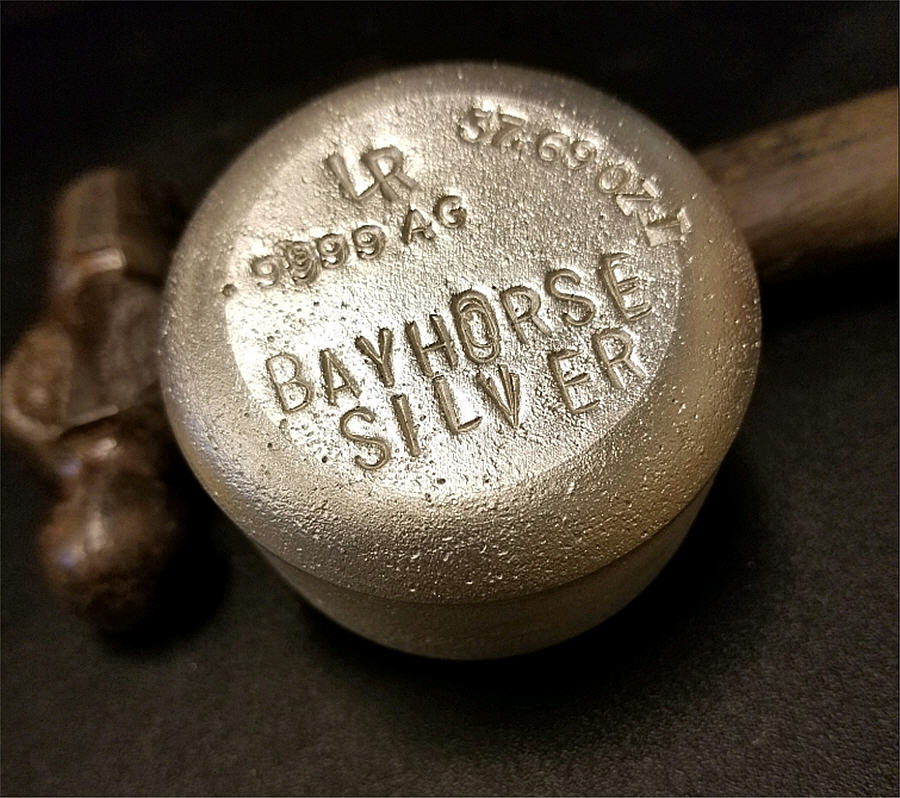

The property has a known mineralized zone that was historically estimated to be 255 metres long, 25 metres wide, and 6.7 metres thick. It was previously estimated (not 43-101 compliant) to contain 150,000 tonnes of mineralization grading 585 to 690 grams silver per tonne, including a 30,000-tonne zone of rhyolite that has returned grades as high as 10,793 grams silver per tonne.

Bayhorse has opened up a zone of mineralization in the most westerly part of the existing workings. The company has also completed a new 35-metre exploration drift to the southeast of the main haulage way. This new drift intersects high-grade zones that were previously mined as part of the Big Dig stope. Drilling continues.

Processing equipment includes a new Steinert x-ray transmission ore sorter that Bayhorse bought and a crushing plant that has a throughput of about 200 tonnes per day. The company is currently crushing at 100 tonnes per day.

Ore sorting significantly improves the ore grade and reduces the volume of material that must be trucked to a gravity and flotation plant for concentration. Run-of-mine ore with a grade as low as 30 grams silver per tonne can be upgraded to 20 times that.

After processing, the concentrate that is produced contains 7,500 to 15,000 grams silver per tonne and 11% copper.

Bayhorse has made a 43-101 compliant resource estimate for its silver project. Using a 7.5 grams silver per tonne cut-off, the mine has 292,000 tonnes in the inferred category, and the average grade is 742.4 grams silver per tonne, for 6.3 million contained oz. of silver.

The company has also created a conceptual exploration target model at Bayhorse of 200,000 to 250,000 tonnes grading 345 to 690 grams silver per tonne..

