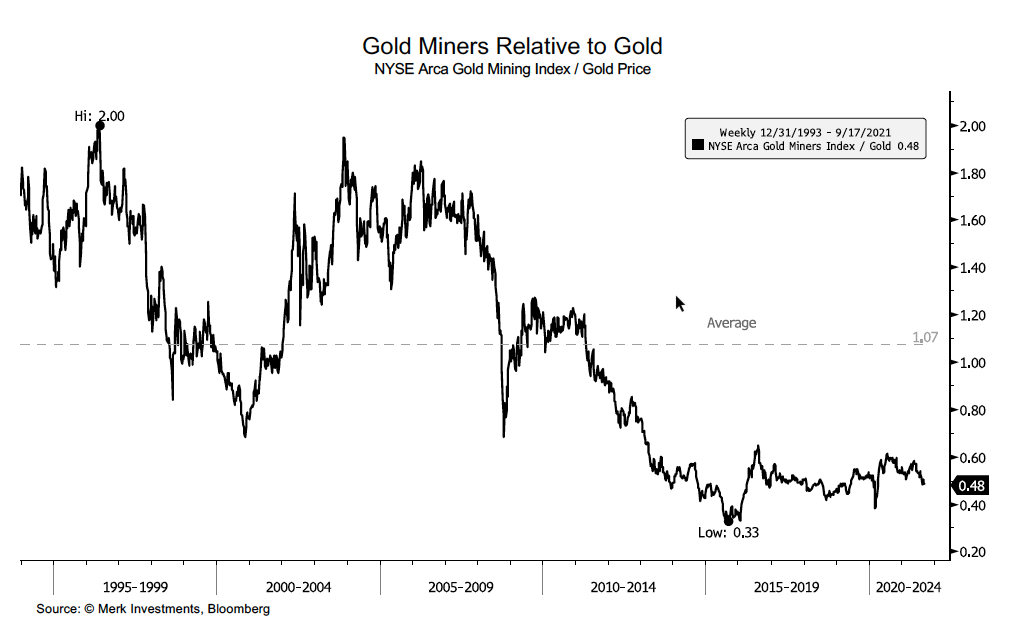

A new chartbook released by Merk Investments, an investment advisor, and ASA Gold and Precious Metals (NYSE:ASA), a closed-end investment fund established in 1958, includes two long-term charts that show gold mining stocks underperforming the price of gold is hardly a new phenomenon.

In fact, the current ratio between the metal and gold stocks as represented by the NYSE Arca Gold Mining Index, is not far off historic lows struck in 2015 and gold stocks have been underperforming gold for a decade.

If the price of gold stays stable at today’s levels, gold stock valuations would have to more than double to bring it in line with the historical average since the early 1990s.

Balance would also be restored should the gold price halve of course, but there is no scenario where bullion trading in triple digits does not bring carnage to the equities.

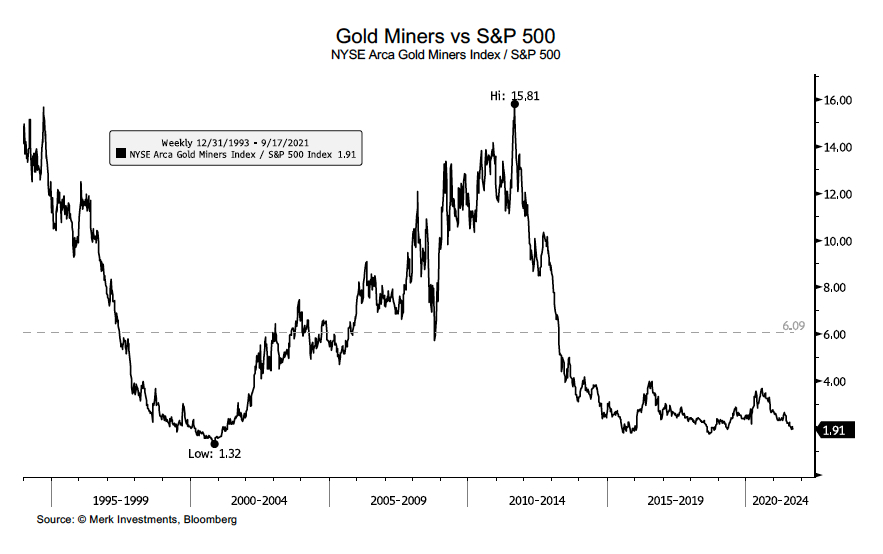

At the same time, despite robust gold prices (and record highs along the way), gold mining stocks have also been deeply discounted when compared to US stocks in the form of the S&P 500.

Download the chartbook here