Investors may be missing increased stagflation risks in ‘worsening Covid situation,’ BofA warns

Federal Reserve Chair Jerome Powell sparked “risk-on” moves in markets with his Jackson Hole speech last week, as investors possibly overlook the potential for stagflation as the delta variant of the coronavirus spreads, according to BofA Global Research.

“Risk-on post Jackson Hole assumes limited Delta economic impact and little inflation risks,” BofA strategists said in a rates and currencies report Thursday. “The latest evidence suggests otherwise and points to stagflation risks that could complicate Fed normalization.”

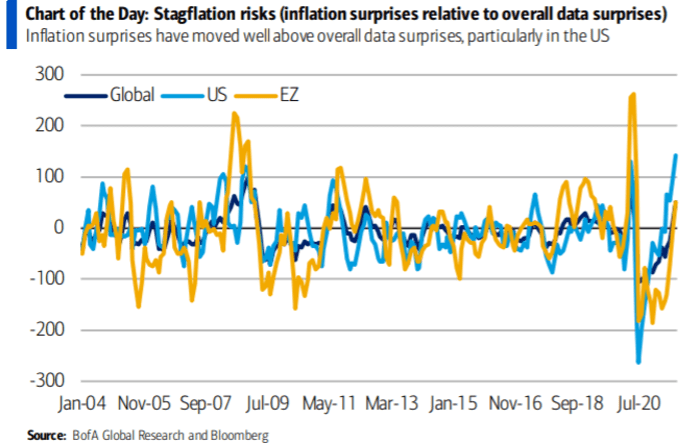

The BofA chart looks at the global economy, including the U.S. and Eurozone, showing “inflation surprises have moved well above overall data surprises.” That’s particularly so in the U.S., according to the report, which noted “the market’s positive reaction to Powell.”

Stocks rose and U.S. bond yields fell in the wake of the Fed Chair’s Aug. 27 speech, with the BofA strategists now urging investors to focus on the impact of the highly-contagious delta variant on the economy as the Covid-19 pandemic persists. They said the “worsening Covid situation” could lead to “further deterioration of supply bottlenecks and higher inflation.”

“The risk is increasing that Covid, as a negative and more persistent supply shock, leads to stagflation, in turn making Fed policy normalization challenging,” the strategists wrote. “The market does not appear to be too concerned about Covid and inflation risks.”

See: Stagflation is ‘a legitimate risk’ that would be painful for U.S. markets

Markets seemed to like Powell’s guidance on rates as he separated the Fed potentially hiking them from ending its quantitative easing program begun last year under its emergency measures taken amid the Covid-19 crisis, according to BofA Global Research. In ending QE, the Fed would begin tapering its $120 billion in monthly purchases of Treasury bonds and mortgage-backed securities — steps some investors have been anticipating could begin as soon as this year.

The yield on the 10-year Treasury note TMUBMUSD10Y,

U.S. stock indexes have risen to recent record levels, with the Nasdaq Composite notching an all-time closing high to start September.

The Nasdaq COMP,

Meanwhile, inflation has risen globally in 2021, the BofA strategists said.

“To a large extent this has to do with base effects from the collapse of oil prices last year, but core inflation has also increased in some cases,” they wrote in the report. “Supply bottlenecks during the reopening has been another reason, which in theory should be temporary, but it is unclear for how long they will actually last and whether they will leave more sustained scars.”

Inflationary pressures have been building at the same time global economic growth is slowing, which is similarly linked to well-anticipated “base effects from the reopening earlier in the year,” according to the report. But “the global economy seems to be slowing more than expected,” the strategists wrote.

The recent rise of Covid infections and mortalities in the U.S. compared with the European Union and globally is “concerning,” in their view. It may be that the vaccination rate in the U.S. is not high enough or there are fewer Covid-related restrictions in the country, the strategists said.

“No matter what the reason, if these trends continue, they could start affecting the real economy soon,” they wrote. “Although the aggressive Fed policy easing during the pandemic has supported risk assets, this may not be the case if Covid persists and the shock to the real economy is more persistent.”

Check out: Worried about ‘value traps’ in stocks? GMO says ‘growth traps’ are even more painful