In British Columbia, the company owns 100% of the Brandywine gold-silver exploration project 14 km south of Whistler. Two historical smelter shipments from prior mining were made from this past-producing mine.

A 50-tonne sample in 1967 that graded 83.1 grams gold per tonne, 354 grams silver per tonne, 9.9% lead, 7.4% zinc, and 0.3% copper was treated in Helena, Montana. A 500-tonne sample grading 2.57 grams gold per tonne, 339 grams silver per tonne, 14.2% lead, and 12.5% zinc was treated in Trail, British Columbia in 1977.

Bayhorse has applied for drilling permission and has identified targets at Dave’s Pond and the Placer Dome zone. Any bulk samples will be treated at the Bayhorse mill. Meanwhile, the company is planning a time-domain electromagnetic (VTEM) survey.

Brandywine has a non-43-101 resource estimate totaling 305,000 tonnes of which 101,400 tonnes is indicated averaging 410 grams silver per tonne, and 201,284 tonnes is inferred averaging 397 grams silver per tonne. This combined tonnage has a gold grade of 0.37 grams per tonne.

Bayhorse Silver has a market capitalization of C$19 million ($14.9m).

Discovery Silver

Discovery Silver (TSXV: DSV; US-OTC: DSVSF) says it may be sitting on the world’s largest undeveloped silver deposit — Cordero in Chihuahua, Mexico. The global resource for the project is said to be 1.5 billion oz. silver-equivalent and the project is 100% owned.

Resources were estimated in 2018 using a 15 gram silver-equivalent per tonne cut-off grade. The result: 990.1 million indicated tonnes averaging 13 grams silver per tonne for 408 million oz. silver and 282.2 million inferred tonnes averaging 21 grams silver per tonne for 188 million oz. silver. Including payable zinc, lead and gold, that works out to 1 billion silver-equivalent oz. in the indicated category and 513 million oz. silver-equivalent in the inferred portion.

Those numbers were used in the preliminary economic assessment completed three years ago. Since then, Discovery has drilled 91,000 meters and confirmed several higher grade domains. According to the company, the potential is there to in-fill and expand the higher grade zones, as it prepares an updated PEA due by the end of this year.

A new resource estimate is due in the third quarter and will include 110,000 metres of historic drilling plus the first 75,000 metres of Discovery Silver’s phase one drill program. Phase two drilling is underway with a focus on three key areas: upgrading inferred resources to indicated resources; expanding mineralization suitable for bulk tonnage recovery; and testing the high-grade vein system that transects the deposit.

Results from metallurgical tests are also expected in the third quarter. Work has shown that 90% of the silver will probably report to the lead concentrate, and there is heap leach potential for oxide pre-stripping material.

Discovery is also working on an optimized preliminary pit design. The mine scheduling update has been completed to evaluate the impact on project economics on different mining rates, mill throughput and stockpiling strategies. An environmental baseline study is also underway.

The 2021 PEA is expected to increase the cut-off grade to over 100 grams silver-equivalent per tonne by prioritizing high-grade zones early in the mine life. Concentrator throughput would be 15,000 tonnes per day to start but could be expanded to 30,000 tonnes per day once the initial capex is paid off, the company says.

Discovery also has a pipeline of three other silver-zinc-lead exploration projects in Coahuila, Mexico: the Puerto Rico property (in the drill permitting stage); Minerva (where modern exploration has been carried out for the first time on three areas of artisanal mining; and Monclova, (another artisanal producer tested with modern exploration methods for the first time).

Discovery Silver has a market cap of C$390 million ($307m).

Excellon Resources

Excellon Resources (TSX: AM; NYSE: EXN) is the 100% owner and operator of one of Mexico’s highest grade silver mines, Platosa, in the state of Durango. Mineralized material is processed at the 800-tonne-per-day Miguel Auza mill, 200 km to the south in Zacatecas.

