“It will also disrupt industry trends for almost all sub-sectors, dooming the coal industry, reviving copper and green steel, and prompting the emergence of new sectors including lithium. As such, it poses key risks and opportunities to the entire mining and metals sector.”

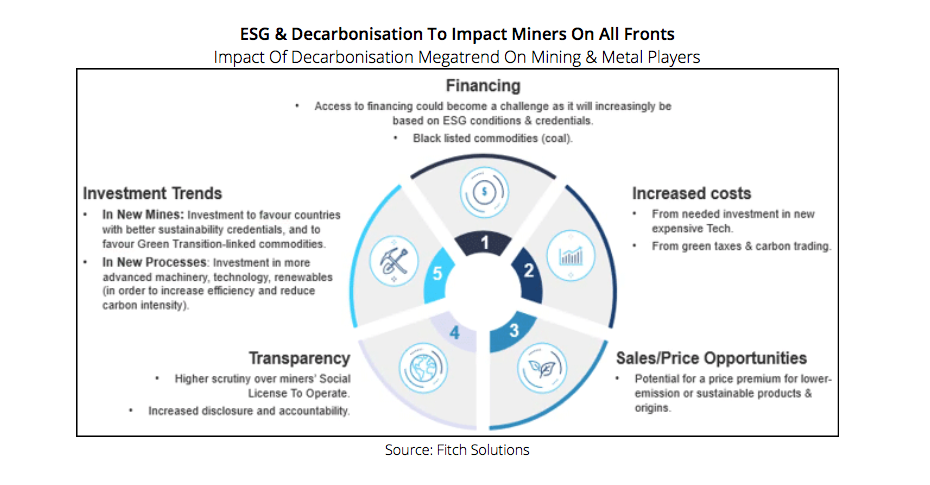

The decarbonisation megatrend will bring risks to the sector, as it will require large investment to adapt processes and reduce emissions. It will also disrupt businesses linked to the commodities in decline, which include coal in particular, along with low-quality iron ore, steel and zinc, says Fitch.

While the energy transition will require the sector to adapt deeply, these shifts also present a number of key opportunities for the mining and metal players, Fitch predicts. Overall, large players will likely benefit, the analyst says, from being able to rely on stronger investment capacity and more robust risk management functions. This could help them gain market share at the expense of junior miners, which will struggle to adapt to the low carbon economy.

There will be key direct business opportunities for players producing or operating in the space of the critical materials for the battery revolution, the boom in renewables capacity or the for the ‘zero carbon economy’ which include copper, nickel, aluminium, tin, lithium, cobalt and low-carbon steel.

Mining and metal players that have reduced significantly their emissions or that have developed new techniques to produce low-carbon products (low-carbon aluminium, steel, ‘zero-carbon lithium, etc) will also likely be able to command a price premium, as their clients strive to reduce their own scope-3 emissions, Fitch says.

Business strategies starting to evolve

Companies have already started to position themselves and invest to benefit from these trends since 2020. This will be strongly encouraged by earnings at multi-year highs in FY2021 (and likely into FY2022), Fitch says, and as mining and metal players are planning on increasing significantly their capital expenditures.

In July, Rio Tinto committed $2.4bn to its Jadar lithium mine project in Serbia, a project which is expected to begin production in 2026 and which would help make the company among the top 10 lithium producers globally. Rio Tinto could look at acquiring other lithium-related projects in the coming years. The company is also moving forward with the Winu copper-gold project in Australia and the Oyu Tolgoi expansion in Mongolia.

Meanwhile, BHP has identified in 2020 nickel, copper and potash as priority investment sectors, under its “future facing” commodities initiative, as the company shifts away from fossil fuels.

In April 2021, Vale said it is exploring spinning off of its base metals business from the iron ore business to unlock value for its nickel and copper businesses amidst the EV battery value chain boom.

Vale is the largest producer of nickel ore globally, and aims to increase copper output in the coming years, with the development of a new deposit (Hu’u) in Indonesia.

Meanwhile, Russian aluminium producer Rusal, the world’s largest aluminium producer outside China, is in the process of demerging its high-carbon smelters and refineries into a new company so that it can focus on the fast-growing market for “green” aluminium.

(Read the full report here)