Here’s why Robert Shiller’s two stock-market indexes are telling wildly different valuation stories.

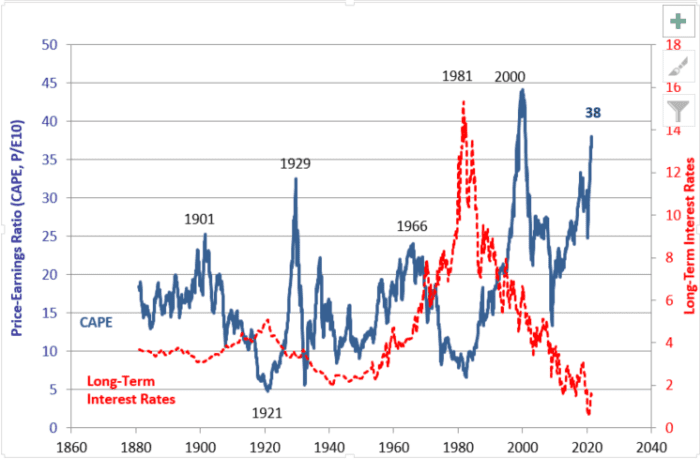

When making the argument that stocks are overvalued, one index often is trotted out — the cyclically adjusted price-to-earnings ratio popularized by Robert Shiller, the Yale professor and Nobel laureate. The index uses earnings over the last decade, rather than a single year, to provide a long-term perspective. July’s reading of 37.98 is more than double the average, and the highest since the dot-com bubble.

The traditional cyclically adjusted price-to-earnings ratio.

Robert Shiller’s website

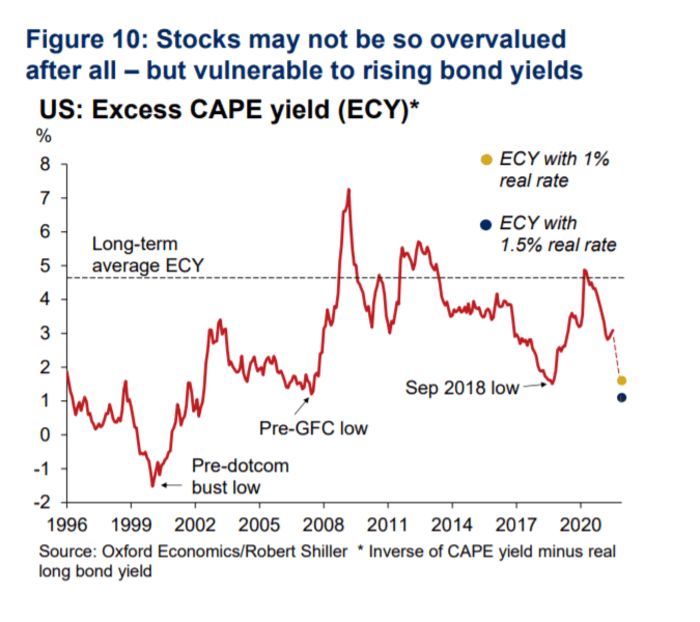

But Shiller himself has moved onto a different metric, called the excess CAPE yield, which considers both equity valuation and interest-rate levels. It’s defined as difference between the inverted CAPE ratio and the 10-year inflation-adjusted interest rate.

Adam Slater, lead economist at Oxford Economics, used the excess CAPE yield model to look at what’s currently going on. As the chart shows — and remember, since we’re looking at yield, low numbers imply higher valuations — current valuations aren’t outrageous.

Slater says Oxford’s fair value models for government bonds suggest yields are expensive by anywhere from 20 to 100 basis points. He writes that there’s “a fundamental problem with the low rates argument –– that we may be comparing one overvalued asset class with another.”

Now much has been made about what could move yields higher, but hot inflation readings lasting for longer than the Federal Reserve expects would be the likely catalyst.

Put another way, if real rates rise to where they stood at the end of 2018, Shiller’s new valuation measure would move to 2007 territory — right before the global financial crisis.

The chart

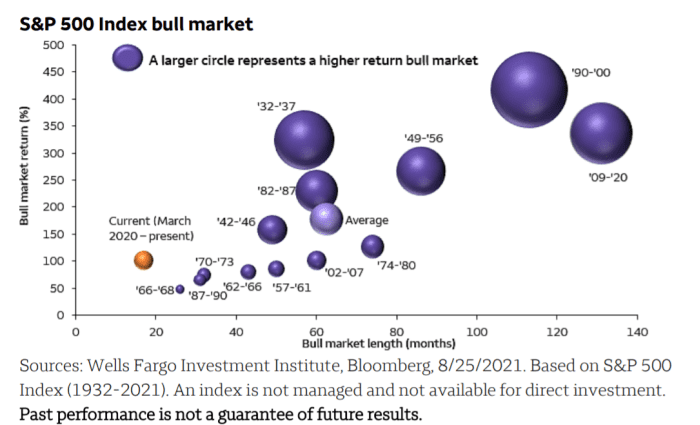

One topic that’s been doing the rounds is whether the current bull market is relatively young, or an extension of the one that began in 2009 and only ended when the coronavirus pandemic struck the west.

If you use the more traditional definitions, the current market is in its infancy, and its more than 100% returns are below the average 62-month bull that generates 178% average returns, according to an analysis from Wells Fargo Investment Institute. “Barring any unforeseen events such as a serious policy mistake, we believe these factors [strong economic and earnings growth and low interest rates] will support higher equity prices and sustain the bull market rally,” said Chris Haverland, global equity strategist.

The buzz

The economic calendar includes the ADP private-sector payrolls report, the Institute for Supply Management manufacturing index, and the final release of Markit’s manafacturing purchasing managers index.

Intuit’s INTU,

CrowdStrike Holdings CRWD,

Cathie Wood’s Ark Invest has filed to launch a new exchange-traded fund designed to track corporate transparency ratings.

The market

Dow futures YM00,

The yield on the 10-year Treasury TMUBMUSD10Y,

Random reads

Another day, another TikTok cooking hack, this time involving pasta.

An Illinois woman was arrested for using a fake vaccination card to travel. One giveaway was her unfortunate spelling of a vaccine maker: “Maderna,” which was trending on Twitter.

Women finding mumbling attractive, according to a study.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.