European Stocks Slide to Two-Month Low on China and Fed Concerns

(Bloomberg) — European stocks slid to the lowest level in two months as China’s real estate crackdown and worries ahead of this week’s Federal Reserve fueled risk-off sentiment.

The Stoxx Europe 600 index fell 2%, the most in a month and to the lowest level since July 21. Germany’s DAX slumped 2.3% on the day the index’s rebalancing takes effect, with banks and automotive shares underperforming.

While all sectors retreated on the European gauge, miners declined the most, sliding to the lowest level since February as iron ore’s rout deepened and base metals fell. Anglo American Plc, Rio Tinto Plc and Glencore Plc were among the worst performers.

Growing investor angst about China’s real estate crackdown rippled through markets on Monday, pummeling Hong Kong developers. These concerns add to mounting investor worries over rising inflation, pullback in stimulus measures and Covid-19 risks.

“Worsening sentiment out of China, and a ratcheting up of geopolitical tensions has led to the pullback,” Altaf Kassam, State Street EMEA head of investment strategy & research, said by email. “With a raft of central bank meetings and announcements this week and soon after, the market is becoming nervous that the ‘transitory’ inflation narrative will be undermined by continued strong inflation data, leading to an earlier-than-expected policy tightening.”

The Stoxx 600 has been retreating from a record high reached in August as investors focus on risks ahead. All eyes will be on Wednesday’s Federal policy statement, with officials expected to signal a move toward scaling back stimulus.

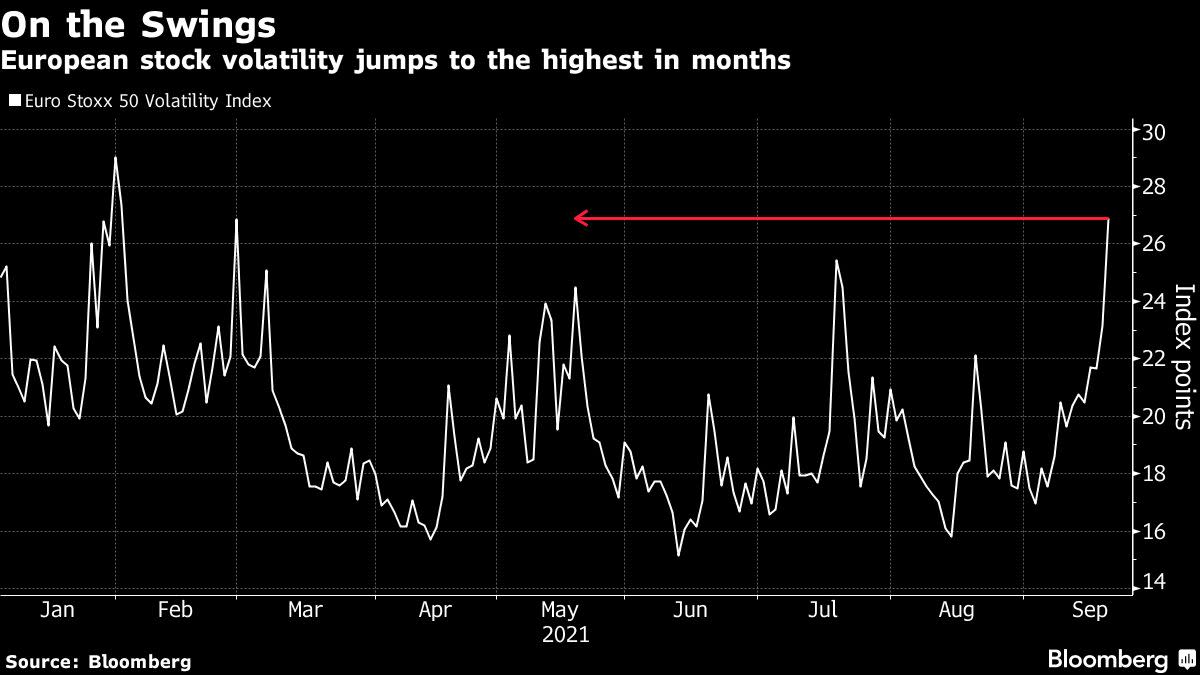

Meanwhile, the VSTOXX European volatility index jumped to the highest intraday level since mid-May and the highest since February on a closing basis.

Alberto Tocchio, a portfolio manager at Kairos Partners, doesn’t think there will be “a contagion effect” from China’s crackdown on other continents.

“A correction was due and is healthy after one of the biggest uninterrupted rallies in history, which will eventually resume,” Tocchio said. Other factors denting investor confidence in the near-term include inflation and the slowdown in economic growth, he said.

Among the biggest individual movers, Deutsche Lufthansa AG rose after announcing plans to raise 2.14 billion euros ($2.5 billion) to repay part of a German government bailout. Meanwhile, luxury stocks including LVMH and Kering SA declined amid persistent worries over China’s slowing growth. Also, Prudential Plc sank as much as 8.3% after news of a share placing came on what an analyst called the worst day possible.

For a daily wrap highlighting the biggest movers among EMEA stocks, click hereYou want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance.

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.