Plug Power stock surges after Piper Sandler says time to buy, citing ‘tremendous forward momentum’ on green hydrogen plans

Shares of Plug Power Inc. rallied Thursday, after Piper Sandler analyst Pearce Hammond turned bullish on the hydrogen and fuel cell systems company, citing attractive valuation and “tremendous forward momentum” on its green hydrogen plans.

Hammond raised his rating to overweight, after initiating Plug at neutral eight months ago. He reiterated his $33 stock price target, which is 19.6% above current levels.

The stock PLUG,

“[T]he shares have come off significantly despite the company making significant progress on its growth initiatives,” Hammond wrote in a research note to clients. “Since May, Plug shares have been rangebound between $20-$35/share, and we believe the current share price offers an attractive entry point and risk/reward ahead of a catalyst-rich analyst day next month.”

The company is hosting its next Plug Symposium on Oct. 14, at which Hammond expects Plug to update its multiyear outlook and provide more color on new customers. He also expects the company to update its target markets, such as data center backup power and mobility, as well as highlight the size of the green hydrogen and electrolyzer markets.

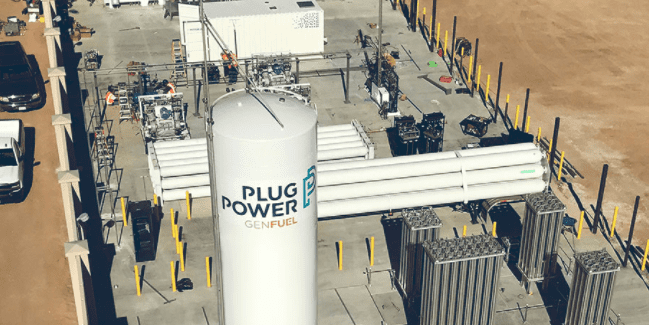

Plug had announced on Monday it will construct a new green hydrogen plant in California, adding to the ones it already has in New York, Tennessee and Georgia. Hammond expects the company to announce a fifth plant, in Texas, before the end of the year.

Despite the stock’s weakness this year, it has still soared 128.5% over the past 12 months, while shares of rivals Ballard Power Systems Inc. BLDP,

Hammond started coverage of Bloom Energy on Thursday at neutral with a $21 stock price target, saying the company is his second favorite of the three hydrogen and fuel cell companies he covers. His third favorite is Ballard Power, which he also rates neutral, but on Thursday he cut his price target to $12 from $14.