The mine began with small scale underground production in July 2005, and a preliminary economic assessment in 2015 indicated a six-year mine life. In 2018 mining transitioned to pillarless methods, using cut and fill in steeply dipping areas and drift and fill in shallow dipping areas. The change lowered costs and boosted productivity.

At the end of March, Excellon updated the Platosa mineral resource to 317,000 indicated tonnes grading 485 grams silver per tonne for 4.9 million contained ounces. The indicated resource also has an average lead grade of 5.3% for 36.7 million contained lb. lead and an average zinc grade of 5.55% for 38.8 million contained lb. zinc.

The inferred resource stands at 42,000 tonnes grading 749 grams silver per tonne (1 million contained oz. silver), 4.3% lead (4 million contained lb. lead) and 5.4% zinc (5 million contained lb. zinc).

Last year the Platosa mine produced 997,690 oz. of silver by milling 65,567 tonnes of mineralized material grading 319 grams silver per tonne, 5.4% lead and 6.6% zinc. Lead production was 6.5 million lb. and zinc production came in at 7.5 million pounds.

Underground drilling continues at Platosa to define mineralization in areas ahead of production and outside the current mine plan. The most recent drill assays included 1,051 grams silver per tonne, 12.1% lead and 13.1% zinc over 5.2 metres; 1,647 grams silver per tonne, 12.3% lead and 11.6% zinc over 1.6 metres; and 784 grams silver per tonne, 7.7% lead and 13.9% zinc over 2.5 metres.

Excellon believes there is significant potential for additional stratabound deposits in the area. The Platosa deposit is open to the north, northeast, east, and southeast of known zones. The company is on the hunt for additional massive sulphide zones that can be accessed from existing underground development. Of particular interest is the gap between the 623 and NE-1S zones.

There are also several other targets in the vicinity of the Platosa silver mine. To the north less than 15 km away is the Jaboncillo target, where follow up work is being done to confirm sulphide silver species, sulfosalts and base metal sulphides.

Much closer to the mine is the PDN target and south of it is the Rincon Del Daido target. Immediately south of the Platosa mine is the 10-20 target. Historical drilling of these targets has returned significant silver assays.

The Evolution deposit in Zacatecas, adjacent to the Miguel Auza mill, ceased mining in 2008. Excellon continues to examine the property, releasing a resource estimate this year with 6.4 million indicated tonnes grading 64 grams silver per tonne, 1% lead and 1.1% zinc plus 15 million tonnes inferred at 39 grams silver per tonne, 0.8% lead and 1.2% zinc. The resources contain gold averaging 0.09 gram per tonne and 0.1 gram per tonne, respectively.

Excellon also has two drills turning at the Silver City project in a high-grade silver mining district in Saxony, Germany. Mining ceased in the region in the 1880s, but historical assays of veins up to 10 metres wide were as high as 3,700 grams silver per tonne. Records from the past-producing Braunsdorf mine describe veins up to 1.5 metres wide grading 900 to 2,500 grams silver per tonne.

The company doubled its Silver City landholdings in March, and began a 12,000-metre drill program over a 7.5-km strike length. Last year hole SC20GWO012 intersected 1.2 metres grading 331 grams silver-equivalent per tonne and 8.1 metres at 194 grams silver-equivalent, including 1.3 metres at 1,043 grams silver-equivalent per tonne. Gold, lead and zinc assays were also reported.

The company has identified high priority exploration targets through historical analysis, mapping, geochem and induced polarization studies. The Freiberg mineralogical galleries have a spectacular collection of mineral samples from historical mines, leading Excellon to believe that the German epithermal belts have similar characteristics to those in Mexico.

When Excellon is not hunting for silver, it is testing two gold projects in Idaho in the United States. A PEA was completed in 2019 for the Kilgore project near the Montana border in the eastern part of the state. It showed potential for annual production of 100,000 oz. of gold. Centerra Gold (TSX: CG; NYSE: CGAU) is earning 70% of Excellon’s Oakley project near the Nevada-Utah border. Centerra will spend up to US$7 million over seven years, and a 2,800-metre drill program is underway.

