Next year, which marks its Karowe mine’s tenth year of operations, Lucara anticipates producing up to 340,000 carats, to be sold through its multi-sales channel approach, which should generate revenues of between $185 million and $215 million.

The figure does not include any estimated contributions of revenue from large, exceptional diamonds that have historically formed a regular part of Karowe’s production profile, the company said.

“The business environment for diamonds and diamond jewellery is the healthiest we’ve seen in several years,” President and CEO Eira Thomas said in the statement.

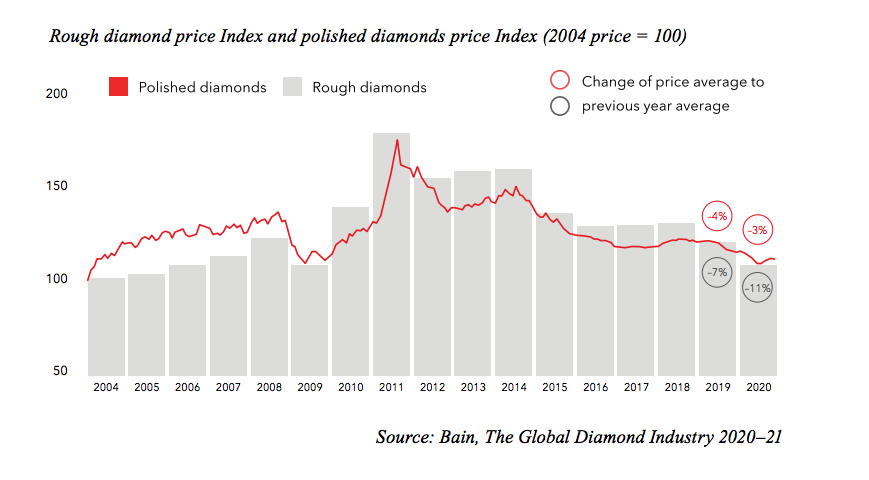

The diamond market came to a standstill at the height of the covid-19 pandemic, increasing worries that oversupply could hurt the sector for years. But surging purchases by intermediaries who cut, polish and trade stones has all but wiped-out miners’ stockpiles, even as Alrosa and its closest competitor, Anglo American’s De Beers, have hiked prices.

The Botswana-based mine, which began commercial operations in 2012, is the only diamond operation in recorded history to have yielded two 1,000+ carat stones — the 1,758 carat Sewelô in 2019 and the 1,109 carat Lesedi La Rona in 2015, which sold for $53 million.

Beyond Sewelô, the only larger diamond ever unearthed is the 3,106-carat Cullinan Diamond, discovered in South Africa in 1905. The Cullinan was later cut into smaller stones, some of which now form part of British royal family’s crown jewels.

Year to date, Karowe has produced 17 diamonds greater than 100-carats, including five over 300-carats. Several of them were recovered from the EM/PK(S), which forms a key economic driver for the proposed $514 million underground expansion of the mine.

Open pit operations at Karowe will cease in 2026, but mining can continue underground to at least 2040, thanks to the ongoing revamp, Lucara said.

Capital costs for the expansion, which remains on time and within budget, are expected to reach $110 million in 2022.

Work will focus on the start of shaft sinking activities, the commissioning of power and detailed engineering for underground development, Lucara said.

Sustaining capital and project expenditures are expected to be up to $17-million, with a focus on completion of a community sports facility, dewatering activities and an expansion of the tailings storage facility.

Karowe remains one of the highest-margin diamond mines in the world, producing an average of 300,000 high-value carats each year.

In 2022, Lucara aims to process 2.6 million to 2.8 million tonnes of ores, which should yield between 300,000 and 340,000 carats.

Online boost to sales

Lucara highlighted the increasing role its 100%-owned proprietary web-based sales platform Clara continues to have in the company’s bottom line.

It said Clara is growing in terms of volumes traded and customer participation. Platform trials and discussions with third-party suppliers of rough diamonds are ongoing to build supply, it noted.

“The rationale for a web based digital sales platform for the transaction of rough diamonds has never been stronger, sparked by industry’s need for increased transparency, global restrictions on travel, and a new openness to the use of innovation and technology to create a more efficient supply chain,” Thomas said.

Lucara noted it will continue to use three different sales channels to maximize revenue and generate consistent cash flow to support the ongoing expansion of Karowe.

The company’s optimism contrasts with DeBeer’s decline in sales revenue. The world’s largest diamond miner by value reported on Wednesday it has sold $430 million worth of roughs this month, down from the $492 million in sales it obtained in the previous cycle.

Despite Lucara’s positive outlook, shares fell 4.6% in early trading in Toronto to C$0.62. The company has a market capitalization of about C$287 million ($226m).