When the Fed finally steps back, can the U.S. stock and bond markets stand on their own legs?

Financial markets have staged a dramatic turnaround in the roughly 18 months since global central banks sent in the cavalry, with U.S. stocks climbing to dizzying heights and corporations raking in record profit.

The big question heading into this fall is whether markets can stand on their own legs once the Federal Reserve starts to pull back its pandemic firepower.

For its part, the European Central Bank this week announced plans to recall some of its pandemic monetary support for financial markets, raising expectations for the Fed to soon follow in its footsteps.

While ECB President Christine Lagarde said the pullback didn’t amount to a “tapering,” but was instead a mere recalibration of stimulus efforts, the decision was still viewed as a significant step.

Read: ‘The lady isn’t tapering,’ says Lagarde as ECB slows asset purchases

When the pandemic struck the global economy in 2020 central banks embarked on large-scale asset purchases and vowed to keep interest rates near historically low levels to help heal their economies and keep credit flowing during the COVID crisis.

“The ECB has throwing down the gauntlet,” said Phil Orlando, chief equity market strategist at Federated Hermes, in a phone interview. “We are expecting a Fed taper announcement this year.”

“To narrow it down, we are suggesting it is going to come on Nov. 3, which is the conclusion of the Fed’s two-day November meeting.”

He also expects a quick tapering process that ends by June of 2022, followed by a 75 basis point increase in the Fed’s benchmark interest rate by the end of 2023, up from the current 0% to 0.25% range.

Vaccines, jobs, free markets

Fed Chairman Powell often has tied the pace of the U.S. economic recovery, and levels of central bank support, to the coronavirus, vaccinations and labor market conditions.

As a result Federated Hermes’ Orlando expects no decision on tapering the Fed’s $120 billion in monthly asset purchases at the central bank’s Sept. 21-22 policy meeting. “The reason for that is that the August jobs report was terrible. It missed by a half million jobs relative to consensus,” he said.

Labor market conditions are expected to improve in the next few months, given the expiration of the extra $300 a week in unemployment benefits and record job openings.

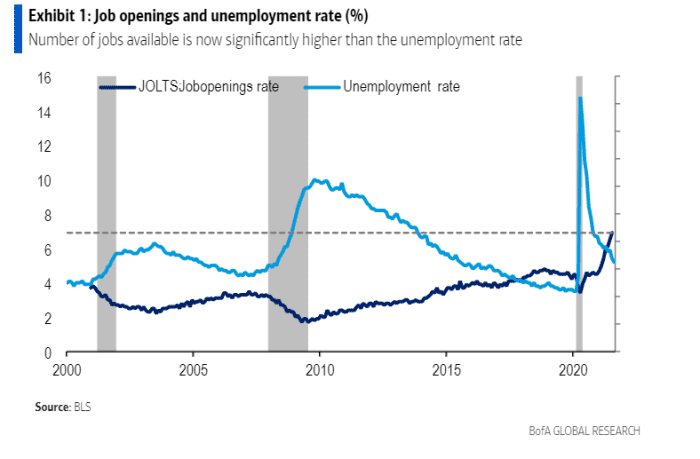

BofA Global summed up “perhaps the most underappreciated statistic in the jobs market” in this Friday chart, showing how job openings now outpace people seeing work.

Job openings outpace seekers

BofA Global, BLS

“The Fed is pointing to the labor market statistics as a reason to delay tapering,” Ethan Harris and BofA’s global rates and currencies research team wrote. “We don’t agree.”

“If demand is red hot, their job is to lean against it regardless of whether it shows up as surging payrolls or surging excess demand for labor.”

The recent bullishness in the U.S. stock market has come as the U.S. faces its highest daily death count from COVID in six months, with nearly a quarter of the U.S. population still refusing to get vaccinated despite widespread availability in America.

In a renewed push to halt COVID’s toll, President Joe Biden in a Thursday White House speech unveiled a 6-part plan to defeat “the pandemic of the unvaccinated,” which has been filling up hospital emergency rooms and leaving others without access to medical care.

Rough patch

While it has been smooth sailing for investors this year, with the S&P 500 index up almost 19%, a rough patch likely lies ahead.

The Dow Jones Industrial Average DJIA,

With stock-market valuations at “historically extreme” levels, a Deutsche Bank analyst said on Friday that the risk of a “hard” correction is growing.

In addition, there could be several waves of the coronavirus’ delta variant and the threat of other strains to follow, but also the potential for a significant leadership change when Chairman Powell’s term expires in January.

Since August, Orlando has been bracing for a 5% to 10% pullback in stocks through October, something which has not happened since November 2020 and which could take the S&P 500 down below its 200-day moving average of about 4,000. However, after that clears, he expects the index to top 4,800 around year-end, with a 5,300 forecast for 2022.

Debt test

Another test of U.S. financial conditions has been playing out in real time for borrowers in the near $11 trillion corporate bond market, where the first part of a September financing blitz has been going off without a hitch.

The week of the U.S. Labor Day holiday smashed daily records for the number of investment-grade companies LQD,

“It really speaks to the resilience of the market in terms of its ability to digest this volume of corporate credit transactions, despite the deluge,” said U.S. Bank’s James Whang, co-head of the credit fixed income and the municipal product group.

Spreads in both the U.S. investment-grade and high-yield, or “junk bond,” market have been hovering near all-time lows, even as the Fed sells the remainder of its pandemic holdings of corporate bonds.

“I think concerns around tapering are a little overplayed,” Whang told MarketWatch. “I don’t think the Fed would do anything to constrain economic growth, when there still is a fair amount of uncertainty around delta.”

In the week ahead, U.S. economic data will be focused on Tuesday’s cost of living reading via the Consumer Price Index and Core CPI for August. Then, it is more jobs data on Thursday, while Friday brings the preliminary University of Michigan’s consumer sentiment index for Sept.