Excellon has a market capitalization of C$55 million ($43m).

Metallic Minerals (TSXV: MMG; US-OTC: MMNGF) has several silver projects in the Yukon, notably in the famous historic Keno Hill camp, 350 km north of Whitehorse. Between 1913 and 1989, Keno Hill produced over 220 million oz. of silver, worth more than all the gold mined in the Klondike.

Metallic’s Keno project is adjacent to Alexco Resources’ (TSX: AM; NYSE: AXU) Keno Hill asset, where mining has been restarted and the first concentrates produced in November 2020. Alexco estimates its Keno Hill mine will produce 4.4 million oz. of silver annually.

Metallic holds a 100% interest in Keno, which covers several past-producers and where it is actively exploring. The company is testing the West and East Keno areas. In particular, the East Keno area has been underexplored due to fragmented private ownership, the company says. Metallic has consolidated the properties and has already make new greenfield discoveries.

In the West Keno portion, the advanced stage Formo property is the home of the historical Formo underground mine. The target exhibits very high-grade Keno-style silver mineralization that remains open in all directions. In April Metallic issued results from drilling, which included 1,568 grams silver per tonne over 3 metres from less than 100 metres below surface. The assay also included 29.45% lead and 15.35% zinc.

Modeling of the Formo deposit has revealed three defined mineralized shoots of high-grade silver grading over 1,000 grams silver per tonne, and sampling on the 2600 level of the old mine shows two more shoots.

Also in the West, Metallic’s Silver Queen target area is adjacent to the mine of the same name owned by Alexco. Metallic has completed soil sampling, very low frequency (VLF) geophysical surveys, reinterpretation of regional geophysics and 3D modeling. The geophysical surveys indicated a 400-metre-wide resistive body that may indicate the presence of a structural corridor.

Soil sampling and geophysical surveys at East Keno have identified 12 multi-kilometre-scale anomalies. The largest of these extends up to 5 km long and 2 km wide. In 2020, 30 shallow reverse circulation holes were drilled, and the company says that work confirmed the presence of high-grade mineralization within broad zones of potential bulk tonnage mineralization.

Metallic began its initial drill program in July at the La Plata silver-gold-copper project near Durango, Colorado in the U.S. The first silver deposits in the district were discovered in the 1700s by Spanish explorers. The company says almost no modern work has been done in 50 years, but the property does have a non-43-101 compliant historic resource estimate.

Metallic is concentrating its efforts on the Allard and Copper Age porphyry targets, both of which are open along strike and at depth. One of the deepest holes at La Plata returned 378 metres of porphyry style mineralization grading 0.5% copper, 6.2 grams silver per tonne, and 0.06 gram gold per tonne, including 110 metres grading 0.6% copper, 7.4 grams silver per tonne and 0.13 gram gold per tonne.

Fifty kilometres to the north, stretching to the Alaska border, is the McKay Hill project. This is another historic high-grade silver producer that Metallic hopes will prove to be a district scale vein system similar to Keno Hill. McKay Hill was discovered in the 1920s and worked sporadically until 1949. The company has defined 37 new vein structures with rock sampling and trenching. A comprehensive exploration program is planned.

The company will receive 10% to 15% royalties on two alluvial gold projects — Australia and Dominion creeks —southeast of Dawson City, Yukon. These properties cover four claim blocks under development by three operators.

Metallic Minerals has a market capitalization of C$47.3 million ($37m).

Nickel Creek Platinum

Nickel Creek Platinum (TSX: NCP; US-OTC: NCPCF) is focused on its wholly owned Nickel Shaw PGM-copper-nickel advanced exploration project 317 km northwest of Whitehorse, Yukon.

The property was acquired in 2011, when Nickel Creek was known as Wellgreen Platinum. Then in 2018, both the company name and property name were changed, along with the corporate vision to become the next world-class nickel sulphide mine. With almost 2 billion lb. of nickel estimated to be in the ground, it may make it.

