Since 2020 prices have been on a strong uptrend, due to severe supply tightness resulting from covid-19 lockdowns, especially in Malaysia and Indonesia, major tin producers accounting for a combined 30% of global refined tin production in 2020, Fitch notes, that has yet to match up with demand despite easing slowly.

The slow pace at which global tin supply has recovered from the covid-19 pandemic has been significantly outpaced by the rapid recovery in demand, especially as tin is used in electronics through solders in semiconductors, a sector that saw a massive spike in demand during the pandemic due to the increased sales of medical as well as home equipment and personal devices.

The resulting reduction of global refined tin stockpiles has continued to force prices higher in the year-to-date, and left the market significantly exposed to price increases during China’s power crunch, Fitch says.

With tin solder being a major part of photovoltaic cells, that are the main components that make up a solar panel, demand for tin during China’s power crunch also sky-rocketed.

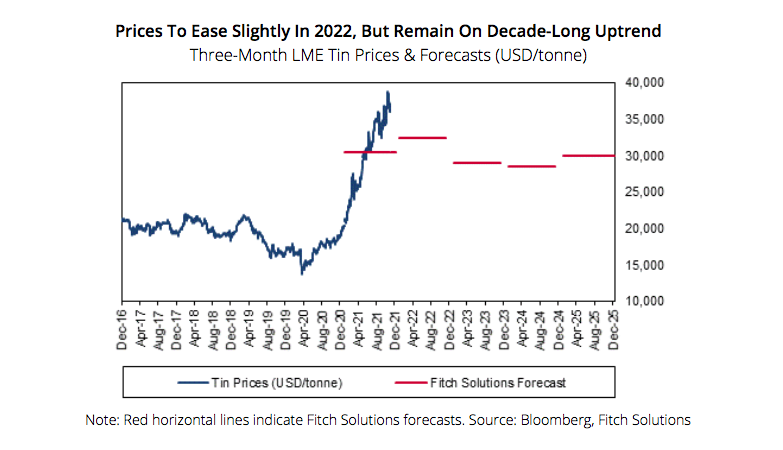

Fitch expects the tin market’s fundamentals to ease slightly going into 2022, driven by supply increases.

While China’s tin output in September 2021 declined by 4.7% month-on-month as a result of power rationing and environmental inspections, October production rose by 12.5% m-o-m due to an easing of China’s power crunch. At the same time, as of October, 80% of Malaysia Smelting Corporation Berhad’s (MSC) production was back online following covid-19 lockdowns in Malaysia earlier in 2021.

MSC is also expecting to commission its new and modern Pulau Indah smelting plant in early 2022, which will replace the aging inefficient smelter in Butterworth in Penang.

The new Pulau Indah plant, with a capacity 50% greater than that of Butterworth, is equipped with cutting-edge smelting technology of top submerged lance furnaces that saves costs by 30%, Fitch reports, adding that this will enable significant improvement in reaction and production rates as opposed to the aging reverberatory furnace in the Butterworth plant.

In Indonesia, PT Timah maintains its guidance for 2021 output at 30,000 tonnes, after a 57% year-on-year decline in production in H121 due to lockdowns. However, Fitch expects the company will eventually reverse the significant production cuts made in 2020 by 2022, encouraged by high tin prices.

On the demand side, Fitch says, record-high prices for refined tin will start to result in rationing of demand by electronics manufacturers as they struggle to pass on higher input costs to end users.

Longer-term look

Fitch expects tin prices to remain on a firm uptrend in the coming decade. While prices will ease slightly from spot levels in 2022, Fitch forecasts they will still remain historically elevated, and edge higher to reach $35,500/tonne by 2030. In perspective, this is nearly double when compared to the 2016-2020 average of $18,729/tonne.

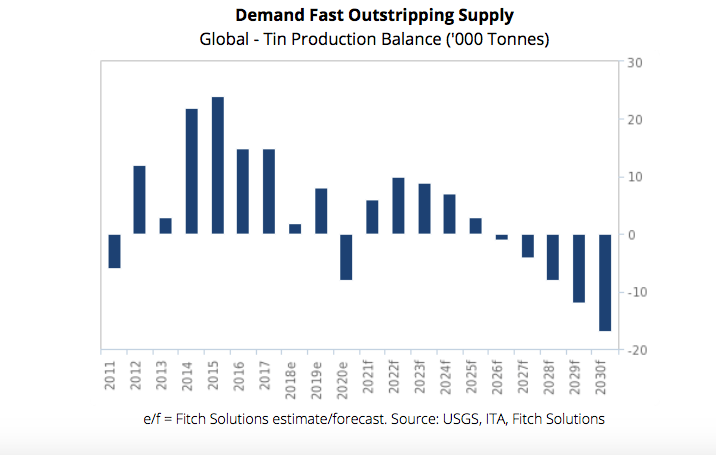

The analyst expects tin demand to continue outstripping supply, pushing the market into deficit by 2026. On the supply side, a thin pipeline of tin mining projects will tighten the tin concentrate market, leading to increased competition among smelters and constrained ore feed for refined output growth, Fitch says.

On the demand side, the global use of tin will increase rapidly through the metal’s use in electronics (especially as electric vehicles increasingly contain greater amounts of electronics in their body) and solar panels (in photovoltaic cells), cementing tin’s status as a commodity of the future. Ultimately, this will allow the market to tighten and return to a production balance deficit by 2026 that will only grow deeper over the years.

Market tightness should begin to ease by the end of 2021 and this should start to stabilise prices, Fitch says, but there will be no collapse as demand will continue to be robust and increasingly outstrip supply.

(Read the full report here)