These are the big levels to watch for the S&P 500 and Nasdaq. Expect ‘wild trade,’ if they break, warns this strategist.

Holiday spirit is thin on the ground, with global assets in the vicegrip of a selloff as we kick off the countdown to Christmas.

Blame growing alarm over the omicron coronavirus variant, of course, but some coal may show up in the stocking of Sen. Joe Manchin, who all but torpedoed President Joe Biden’s Build Back Better plan, and prompted Goldman Sachs to cut its U.S. growth forecast.

And with traders gradually checking out for the holidays, volatility may be no stranger to markets this week. Our call of the day, from Miller Tabak + Co.’s chief market strategist Matt Maley, offers up all the big index levels investors should be watching for, and he warns that “wild trading” could ensue if any of them break.

“As we learned all too well last week, there is still plenty of volatility left in the stock market as we move into the end of the year. Of course, 2021 could act like an ‘old soldier’ and just ‘fade away’…but if the key short-term support/resistance levels are broken, it could still lead to a big move before the end of the year,” Maley said in note to clients.

He said given that markets currently have lots of activity in the options market, with momentum-based algo strategies (using computer programs to automate buying and selling assets, futures, options, etc.), investors could see outsize moves.

Maley explains that if a key support level breaks to the downside, it could trigger so-called “negative gamma,” pushing markets lower in a material way and exacerbated by momentum based “algos” that have much riding on that strategy. On the other hand, if stocks push past key resistance areas, that could trigger positive gamma, with algos buying stocks in a rising market, driving upside moves.

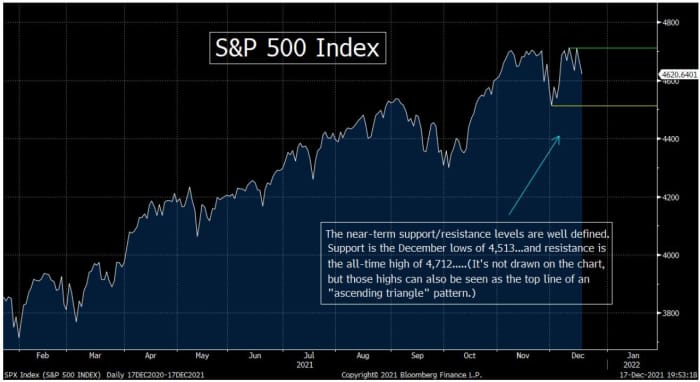

As for resistance levels, Maley points to recent highs of 4,712 for the S&P 500 SPX,

Meanwhile, support levels are marked by early December lows for all three indexes — 4,513 for the S&P 500, 15,085 for the Nasdaq and 2,130 for the Russell 2000. Maley said early October lows though, are much more important support levels, but those will likely be an issue in 2022 rather than this year.

The buzz

“I’ve tried everything humanly possible. I can’t get there,” Manchin told Fox News on Sunday, in reference to months of negotiating over Biden’s signature $2 trillion Build Back Better bill. White House press secretary Jen Psaki called his announcement “sudden and inexplicable.”

Moderna MRNA,

Sens. Elizabeth Warren of Massachusetts and Cory Booker of New Jersey both tested positive for COVID-19; both are fully vaxxed and boosted. And while European countries are weighing up new restrictions, with the Netherlands already locked down, the White House’s top medical adviser Dr. Anthony Fauci warned of a tough winter ahead for the U.S., but no lockdowns.

“Spider-Man: No Way Home,” the third installment in the Disney DIS,

Novo Nordisk NVO,

BNP Paribas BNP,

The markets

Stock futures ES00,

Top tickers

Here are the top tickers on MarketWatch, as of 6 a.m. Eastern:

| Ticker | Security name |

| AMC, |

AMC Entertainment |

| TSLA, |

Tesla |

| GME, |

GameStop |

| ES00, |

E-Mini S&P 500 Future Continuous Contract |

| NIO, |

NIO |

| DXY, |

U.S. Dollar Index |

| TMUBMUSD10Y, |

U.S. 10-year Treasury note |

| NQ00, |

E-Mini Nasdaq-100 Index Continous Contract |

| DJIA, |

Dow Jones Industrial Average |

| AAPL, |

Apple |

Random reads

“Peeing is very easy,” and other highlights from a Japanese billionaire’s trip to space.

“Buddy the Elf” wannabe is on a mission to cheer up this North Carolina town.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.