Corporate rates left alone, stock buybacks targeted: What’s in Biden’s tax plan

A corporate tax hike and a new levy on billionaires didn’t make it into the Biden administration’s proposals to pay for its social-spending priorities, but some companies could still wind up paying more and it may get more costly to repurchase stocks.

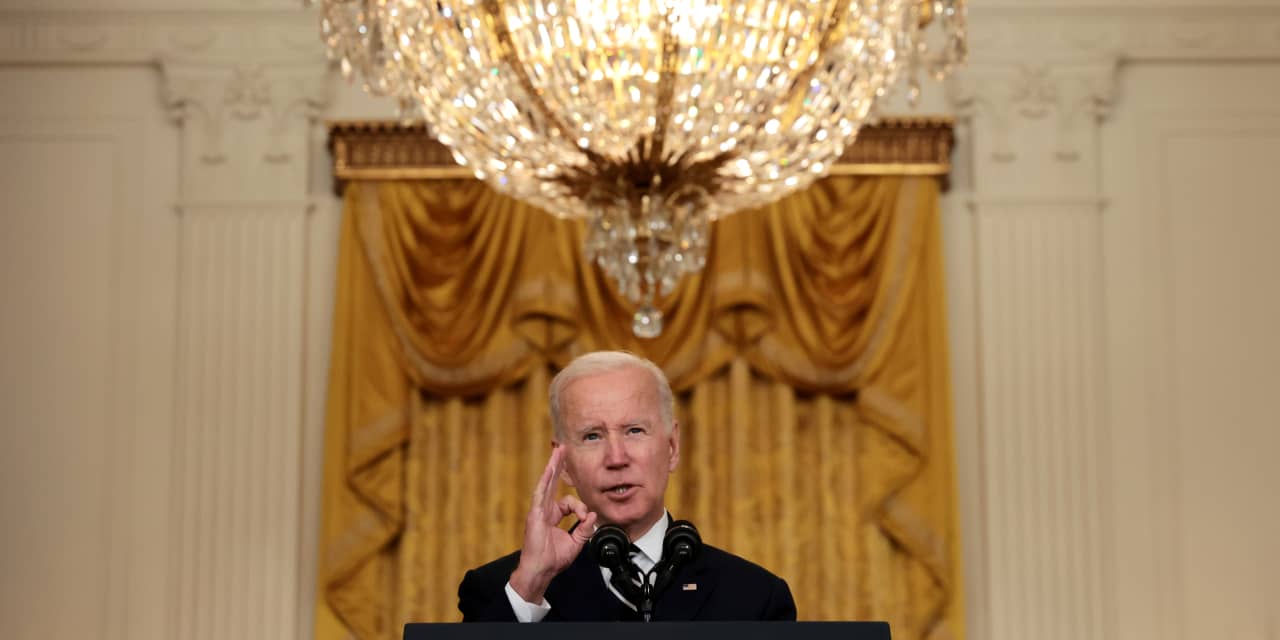

Released Thursday before President Joe Biden left for a series of meetings in Europe, the tax plans aim to pay for clean-energy initiatives, universal preschool and many more items in the White House’s sweeping “Build Back Better” agenda. Negotiations are expected to continue over the package, which has shrunk to $1.75 trillion from an earlier target of $3.5 trillion over 10 years.

Following are some major tax provisions that made the cut, and some that aren’t included.

What’s in:

MINIMUM 15% CORPORATE TAX: The White House is aiming to raise $325 billion over 10 years through a 15% minimum tax on big corporations, based on profits reported to shareholders. As the Wall Street Journal reported, backers say the minimum tax would apply to about 200 companies. The idea is to collect more taxes from large companies like Amazon AMZN,

Also see: Large companies, like Amazon, could pay more with a 15% corporate minimum tax

STOCK BUYBACKS TAX: Corporations that purchase their own shares would see a 1% surcharge on those buybacks. The White House says executives use buybacks too often “to enrich themselves” instead of investing in workers and the economy, with buybacks surging after the Republican tax-code overhaul of 2017. If the provision goes through, meanwhile, investors SPX,

Read: S&P 500 companies will still increase buybacks next year despite new taxes, Goldman analysts say

SURCHARGE ON TOP 0.02%: Though the top marginal tax rate on individuals won’t change under Biden’s plan, the very wealthy won’t get off scot-free. As MarketWatch reports, the highest-end households would face a 5% added tax for income above $10 million, and, once income reaches $25 million, they’d pay an 8% added tax. It would affect 0.02% of Americans, according to the White House.

Learn more: How does Biden’s latest plan to tax the superrich work? ‘It’s more straightforward.’

ENERGY TAX CREDITS: The proposal makes major investments in climate, including through tax credits to encourage moving toward cleaner energy sources. It includes expanded credits to boost usage of “clean energy” ICLN,

CHILD TAX CREDIT: An enhanced child tax credit would continue for another year under Biden’s plan. The yearlong extension is a disappointment for Democrats who wanted to make it permanent, and also falls short of Biden’s previously sought extension through 2025. The White House says the plan would mean monthly payments to parents of nearly 90% of children next year. The new framework would also make the credit completely refundable on a permanent basis, a change that would ensure lower-income households could receive the full credit amount even if they did not face a big tax obligation.

Now read: Biden unveils framework for $1.75 trillion social-spending bill with extended CTC payments and more

What’s out:

CORPORATE RATE HIKE: Democrats jettisoned plans to raise the federal corporate tax rate of 21%, amid opposition from Sen. Kyrsten Sinema of Arizona, who said she wouldn’t support rate increases for companies or high earners.

TOBACCO AND NICOTINE TAX: An excise tax on tobacco and nicotine products was also left out of Biden’s proposal, “and we don’t expect it to return,” said analysts at Beacon Policy Advisors. A proposal earlier this year from the House Ways and Means Committee would have doubled the current federal cigarette tax to $2.01 a pack.

See: Oil industry avoids pain in House Democrats’ tax plan, but tobacco, vaping get hit

SALT: Biden’s framework didn’t mention changes to the state and local tax deduction, commonly abbreviated as SALT. But Democratic lawmakers say they expect changes to the cap before any bill is voted on.

BILLIONAIRE TAX: A proposal to tax billionaires’ unrealized capital gains proved to be short-lived, drawing opposition from the likes of Tesla TSLA,

More on Musk: Elon Musk slams billionaire tax: ‘Eventually, they run out of other people’s money and then they come for you’

IRS BANK REPORTING REQUIREMENTS: Even a scaled-back proposal to have banks tell the Internal Revenue Service about certain customers’ accounts’ cash flow flopped in the face of opposition from Sen. Joe Manchin, a conservative Democrat from West Virginia, and others.

Related: These healthcare stocks are winners in Biden’s social-spending plan, analyst says

Andrew Keshner contributed to this report.