The open pit resource was updated later that year. The estimate included 323.4 million measured and indicated tonnes grading 0.26% nickel, 0.16% copper, 0.015% cobalt, 0.255 gram palladium per tonne, 0.253 gram platinum per tonne, and 0.046 gram gold per tonne. The inferred resource was 108.1 million tonnes averaging 0.29% nickel, 0.15% copper, 0.016% cobalt, 0.256 gram platinum per tonne, 0.279 gram per tonne palladium, and 0.04 gram gold per tonne.

In 2019 and 2020, Nickel Creek flew an electromagnetic (EM) survey over its entire property, including 18 km of ultramafic strike length. The Nickel Shaw deposit is just west of centre, and farther west is the Arch target. To the east, near the centre of the property, is the Quill target and farther east are the Burwash East and West targets.

This year the company completed 1,300 metres of drilling in 12 holes at the Arch and Burwash targets. The work was funded by the issuance of flow-through units worth C$3.6 million ($2.8m). Four of the 12 holes were surveyed for their EM signature and some additional EM surface work was done at Arch. Assays for these holes are anticipated before the end of the year.

Nickel Creek has completed mini-pilot plant metallurgical tests that point toward saleable nickel and copper concentrates. It has also completed internal mine planning and optimization studies, as well as baseline environmental studies with the potential to maintain a low carbon footprint.

Nickel Creek has a market capitalization of $35 million ($27.6m).

Palladium One Mining

The pride of Palladium One Mining (TSXV: PDM; US-OTC: NKORF) is its Läntinen Koillismaa (LK) palladium project in north-central Finland. The company has exploration permits covering 2,485 hectares and exploration reservation applications covering an additional 1,352 hectares.

Palladium One calls LK “possibly one of the largest palladium dominant projects of its time in the first world.” For the Kaukua target, as calculated in 2019, the existing indicated resource is 11 million tonnes grading 0.81 gram palladium per tonne, containing 635,600 palladium-equivalent ounces. The inferred resource is 11 million tonnes averaging 0.64 gram palladium per tonne, containing 525,800 palladium-equivalent ounces.

A new resource estimate will be announced for Kaukua by the end of this year.

In September, Palladium One reported the highest ever drill hole in Finland at the LK project’s Kaukua South zone. Beginning at 171.5 metres depth, hole LK21-081 returned 4.1 grams palladium-equivalent over 24 metres, within a 112-metre section grading 2.08 grams palladium-equivalent per tonne.

Expressed another way, the 112-metre section assayed 0.93 gram palladium per tonne, 0.33 gram platinum per tonne, 0.10 gram gold per tonne, 0.16% copper 0.16% nickel, and 78 parts per million (ppm) cobalt. The hole included a 24-metre intersection that assayed 1.98 grams palladium per tonne, 0.7 gram platinum per tonne, 0.18 gram gold per tonne, 0.31% copper, 0.27% nickel, and 104 ppm cobalt.

The Kaukua South zone, 500 metres south of the pit resource, has seen limited drilling, but it has demonstrated up to 0.74 gram palladium per tonne, 0.24 gram platinum per tonne, and 0.07 gram gold per tonne (1.05 grams PGM per tonne) plus 0.17% copper and 0.13% nickel.

Palladium One plans to target zones of high-grade mineralization in the Kaukua deposit for future drilling and upgrade the inferred tonnage. Near term expansion of resources will come from more drilling at the Kaukua South target.

Future drilling is also planned for the Haukiaho deposit, 12 km south of Kaukua. Haukiaho’s 2021 inferred resource estimate stands at 32.7 million tonnes grading 0.35 gram palladium per tonne, 0.10 gram platinum per tonne, 0.10 gram gold per tonne, 0.13% nickel, 0.18% copper, and 53 ppm cobalt (1.15 grams palladium-equivalent per tonne).

