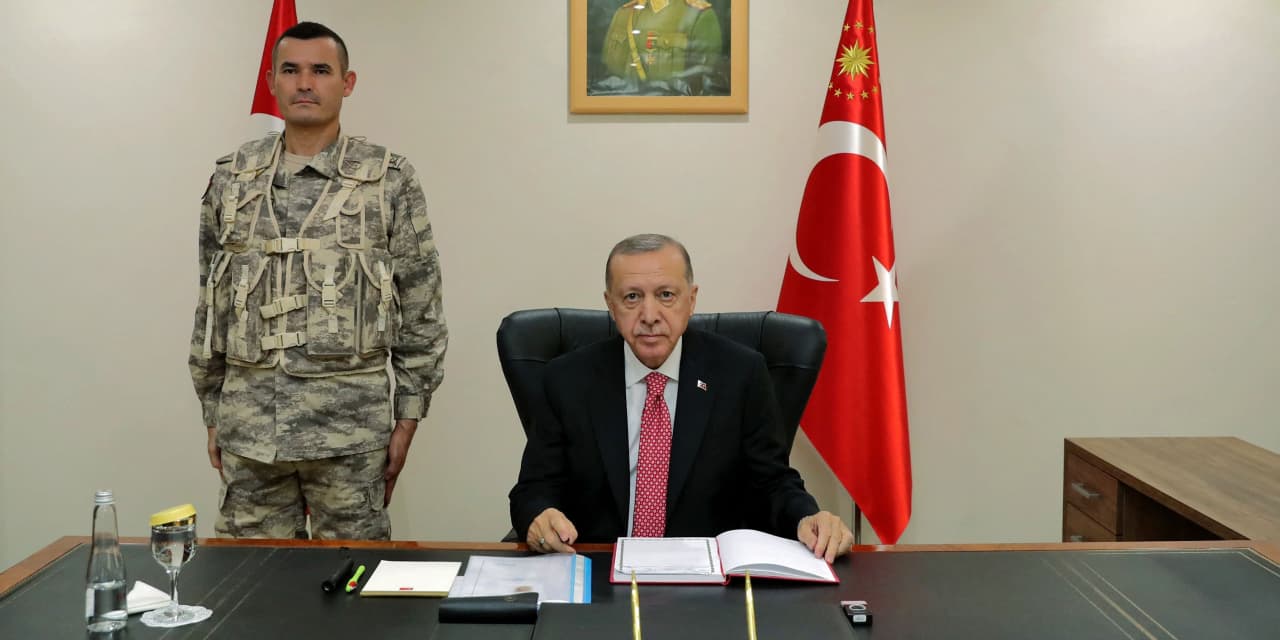

The Turkish central bank, pressured by President Tayipp Erdogan, may cut interest rates by another 1 percentage point this week. It’s already cut rates by 4 points since September.

The central bank intervened in the currency market on Monday, after what it called “unhealthy price formations in exchange rates,” which brought the dollar lower but still trading above 14 lira.

The Turkish BIST 100 XU100,

The Turkish woes didn’t extend to Continental Europe, as the Stoxx Europe 600 SXXP,

Strategists at UBS don’t expect the equity rally to be derailed by inflation fears. They expect global central banks to be adding liquidity through 2022, note markets have already priced in faster tightening by the Fed, and expect inflation pressures to decline next year. “We believe markets can continue take a higher inflation reading in their stride, though additional volatility remains a risk,” they said.

Of stocks on the move, Vifor Pharma VIFN,

Telecom Italia TIT,