Has the ‘crypto winter’ arrived? Selloff sends bitcoin under $60,000, Ether sharply lower

A cryptocurrency selloff pushed bitcoin and Ether to levels not seen in more than a week on Tuesday, weighed by talk of a fresh China clampdown on mining and worries over tax implications from the newly signed U.S. infrastructure bill.

The price of bitcoin BTCUSD,

A choppy rally that started in early November saw bitcoin reach a high of $68,990 and sent Ether to an all-time high of $4,865.57.

“The weaker sentiment is subscribed to two events with China announcing again that it stands firm on regulation of the crypto industry, contemplating punitive power prices for companies that engage in crypto mining, and secondly the newly signed U.S. infrastructure bill will require new tax requirements of the industry,” said Saxo Bank’s chief investment officer, Steen Jakobsen.

National Development and Reform Commission spokesperson Meng Wei told reporters on Tuesday that her agency would launch a “full-scale” crackdown on commercial miners and the role in that played by state-owned businesses.

Criticizing crypto mining for was consuming “lots of energy” and driving up carbon emissions, Wei said state-owned units engaged in crypto mining could face “punitive electricity prices,” according to a Google-translated transcript of her comments on state-run news site China.com.

See: VanEck to launch bitcoin futures ETF on Tuesday, while spot bitcoin ETF remains elusive

President Joe Biden signed a $1 trillion bipartisan infrastructure bill on Tuesday and investors have been worried about a rule that would require reporting of any digital-asset transactions over $10,000 would be required, whether or not it’s done through a broker.

Meanwhile, CoinDesk reported that crypto selling began in Asia following comments by Twitter’s TWTR,

“We [would] have to change our investment policy and choose to own assets that are more volatile,” Segal said in a Monday interview with The Wall Street Journal. He said the company prefers securities, which are less volatile.

One analyst questioned whether the selloff was the start of a “crypto winter” for prices and bulls losing their grip.

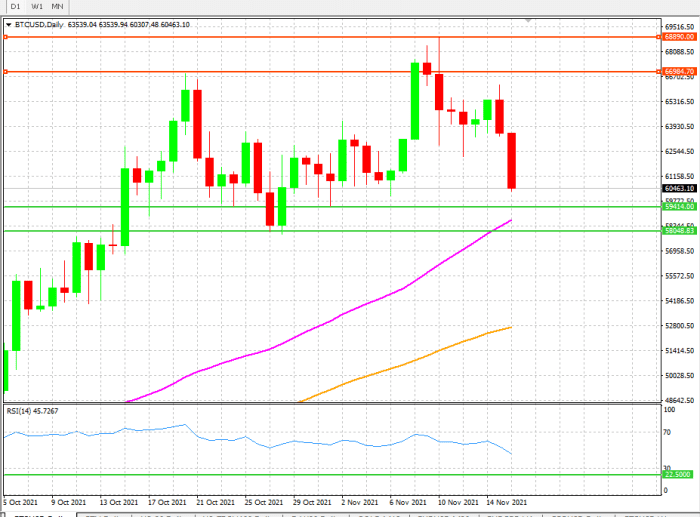

Naeem Aslam, chief market analyst at AvaTrade, said investors should watch for whether bitcoin breaks below its 50-day simple moving average (SMA) of $58,000, a potential support for prices. Bitcoin could see a substantial rally if it stays above that level, he said.

Here’s his 50-day SMA chart:

The “biggest fear among crypto traders is whether the crypto winter is here,” said Aslam, referring to a long period of weakness for cryptocurrencies that occurred after highs reached in 2017.

“No one wants to see another crypto winter as it is difficult to forget the dire consequences of the previous one. Moreover, what traders have been hoping for is a strong rally especially given the fact that during this time of the year, we usually see a strong rally for cryptos — of course, with the exception of the crypto winter,” he said in a note to clients.

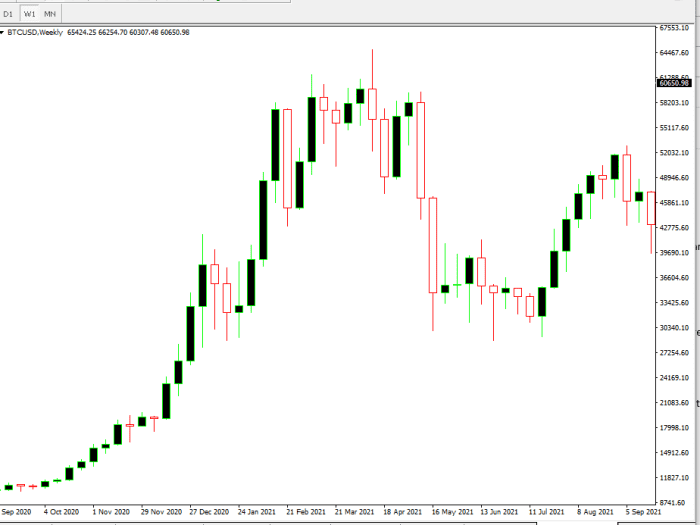

Aslam added that cryptos tend to rally more than 80% during this time of year, offering up this monthly chart: