Value of battery metals in new electric cars surges 177% year-on-year

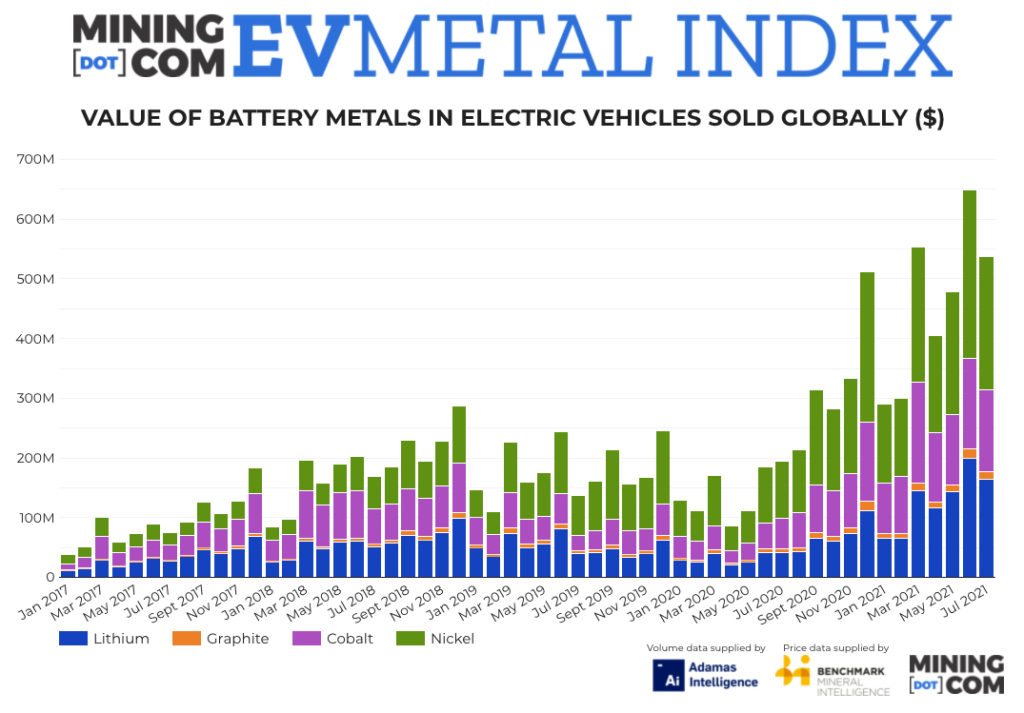

That means that almost as much EV battery metal business was done in the first seven months of 2021 than 2017 ($1.1 billion) and 2018 ($2.2 billion) combined.

Total battery capacity of EVs sold during July almost doubled year on year to 19.9 GWh according to Adamas Intelligence, which tracks demand for EV batteries by chemistry, cell supplier and capacity in over 100 countries.

In order to produce the most accurate data, the monthly battery capacity deployed numbers in the MINING.COM EV Metal Index do not include cars leaving assembly lines, those on dealership lots or in the wholesale supply chain, only end-user registered vehicles.

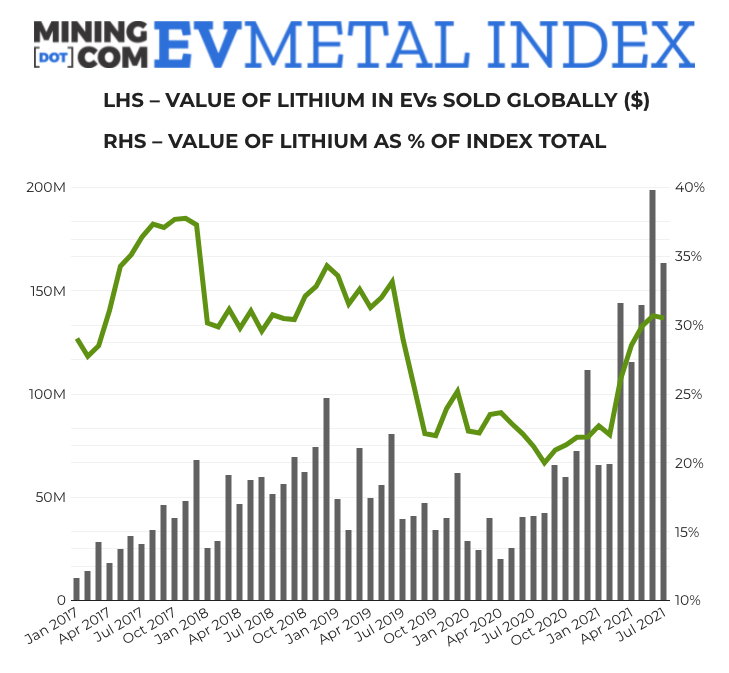

In July 2021, just over 12,200 tonnes of lithium carbonate equivalent were deployed onto roads globally in batteries of all newly-sold passenger EVs according to Adamas. Average lithium on a per vehicle basis including hybrids was up 19% year over year in July, jumping from 13.1kg to just shy of 16kg.