A new resource estimate including Kaukua and Haukiaho is due in the first quarter 2022, and a preliminary economic assessment is to be done three months later.

Palladium One also owns the Kostonjärvi (KS) property southeast of the LK property. This is another high-grade massive sulphide target said to have similarities to Norilsk in Russia and Voisey’s Bay in Newfoundland and Labrador.

In Canada, Palladium One owns the Tyko nickel-copper-PGM sulphide property near Manitouwadge, Ontario. When drilled in 2016, the Tyko showing returned 4.1 metres of 1.09% nickel, 0.77% copper, 0.42 gram platinum per tonne and 0.42 gram palladium per tonne. The Tyko North (RJ) showing returned 13.4 metres grading 1.03% nickel, 0.55% copper, and 0.75 ppm PGM-plus-gold; 6.2 metres grading 1.06% nickel, 0.35% copper, and 0.65 ppm PGM-plus-gold; and 1.47% nickel, 0.49% copper, and 0.71 ppm PGM-plus-gold. The company hopes to find continuity between the two showings, which are 1.6 km apart. As well, there are numerous untested targets on the 25,000-hectare property.

Palladium One Mining has a market capitalization of C$49.4 million ($38.9m).

Platinum Group Metals (TSX: PTM; NYSE: PLG) is the operator of the Waterberg PGM-gold exploration project on the North Limb of the Bushveld Complex in South Africa. The project itself is a joint venture between Platinum Group (37.05%), Impala Platinum (15%), JOGMEC (Japan Oil, Gas and Metals National Corp.) (12.195%), Hanwa (9.75%), and BEE partner Mnombo Wethu Consultants (26%). As a result of Platinum Group’s 49.9% ownership in Mnombo, the company has an effective interest in the Waterberg joint-venture of 50.02%.

Platinum Group made the Waterberg discovery in 2011 and completed a prefeasibility study in 2016, followed by a definitive feasibility study in 2019. The project is shaping up as a shallow, low-cost, bulk mineable undertaking.

The feasibility study outlined proven and probable mineral reserves with a cut-off grade of 2.5 grams per tonne PGM+gold to be 187.5 million tonnes grading 0.94 gram platinum per tonne, 2.004 grams palladium per tonne, 0.5 gram rhodium per tonne, and 0.21 gram gold per tonne. Expressed as PGM-plus gold, the reserves contain 19.5 million ounces.

Measured and indicated resources total 242.4 million tonnes at 0.98 gram platinum per tonne, 2.13 grams palladium per tonne, 0.05 gram rhodium per tonne, 0.22 gram gold per tonne, or 26.4 million oz. of PGE plus gold. The inferred resource is 66.7 million tonnes grading 0.96 gram platinum per tonne, 1.92 grams palladium per tonne, 0.05 gram rhodium per tonne, and 0.22 gram gold per tonne for 7 million oz. of PGM-plus gold.

Both reserves and resources contain measurable amounts of copper and nickel.

The feasibility study gave the mine a 45-year life based on current resources with average production of 420,000 oz. of PGM-plus-gold and 16.7 million lb. of total nickel and copper. A fully mechanized, shallow mine accessed by a decline, will make it a large, low cost PGM mine.

The Waterberg project has an after-tax net present value at an 8% discount rate of US$982 million and an after-tax internal rate of return of 20.7%. The estimated pre-production capital requirement is US$874 million, including US$87 million in contingencies.

The project will create about 1,100 new highly skilled jobs, and Platinum Group Metals will have to oversee investments in local training and business opportunities. The project includes a commitment to upgrade the local water infrastructure.

Timelines are dependent on regulatory approvals and financing, but the company would like to see the five-year construction period begin next year. The six-year underground development phase would start a year later with production beginning half way through. Mill throughput will be built up over three years from plant commissioning reaching steady state production perhaps in 2028.

In February, the South African department of mineral resources and energy granted the mining right for the Waterberg joint venture. The next month the decision was appealed by four individuals from a local community. A second appeal was launched in April, followed in May by a community seeking to overturn the environmental authorization.

