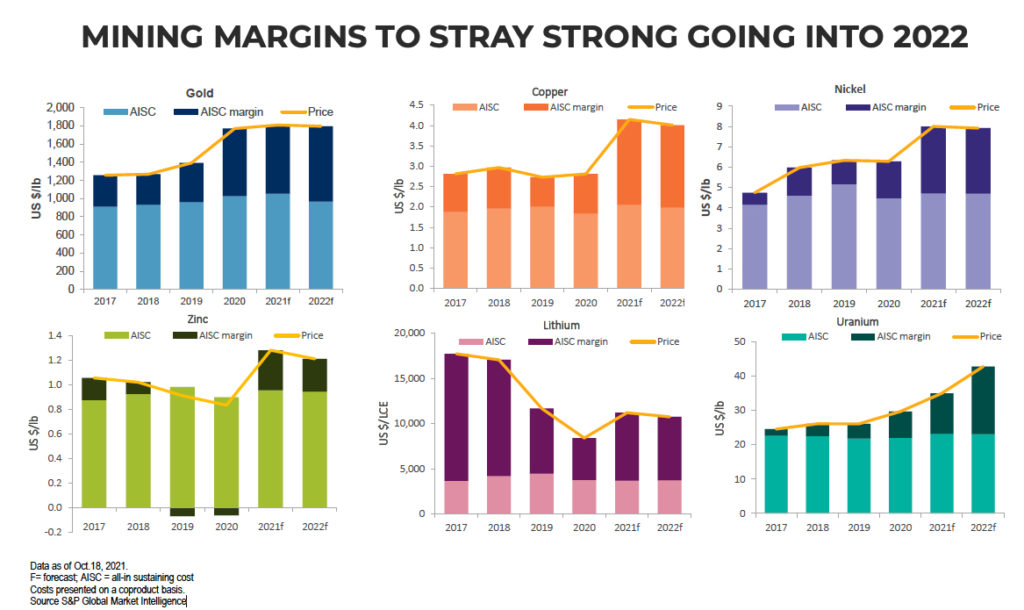

Gold mining companies are best positioned as gold continues to trade around the $1,800 an ounce level. Indeed, the sector is set to enjoy its fattest margins on record in 2022 expanding from an expected 72% this year to 86%.

Some of the better profitability and lower all-in sustaining costs for gold diggers will stem from richer head grades which S&P GMI sees increasing slightly from 1.4g/t in 2021 to 1.42g/t in 2022.

[SEE ALSO: Zinc jumps as Glencore cuts production in Italy]

Copper margins are expected to shrink as the price falls back to around $4/lbs or $8,820/t next year and mine site costs (Holden highlights rising labour costs as a factor) increase but should remain above 100% for a second year in a row – this first time that’s happened in over a decade.

The margins of zInc miners are set to shrink in 2022, but remain robust compared to 2019 and 2020 when the sector was losing money while nickel’s 2022 will be much like this year.

Lithium miners’ all-in costs are set to remain stable next year, but S&P GMI does not believe prices for the battery raw material will hold onto record highs in 2022.

Click on the image for full size version