The Dow is on track for its best October in 6 years and third-quarter earnings are strong so far. What could go wrong?

A traditionally troublesome month is turning out to be anything but for the stock market…so far. Who would have thought, based on the way things ended last month, and the start to the first full week of October, that investors would be sitting pretty now. Certainly not Dennis Gartman.

Yet, here we are. Look at us, as actor Paul Rudd might say.

Check out: Sign up for a new MarketWatch newsletter on crypto, Distributed Ledger, launching next month.

Indeed, the Dow Jones Industrial Average DJIA,

The rally, in what is typically one of the weakest months of the year, has put blue-chips within 1% of its Aug. 16 record closing high at 35,625.40. And our colleagues at Dow Jones Market Data said that the index’s performance so far represents the best start to October since, 2015.

The S&P 500 SPX,

It is very early days, with only 8% of the S&P 500 index companies reporting third-quarter results thus far, but at least 80% of companies are beating expectations on earnings and revenue, according to John Butters, FactSet’s senior earnings analyst.

Butters says that the blended growth rate (estimates and actual results) of reporting S&P 500 companies is 30%, which would, if it holds, represent the earnings growth rate in over a decade.

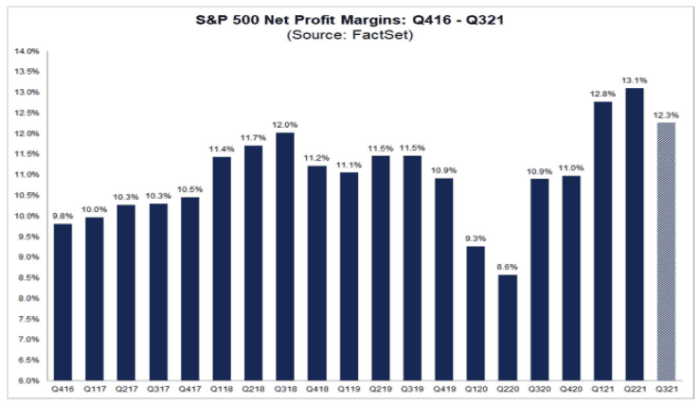

On top of that, the blended net profit margin of 12.3% would mark the third-highest recorded by FactSet since it began tracking that metric in 2008. On June 30, the estimated net profit margin for the third quarter was 12%.

It certainly didn’t hurt that JPMorgan Chase JPM,

To be sure, it isn’t as if an all-clear signal has sounded for the bulls, with investors still harboring agita centered on surging inflation, stagflation, the Evergrande-fueled China property saga and an ongoing energy crisis, among other concerns.

However, the drift higher in U.S. stocks has defied the gravitational pull of those bearish factors. Maybe bulls can thank investor and market prognosticator Dennis Gartman, who after a particularly bad day in October declared the bull market dead.

That prediction may yet turn out to be true but market analyst and founder of NorthmanTrader.com, Sven Henrich, was’t going to miss the opportunity to rib Gartman.

However, the market is far from out of the woods. The Federal Reserve seems poised to start tapering its monthly purchases of Treasurys and mortgage-backed securities.

And MarketWatch’s Vivien Lou Chen has written that stronger-than-expected U.S. inflation data for September has bond investors considering the risk that the Federal Reserve may end up being forced to tighten interest rates into a stagnating economy with persistently higher price rises.

Fed Chairman Jerome Powell is slated to give a speech at the end of this coming week that will mark the final comments from policy makers before the central bank’s Nov. 2-3 policy meeting, when it’s possible the start of the tapering of its bond purchases could be launched.

Will another pop in 10-year Treasury yields TMUBMUSD10Y,

But for now, the bulls are riding high in October.

What’s ahead in U.S. economic data this week?

Monday

- Data on industrial production and capacity utilization rate for September at 9:15 a.m. ET

- National Association of Home Builders index or October at 10 a.m.

Tuesday

Building permits and housing starts for September at 8:30 a.m.

Wednesday

Fed Beige Book at 2 p.m.

Thursday

- Initial jobless claims at 8:30 a.m.

- Philadelphia Fed manufacturing index for October at 8:30 a.m.

- Existing home sales for September due at 10 a.m.

- Leading economic indicators due at 10 a.m.

Friday

A flash reading of manufacturing PMIs and services from IHS Markit due at 9:45 a.m.

Earnings reports to watch this week

Tuesday

- Johnson & Johnson JNJ,

+0.74% , - Procter & Gamble Co PG,

+0.26% - Travelers TRV,

-0.67% - Netflix NFLX,

-0.87%

Wednesday

- Verizon Communications VZ,

+0.67% - IBM IBM,

+0.85% - Tesla Inc. TSLA,

+3.02% - Baker Hughes Co. BKR,

+0.22% - Biogen Inc. BIIB,

-1.43% - United Airlines Holdings UAL,

+0.19% - Las Vegas Sands Corp. LVS,

-0.67%

Thursday

- Intel Corp. INTC,

+1.04% - American Airlines Group Inc. AAL,

+1.73% - Southwest Airlines Co. LUV,

-2.23% - AT&T T,

+0.31% - Chipotle Mexican Grill Inc. CMG,

-0.53% - Tractor Supply Co. TSCO,

-0.01% - Snap-On SNA,

+0.10% - KeyCorp. KEY,

-0.82%

Friday

- American Express Co. AXP,

+2.51% - Honeywell International Inc. HON,

+0.97% - Whirlpool Corp. WHR,

+0.99% - Seagate Technology Holdings STX,

-0.62%