Under the deal Dolly Varden will pay C$5 million in cash and issue 76.5 million of its common shares to Fury Gold Mines. If the transaction is completed, Fury Gold Mines will own about 36.9% of Dolly Varden Silver.

Dolly Varden shareholders will vote on the acquisition at a special meeting in February.

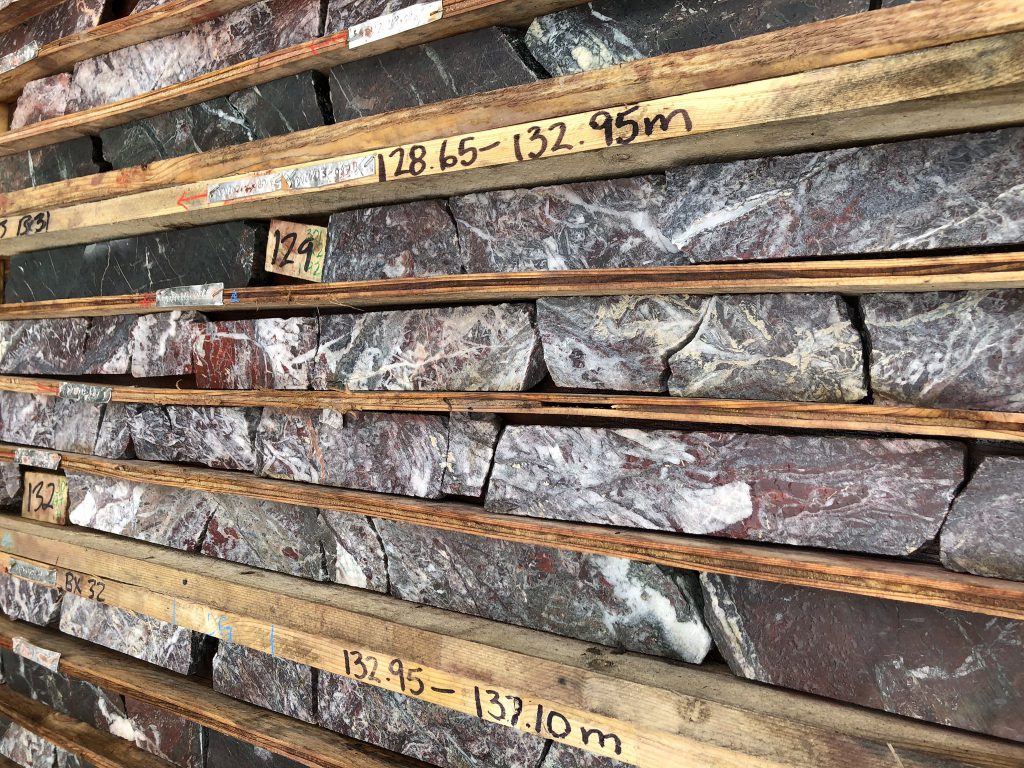

The 7,500-hectare Homestake project is estimated to contain indicated resources of 0.736 million tonnes grading 7.02 grams gold per tonne, 74.8 grams silver per tonne, 0.18% copper and 0.077% lead for contained metal of 165,993 oz. of gold, 1.8 million oz. silver, 2.9 million lb. copper and 1.25 million lb. lead. Inferred resources add 5.55 million tonnes grading 4.58 grams gold per tonne, 100 grams silver per tonne, 0.13% copper, 0.142% lead for 816,719 oz. gold, 17.8 million oz. silver, 15.9 million lb. copper and 17.3 million lb. lead. The resource estimate used a cut-off grade of 2.0 grams gold-equivalent per tonne.

When combined, the two projects will be called the Kitsault Valley project, and will be among the largest high-grade precious metal assets in Western Canada, the companies say.

The Dolly Varden project has indicated resources of 3.42 million tonnes grading 299.8 grams silver per tonne for 32.93 million oz. silver and inferred resources of 1.29 million tonnes grading 277 grams silver per tonne for 11.45 million oz. silver. The resource used a cut-off grade of 150 grams silver per tonne.

The two projects will have a combined indicated resource of 166,000 oz. gold and 34.7 million oz. silver and inferred resources of 816,719 oz. gold and 29.28 million silver ounces.

“This is a win-win for both companies. I think we are going to really do well going forward,” Shawn Khunkhum, Dolly Varden’s CEO, said in during a conference call with analysts and investors. “We expect that this combination will result in significant synergies in the areas of exploration, development, permitting and production.”

Fury Gold Mines’ CEO Tim Clark stated that combining the two projects would create an “attractive opportunity” to establish shareholder value through potential synergies.

Fury Chairmain Ivan Bebek noted that while the decision to sell Homestake was a difficult one, given the positive exploration outlook for the project, bringing the two assets together was the “best path forward.”

“This transaction also simplifies Fury’s portfolio which coincides with recent positive drill results from both of Fury’s Quebec and Nunavut assets,” said Bebek.

A preliminary economic assessment on the Homestake project released in April outlined an initial mine life of 13 years producing 45,400 gold-equivalent ounces per year at an all-in sustaining cost of $670 per ounce. Total production over the mine life would come to about 590,040 gold-equivalent ounces. The early stage study estimated an after-tax net present value of $173 million and a post-tax internal rate of return of 32% at a gold price of $1,620 per oz. gold and $14.40 per oz. silver.

Mining analyst Barry Allan, who covers Fury Gold Mines for Laurentian Bank Securities, expects the deal will positively impact Fury’s shares as it allows the company to focus on its Eau Claire and Committee Bay projects in Quebec and Nunavut while still advancing Homestake Ridge. “While our net asset value and target price for Fury valued the project at C$62.7 million, slightly above the actual sale price, we believe this is a good move by Fury,” he commented in a research note to clients.

Allan has a target price on the stock of C$2.65 per share. At press time in Toronto Fury was trading at 84¢ within a 52-week trading range of 75¢ and $2.36 per share.

This is the fifth material transaction in B.C.’s Golden Triangle in 2021. Earlier this year the region saw Newmont Mining (TSX: NGT; NYSE: NEM) acquire GT Gold (TSXV: GTT) for C$456 million; Yamana Gold (TSX: YRI, NYSE: AUY; LSE: AUY) take a 6.4% in Ascot Resources (TSX: AOT); Hochschild Mining (LSE: HOC) spend C$115 million to earn a 60% stake in the Snip project from Skeena Resources (TSX:SKE) and most recently Newcrest Mining (ASX: NCM; TSX:NCM; PNGX: NCM) announce plans to buy Pretium Resources (TSX: PVG; NYSE: PVG) for C$3.5 billion.

(This article first appeared in The Northern Miner)