Crypto clash? Grayscale’s CEO says SEC’s Gensler ‘shortsighted’ in backing a bitcoin futures ETF

Hi, there: Welcome to an update of the most important moves and news in crypto and what’s on the near-term horizon in digital assets. I’m Mark DeCambre, managing editor of markets at MarketWatch, and for the next four weeks, from Oct. 3-24, we’ll be publishing Need to Know Crypto Edition as a prelude to a new weekly crypto newsletter “Distributed Ledger,” which will kick off in November.

Sign up here for Distributed Ledger but until then enjoy Need to Know Crypto Edition.

Crypto in a snap

This week bitcoin BTCUSD,

Crypto Metrics

| Biggest Gainers | Price | % Weekly return |

| Gravitoken | $141.05 | 2,797 |

| GINcoin | $0.08583 | 2,506 |

| Defi Connect | $0.0000004481 | 1,516 |

| KleeKai | $0.00000000049 | 746 |

| BNBPay | $0.01356 | 648 |

| Source: CoinMarketCap.com as of Oct. 1 |

| Biggest Decliners | Price | % Weekly return |

| CAPITAL X CELL | $0.03211 | -99.12 |

| CREDIT | $0.0001722 | -91.34 |

| SafeBull | $0.000000000091 | -85.57 |

| CVCoin | $3.38 | -73.24 |

| Dexit Finance | $0.001319 | -71.08 |

| Source: CoinMarketCap.com as of Oct. 1 |

A shortsighted Gensler?

Grayscale Investments is manager of the world’s largest publicly traded bitcoin funds, holding some 3.5% of bitcoin in existence primarily via Grayscale Bitcoin Trust GBTC,

“It is perhaps shortsighted of the SEC to really lean into futures based products and not spot,” the Grayscale CEO told MarketWatch on Friday. He was referring to the SEC’s apparent preference for endorsing a bitcoin exchange-traded fund that is underpinned by futures, a derivative of bitcoin, rather than the underlying asset itself.

Asset managers have been racing to kick off a U.S. bitcoin ETF but Gensler has intimated that he would be more inclined to support an ETF that uses futures contracts, which let traders bet on whether an underlying asset such as oil CL.1,

Gensler has said that ETFs can be structured under the Investment Company Act of 1940, which use guidelines, usually applied to mutual funds, that are viewed as offering greater safeguards for individual investors, including the ability to stop taking new money.

Sonnenshein, however, argues that using futures contracts, offers indirect ownership of bitcoin and confers additional costs to the end user, which could be mitigated by using the spot market.

The fact is that “there are significant costs that will make their way to investors”…including the need to “roll the contracts from one expiry to the next,” the Grayscale executive said.

Funds that use futures contracts usually buy contracts for the nearest month, or front-month and because these contracts all have an expiration date, the fund administrator must “roll” contracts into the following front-month contract, with the costs of such transfers likely passed on to investors.

And the fees aren’t insignificant by some reckonings.

Eric Balchunas, ETF analyst at Bloomberg, was quoted by The Wall Street Journal estimating that annual costs could be 10 percentage points in annual returns.

Gensler is a former head of the Commodity Futures Trading Commission, which may explain his comfort with futures.

However, Sonnenshein suggested the SEC Chair had seemingly “leaned so far in one direction” that it raised the question “more importantly, are they, in fact, going beyond their investor protection mandate in focusing on one product type?”

Grayscale has a lot to gain from seeing a spot-pegged ETF. The company has put in an application to convert its GBTC trust into an ETF, which would allow it to possibly maintain its dominance in crypto circles.

Sonnenshein said that he would urge the SEC to endorse a model that is similar to that used by SPDR Gold Shares GLD,

The success of GLD “would suggest that the bitcoin ETF scenario would more likely mirror what has occurred for gold versus similar commodities like oil because bitcoin is easy to store,” Grayscale’s Sonnenshein said.

The SEC didn’t immediately respond to a request for comment.

What does that meme?

‘Volcano energy’

El Salvador said it mined its first bitcoin using volcano energy. El Salvador’s president Nayib Bukele tweeted that “We’re still testing and installing, but this is officially the first #Bitcoin mining from the #volcanode Volcano.” The country in September adopted bitcoin as a legal tender.

So, what is volcano energy? El Salvador boasts nearly two dozen “potentially active” volcanoes, which account for almost 22% of the country’s energy supply. Effectively the country is harnessing geothermal energy, which as CoinDesk said “could provide an answer to the hunt for a reliable clean energy source to power bitcoin mining.”

Crypto brief

MarketWatch’s Chris Matthews reports that The International Monetary Fund is warning that the growing popularity of cryptocurrency in emerging market economies poses a threat to their government’s ability to implement effective economic policy, while threatening financial stability in economies at every stage of development.

“Widespread and rapid adoption” of cryptocurrencies, like bitcoin and ether, in emerging markets “can pose significant challenges” when “residents start using crypto assets instead of the local currency,” IMF researchers Dimitris Drakopoulos, Fabio Natalucci and Evan Papageorgiou wrote in a blog post accompanying a new financial stability report on crypto assets, published Friday.

Read the full article here.

Coin quotables

“At least two regulatory clouds are hanging over the market. One has been China’s renewed crackdown on cryptocurrencies, effectively banning residents from participating in the market. The other is uncertainty about an infrastructure bill in the U.S. Congress that could increase taxes on crypto trading,” writes David Russell v.p. of market intelligence at brokerage platform TradeStation Group.

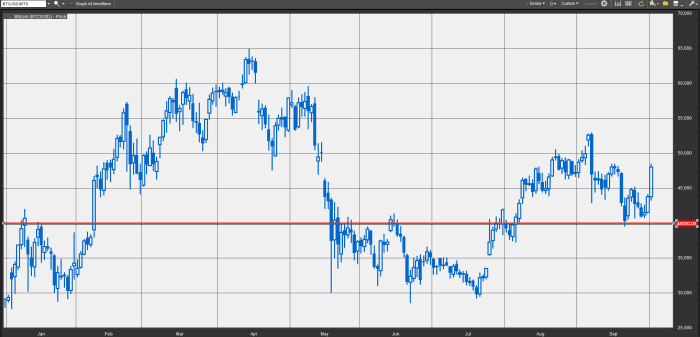

“While these issues are hurting sentiment, they haven’t been able to push Bitcoin below $40,000 — $10,000 higher than the area where prices bounced in late July. It’s also the top of Bitcoin’s range in late May and mid-June, which could mean old resistance has become new support,” the research writes in a Thursday blog.