An economic chill fueled by omicron may stick around. These stocks are your best defense, says Morgan Stanley.

Stock futures are pointing to a bounce, after the S&P 500’s politics and omicron-driven worst session since Dec. 1.

But don’t get too comfy, cautioned Oanda’s senior market analyst Jeffery Halley, who noted that investors didn’t flock to traditional safe haven plays — the Canadian, Australian and New Zealand dollars — on Monday.

“That is as good a warning to the fast-money FOMO [fear of missing out] gnomes as any, that sentiment remains exceedingly fragile, complicated by rapidly thinning liquidity in asset classes ahead of the holiday season and year-end,” he said in a note.

Looking beyond 2021 is our call of the day from a team of Morgan Stanley strategists, who said the omicron variant has awoken investors to a growth slowdown that will linger into mid 2022. Look no further than defensive stocks to face down that, they said.

Their call centered on a fire-and-ice narrative that Mike Wilson, chief U.S. equity strategist, and his team have been talking about for a while.

The fire is central bank tightening, which is playing out with the Federal Reserve’s realization that inflation won’t be transitory and plans to curb support. Expectations for the so-called fire have been hitting growth stocks hard over the past few months, probably discounted since February, said Wilson and the team.

The ice part of that argument is a growth slowdown, and what investors are left to contend with now, as they try to determine growth repercussions from omicron versus a continuing cyclical downturn that started in April.

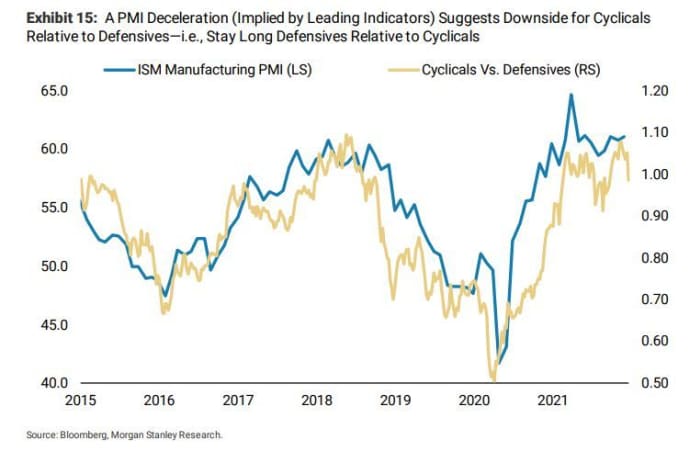

“Leading indicators point to PMI [purchasing managers index] deceleration in coming months, a headwind for cyclicals relative performance. Relative earnings expectations are decelerating for discretionary vs. staples and consumer sentiment around buying conditions for large purchases has plummeted, headwinds for discretionary relative performance,” said Wilson and the team.

Read: Sticky inflation, bigger paychecks, fading stimulus — how the U.S. economy is shaping up for 2022

“In short, our concern that the ice will turn out to be chillier than most expect is increasing. While omicron is part of that concern in the near term for certain activities, we are more focused on the risk of supply picking up just as consumption is fading from a payback in demand, higher prices and demand destruction,” said Wilson and the team.

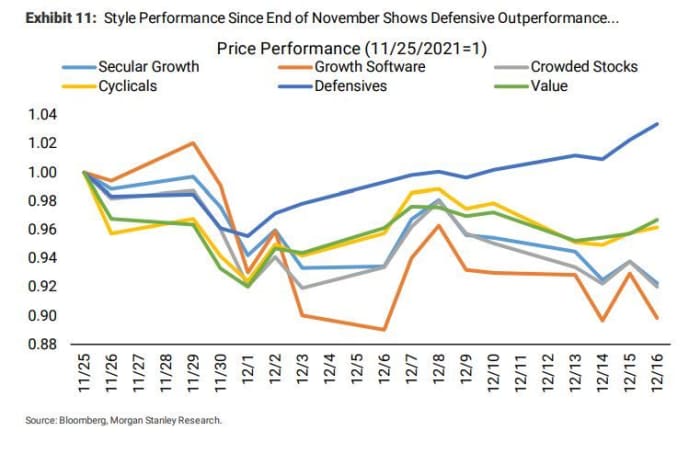

So they are sticking with defensives, which they note have been the best performers since a risk-off move by markets in mid-November, when growth stocks took another turn lower. The sector has overtaken secular growth, growth software and crowded stocks from a year-to-date standpoint.

Here’s a chart showing how that PMI deceleration will hit cyclicals harder than defensives. In that defensive realm, they say healthcare and real-estate investment trusts have been top performers, and continue to favor both.

Note that Morgan Stanley’s S&P 500 forecast is among the most bearish on Wall Street, with a 2022-end year target of 4,400.

The buzz

President Joe Biden will lay out a plan to help communities battle COVID-19, with the latest omicron wave accounting for 73% of all new U.S. infections last week, according to data Monday. Biden, meanwhile, tested negative for the virus on Monday, after close contact with an ill staffer, and will retest Wednesday.

In South Africa, infections have nearly halved from the omicron peaks, but deaths and hospitalizations are reportedly higher. The World Health Organization, meanwhile, is pleading for some to cancel holiday gatherings.

Nike NKE,

Nikola sharesa NKLA,

Data showed a sharply widening current-account deficit for the third quarter. A big data dump is coming Wednesday and Thursday and will include a third-quarter gross domestic product revision and personal income and spending data.

The markets

Stocks DJIA,

The world’s worst performing currency, the Turkish lira USDTRY,

Top tickers

Here are the top tickers on MarketWatch, as of 6 a.m. Eastern:

| Ticker | Asset |

| AMC, |

AMC Entertainment |

| TSLA, |

Tesla |

| GME, |

GameStop |

| ES00, |

E-Mini S&P 500 Futures |

| DJIA, |

Dow Jones Industrial Average |

| NIO, |

Nio |

| DXY, |

U.S. Dollar Index |

| TMUBMUSD10Y, |

U.S. 10-year Treasury Note |

| AAPL, |

Apple |

| NVAX, |

Novavax |

Random reads

It’s nose-to-the-grindstone time for Spain’s jamón sniffers.

Made in prison — a top-10, Italian Christmas panettone.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.