Mining stocks carnage as iron ore, copper prices fall

China produces more steel than the rest of the world combined and Beijing is implementing production curbs this year as it works toward a target of reaching carbon neutrality by 2060.

Copper for delivery in December fell 3% from Friday’s settlement price, touching $4.116 per pound ($9,166 per tonne) midday Monday on the Comex market in New York, a month low. Copper prices hit a record high of more than $10,500 a tonne in May.

Chinese property giant Evergrande is weighed down by a $300 billion debt burden and a collapse could send ripple effects across the sector. In Hong Kong, the Hang Seng property index fell to its lowest since 2016 . The Chinese real estate and building sectors are the main driver of steel consumption and also accounts for roughly a fifth of copper demand.

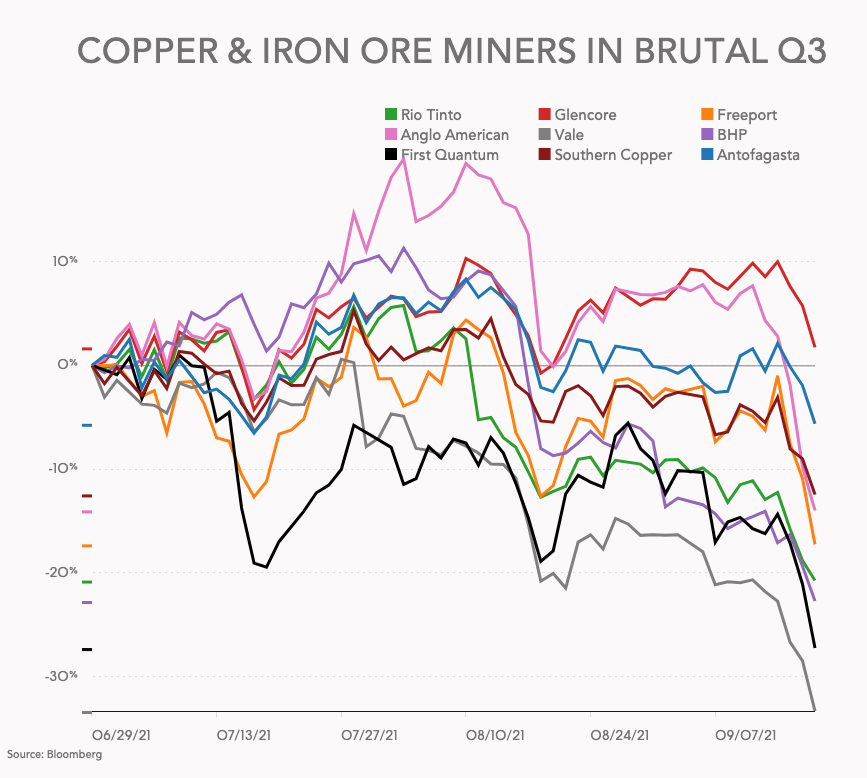

Top mining companies were caught up in the turmoil on equity markets with heavy-volume declines across the board.

Global number three iron ore and number two copper producer BHP fell 3.4% in New York, bringing its Q3 slump to over 26%. Rio Tinto fell nearly 4% while Vale, which vies with the Anglo-Australian giant as top iron ore producer, was down 6.4%. Rio de Janeiro-based Vale has shed a third of its value since end-June while Rio has given up 22%.

Anglo American ADRs trading in New York fell nearly 6%, bringing losses over just the past month to 20%. Units of Glencore trading on US markets declined 5.5% but the Swiss-based miner and commodities trader, unlike its peers managed to remain in positive territory for the quarter.