Iron ore price rally is over, prices to follow multi-year downtrend — report

Chinese demand

Chinese demand for iron ore, stemming from the country’s V-shaped economic recovery and the government’s major stimulus plan in supporting the construction industry peaked in H121, Fitch says.

“While China’s energy crunch has started to ease and production curbs on steel are also being lifted gradually, we do not expect the strong demand impact that had stemmed from stimulus to return in 2022 as construction projects reach completion and the pipeline of new projects lessens, with the Chinese Government focusing on tightening credit lines.”

Fitch also sees rising risks to the Chinese property market and thus iron ore demand from the construction sector, following Evergrande’s financial difficulties.

“Lastly, additional regulations on credit and local government spending are likely to come into effect following Evergrande’s fallout, dampening the outlook for construction and metals demand for the coming 3-5 years.”

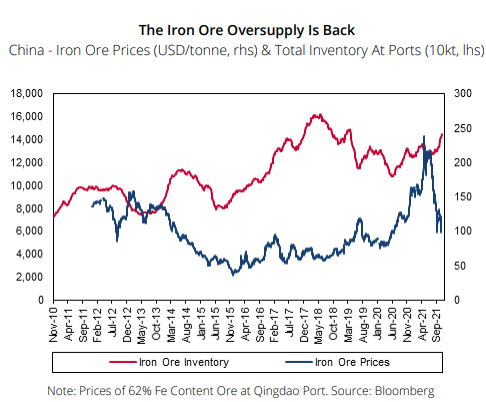

Iron ore oversupply is back

On the supply side, Fitch says improving production growth from Brazil and Australia has started to loosen tight supplies on the seaborne market, though Vale will take longer to return to pre-Brumadinho dam collapse capacity levels.

Vale is working at a current iron ore production capacity of 330 million tonnes. The company’s Q1 2021 iron ore production was 68 million tonnes, 14.2% above Q1 2020, while Q2 2021 production came in at 76 million tonnes, 12% higher than Q2 2020.

Meanwhile, in Australia, Fortescue beat its full-year shipment estimate with a total volume of 182 million tonnes in FY2021 and set shipment guidance for FY2022 at 180-185 million tonnes, Similarly, BHP reported iron ore production of 253.5 million tonnes for FY2021, which sits at the upper end of its forecast range.

“Among the major producers, only Rio Tinto painted a dismal outlook in its half-yearly results, warning that shipments are likely to come in at the bottom end of its 325-340 million tonnes guidance for 2021 at best, and this would require a significant ramp-up in output over the next five months,” says Fitch.

“With all miners holding onto production guidances, we expect better production figures throughout the rest of 2021 and in 2022, compared to H121.”

Long-term outlook

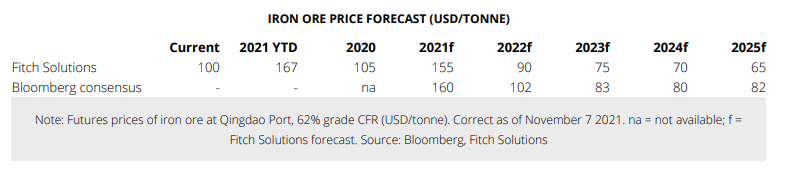

Looking beyond 2021-2022, Fitch expects iron ore prices to follow a multi-year downtrend.

“We maintain our view that iron ore prices will consistently trend downwards, as cooling Chinese steel production growth and higher output from global producers will continue to loosen the market.”

In the longer term, Fitch forecasts prices to decline from an average of $155/tonne in 2021 to $65/tonne by 2025 and $52/tonne by 2030

(Read the full report here)