Platinum Group Metals says it believes the authorizations were correctly granted. The company’s near-term objectives are to continue working closely with local community leaders and to complete construction funding and offtake agreements for Waterberg.

Platinum Group Metals has a market capitalization of C$187.4 million ($147.7m).

SilverCrest Metals (TSX: SIL; NYSE: SILV) released a feasibility study for its Las Chispas silver-gold project in Sonora, Mexico and made a positive development decision earlier this year. Both construction of a 1,250 tonne-per-day mine and mill and underground development have begun.

In August the company said construction is on schedule and capital spending is on budget. A total of 13.1 km of underground development has been completed, access to four veins has been established; and detailed engineering was 90% complete. Most of the procurement contacts have been awarded, the erection of the leach tanks has begun, and the steel-mechanical-pipeline work is underway. Detailed engineering is also underway for the tailings management facility with construction to begin by year-end. The construction camp consists of 513 single occupancy units, and Covid-19 protocols and tests are in place.

The Las Chispas mine is expected to average 6.4 million oz. of silver and 69,000 oz. of gold (12.2 million oz. of silver-equivalent) annually beginning in 2023. All in sustaining costs should be $6.68 per silver-equivalent oz., at a silver price of $19 per oz. and a gold price of $1,500 per ounce.

The initial capital cost for the project is $138 million, plus $124 million for sustaining capital. The project should pay for itself in a year.

The proven and probable reserves are 3.4 million tonnes grading 879 grams silver-equivalent per tonne for 94.7 million contained oz. of silver-equivalent. The measured and indicated resources are 2.8 million tonnes grading 1,191 grams silver-equivalent per tonne for 108.1 million contained oz. of silver-equivalent. The inferred resource is 1.2 million tonnes grading 745 grams silver-equivalent per tonne for 29.7 million contained oz. of silver-equivalent.

Only 15 of more than 45 known veins at Las Chispas are included in the reserve estimate. Reserves also include stockpiled mine development material, which will be used during mill ramp-up.

SilverCrest has identified numerous opportunities for growth and optimization. The company is looking to expand and convert resources at the BAVS, Granaditas, Babi Vista, and Babicanora Norte veins and the El Muerto zone, all of which are close to the planned underground workings and all of which were drilled this year. Other opportunities include optimizing the life-of-mine grade profile and potential acceleration of the mine ramp-up.

Silver was first discovered on the Las Chispas property in 1640 by Spanish soldiers, but it was the late-1800s before any significant production occurred. From 1880 to 1930, several mines on the property produced as much as 100 million oz. of silver and 200,000 oz. of gold. The property then stood idle until the early 1980s when a local company reprocessed old waste and tails but kept no records of production.

SilverCrest also owns the El Picacho property, site of historic silver and gold production, in Sonora. The first production occurred in the late 1800s with grades of over 15 grams gold per tonne. This year the company completed 42 drill holes that traced the El Picacho vein across 500 metres along strike and 300 metres down dip from surface. Permits are in place to continue drilling.

The Cruz de Mayo property, also in Sonora, consists of two mineral concessions totalling 452 hectares. It was transferred to SilverCrest Metals as part of the friendly acquisition of SilverCrest Mines by First Majestic Silver (TSX: FR; NYSE: AG) in 2015. A resource estimate was done the same year that put total indicated material at 793,000 tonnes grading 156 grams silver per tonne and 0.21 gram gold per tonne, for 4.1 million silver-equivalent ounces. The inferred material totalled 325,000 tonnes at 129 grams silver per tonne and 0.25 gram gold per tonne for 1.6 million oz. of silver-equivalent.

SilverCrest also owns the less advanced Angel de Plata and Estacion Llano properties in Sonora. No work is planned at these projects as the company concentrates on development at Las Chispas.

SilverCrest Metals has a market cap of C$1.3 billion $(1.03m).

(This article first appeared in The Northern Miner)