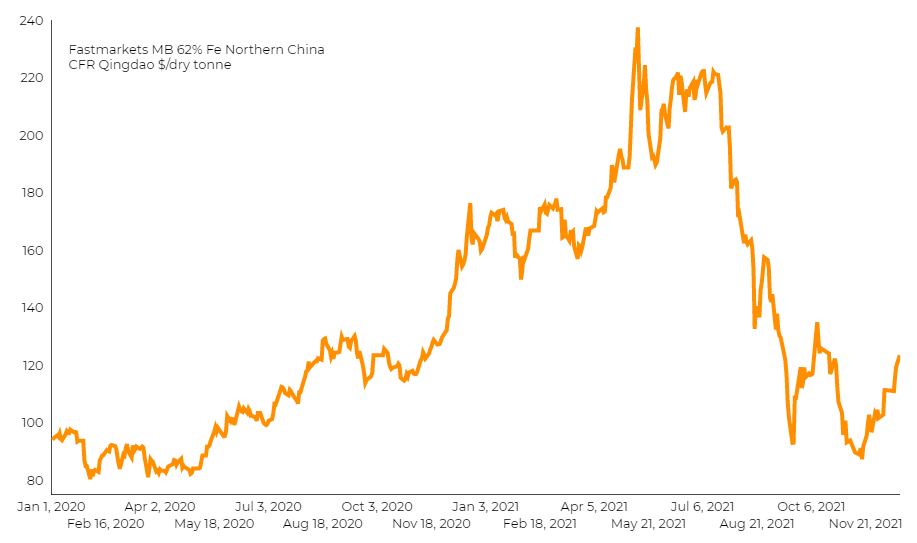

The most-traded iron ore for May delivery on China’s Dalian Commodity Exchange ended daytime trading 0.4% lower at 693.50 yuan ($108.84) a tonne.

China is maintaining a zero-tolerance policy towards local covid-19 cases, moving quickly to quell any local outbreaks by imposing mobility restrictions.

“(Steel demand) is gradually shifting from the peak season to the off-season cycle, and consumption is expected to gradually pull back from the previous month,” Huatai Futures analysts said in a note.

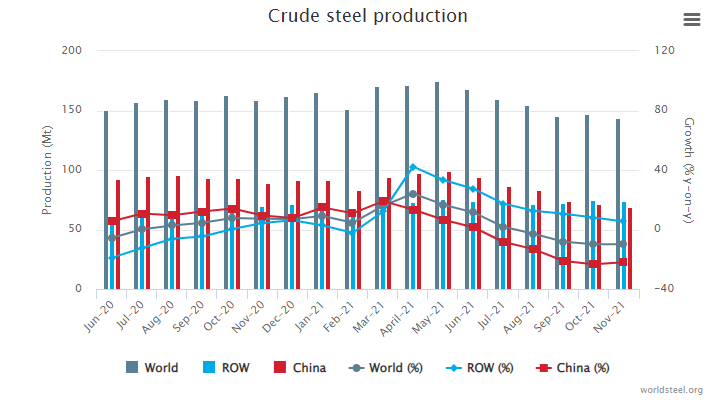

Worldwide crude steel production dropped to 143.3 million tonnes in November from a year earlier but Chinese levels tumbled by 22% to 69.3 million tonnes, World Steel Association data showed on Wednesday.

Compared to last month, Chinese output slipped 3.2%, showing that production may be stabilising at lower levels, Caroline Bain, chief commodities economist at Capital Economics, said in a note.

“While power rationing and efforts to curb emissions explain much of the weakness in China’s steel production recently, we think that demand has also been lacklustre given the slowdown in China’s construction and property sectors,”

“Looking ahead, we expect this weakness to persist, which will act as a lid on any plans to bring steel capacity back online.”

(With files from Reuters)