Carbonate made up 53% of the total versus hydroxide’s 47%, with the latter favoured in the manufacture of high-nickel content batteries, Adamas data show.

Lithium prices are up a stunning 162% year to date and now tops $21,000 a tonne (hydroxide ex-works China mid-September) according to Benchmark Mineral Intelligence, a battery supply chain researcher and price reporting agency.

While the lithium subindex contracted 22% in July compared to the record set in June, at $164 million it still constitutes the second best month on record. As a percentage of the overall index value, lithium represents just over 30%, up from a low of 20% in August last year when prices spent several months under $7,000 a tonne.

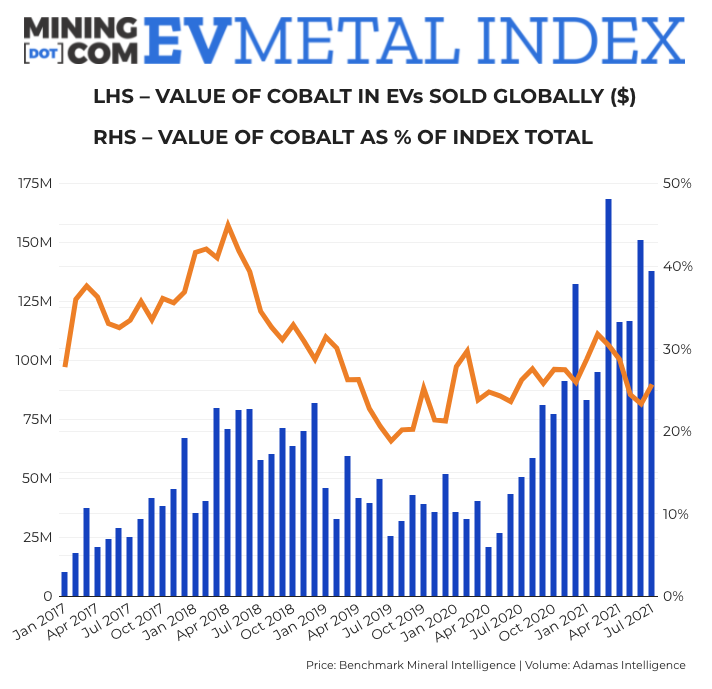

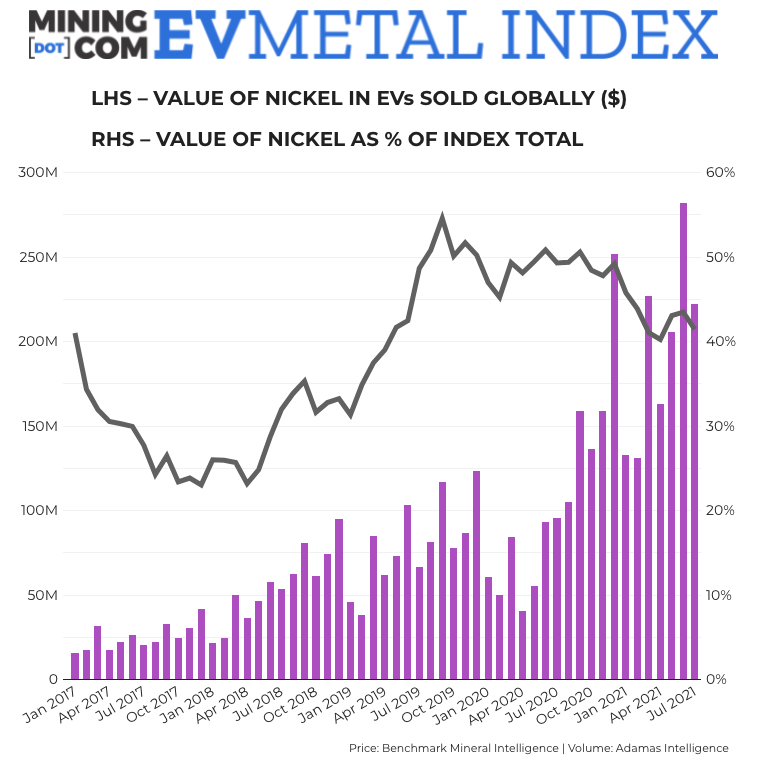

Overall cobalt deployment doubled compared to the same month last year while nickel use was up 69%. On a per vehicle basis nickel use is up 3% while cobalt decreased 5% year over year, as cathode chemistries which forego cobalt altogether like lithium iron-phosphate (LFP) batteries gain in popularity.

Nickel sulphate topped the $21,000 a tonne (100% Ni basis) level in July. Cobalt used in the battery supply chain has surged over the past year to within shouting distance of $60,000 a tonne compared to low $30,000s this time in 2020.

In July 2021, nearly 18,000 tonnes of synthetic and natural graphite were deployed globally in batteries of all newly-sold passenger EVs combined, a 107% jump over the same month last year.

Graphite prices have held steady around $720 a tonne in 2021, after spending all of 2020 below $700 and hitting a low of $644 in September. Prices for the anode material peaked above $1,500 a tonne in early 2012.