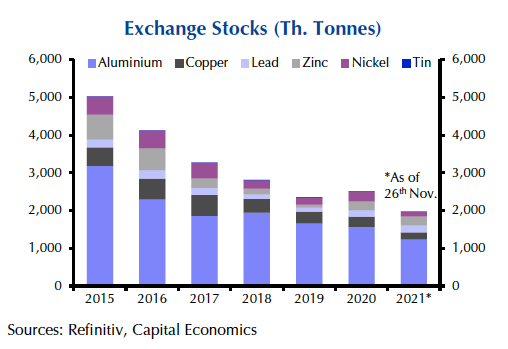

CHART: Dwindling copper, zinc, nickel stocks could shield prices from Omicron impact

Moreover, while a new set of virus-related government restrictions would dampen demand, Capital Economics points out that supply could also be disrupted and any negative impact on prices “may be tempered” particularly at a time when stocks are at historically low levels.

Copper price bounces back

The copper price rose on Monday, recouping some of last week’s losses fuelled by the newly identified coronavirus variant, with markets trying to gauge its severity and its possible impact on economic recovery.

Copper for delivery in March gained 2% on the Comex market in New York, touching $4.38 per pound ($9,636 per tonne) in midday trade before paring some of the gains.

Copper stocks in LME-registered warehouses declined to just over 80,000 tonnes, according to Reuters, and are about a third of level registered in late August. Cancelled warrants – metal earmarked for delivery – indicates another 15,350 tonnes is heading out.

LME aluminium advanced 1.4% at $2,650, lead was up 2.2% to $2,318, tin gained 1.6% to $39,280 and nickel jumped 1.4% to $20,185.