This Treasury dealer says the market has it entirely wrong on the Fed and interest rates. Here’s why.

It feels like year-ahead previews just keeping coming out earlier and earlier, now that many Wall Street firms are having them finished before the table is laid for Thanksgiving. It isn’t a terribly productive exercise — most assessments find that forecasts have very little predictive value beyond three months — but they can at times be thought-provoking.

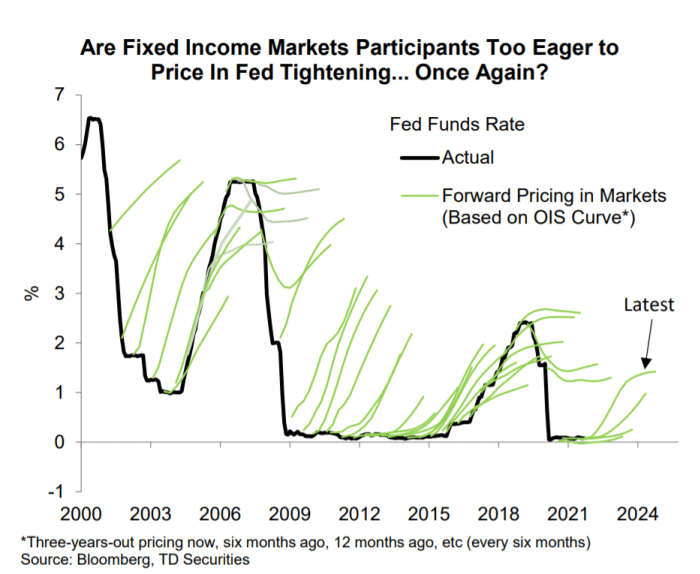

For example, pretty much everyone believes the Federal Reserve will raise interest rates next year. The Fed itself is forecasting one hike, if you believe the dot plot, and futures markets imply two or three increases.

TD Securities, the Canadian brokerage that’s also a primary U.S. Treasury dealer, is notable in predicting zero interest-rate hikes next year. “We expect that markets will be biased towards earlier tightening from the Fed, but where others have buckled, we look for the Fed to hold firm. Tapering buys time before it has to consider lifting rates, and with U.S. growth expected to decelerate through 2022 we don’t see much incentive for the Fed to lift rates next year,” it says.

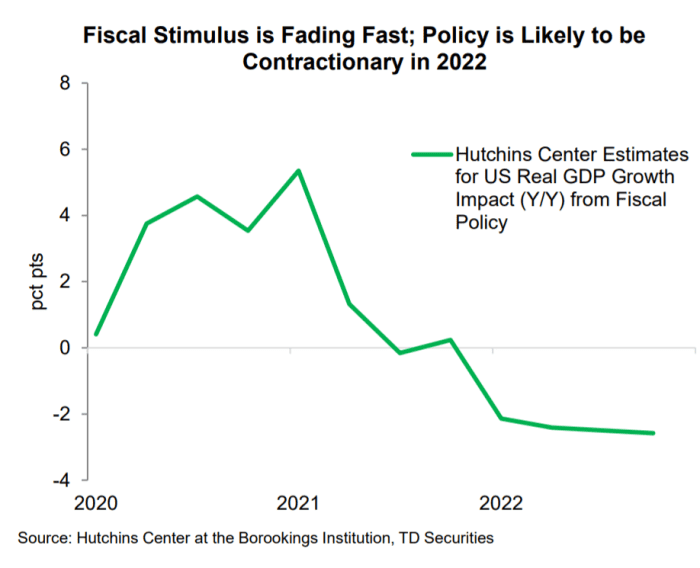

The Fed still has a dual mandate, TD Securities notes, and the employment-to-population ratio is still 2 percentage points below pre-pandemic levels. It expects supply-chain disruptions to ease “more forcefully” in the second half, the withdrawal of policy stimulus to slow growth momentum and a decline in energy prices to ease inflation.

The federal deficit will plunge to 5% of gross domestic product from 12%, TD forecasts, which will be especially negative for goods consumption. The savings rate already has normalized, and excess savings appear to be held by above-average income individuals with lower propensity to spend, it says.

Furthermore, productivity will slow to more sustainable rates, and labor-force participation will gradually improve, which will put less pressure on companies to lift wages.

The bank also predicts a weaker dollar DXY,

The buzz

Another slate of retail earnings is coming, as Target TGT,

After the close, graphics chip maker Nvidia NVDA,

Visa V,

On the economics front, housing starts data were a slight disappointment, with a 1% drop. Treasury Secretary Janet Yellen extended the U.S. debt-ceiling deadline to Dec. 15. There’s a huge slate of Fed speakers, though the topics are largely not monetary policy. Traders also will be eagerly watching any news on who President Joe Biden will pick to be the next Fed chair.

The U.S. government agreed to buy $651 million worth of more doses of an antibody for treating COVID-19 made by GlaxoSmithKline GSK,

The markets

Stock futures ES00,

The yield on the 10-year Treasury TMUBMUSD10Y,

Listen to the Best New Ideas in Money podcast

The tweet

Trung Phan, the always provocative senior analyst at The Hustle, took a trip down memory lane recounting how basketball star Shaquille O’Neal invested in Google, now Alphabet GOOGL,

Random reads

Research finds grandmothers’ brains show more empathy to their grandkids than their own offspring.

A Frida Kahlo painting fetched $34.9 million at auction, the highest ever for Latin American artwork.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.