Crypto traders blame bitcoin’s Tuesday tumble partly on glitches at exchanges and a $44 million sale order

A wild day on crypto exchanges is being blamed on a raft of glitches and reports of a big sale that at least one analyst credited for contributing to the downward pressure on digital-asset prices.

Temporary technical trading issues were reported by users of exchanges from Coinbase Global COIN,

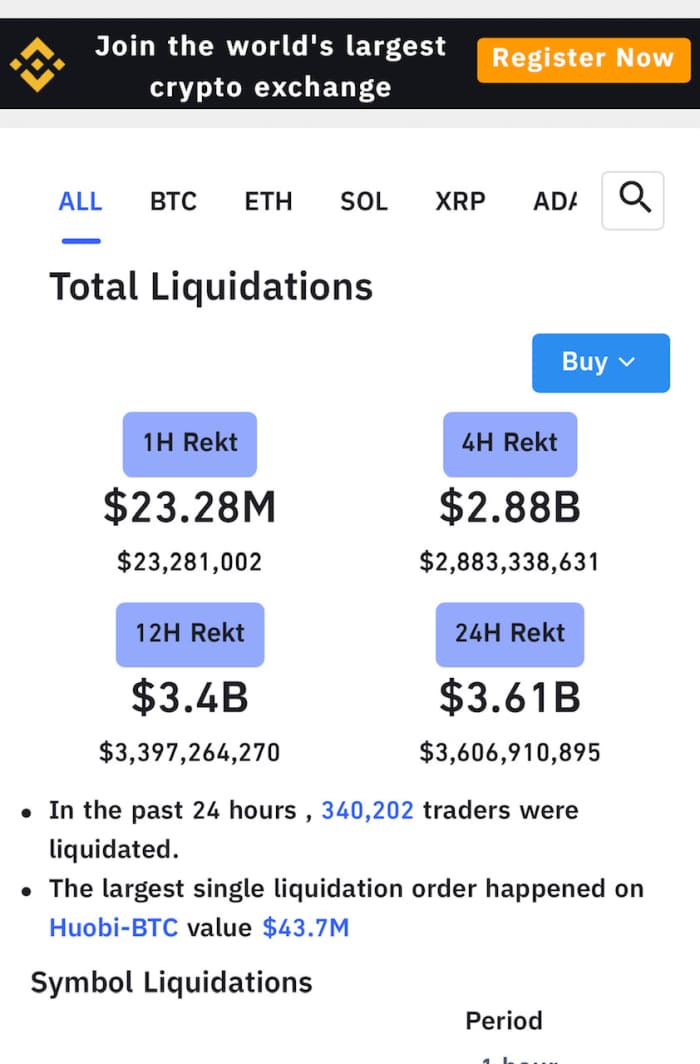

On top of that, an analyst pointed to the big sale of some $44 million in bitcoin on Seychelles-based cryptocurrency exchange Huobi as amplifying the slump on Tuesday, as many traditional investors in the U.S. returned from a three-day holiday.

Traditional stock indexes, such as the Dow Jones Industrial Average DJIA,

Against that backdrop, bitcoin BTCUSD,

Even by crypto’s whipsawing standards, Tuesday’s action was a bit unsettling for digital-asset bulls.

“Bitcoin price [was] being hammered…but if you look at the price action more closely you can see that traders have actually bought the dip as the price has bounced near its 50-day [simple moving average],” wrote Naeem Aslam, chief analyst at AvaTrade, in a daily note.

“At the same time, it is important to note that crypto exchanges like Bitfinex have turned off their platforms, possibly crashed, and this is certainly a concern for investors,” the analyst wrote.

At last check, bitcoin was changing hands at $46,920.19, down nearly 10%, while Ether was trading at $3,414.49, off by nearly 14% on CoinDesk.