This canary in the coal mine shows a 10% S&P 500 correction is getting closer. Play defense, say strategists

With U.S. inflation data on the doorstep, stock futures are mixed headed into Wednesday’s session, as bond yields creep up and technology stocks point south.

How far has this stock market come since last year’s pandemic meltdown? Tuesday marked the 64th high for the S&P 500 SPX,

Dizzy at these heights? Our call of the day from the equity trading desk of investment bank Stifel, led by Barry Bannister and Thomas Carroll, may confirm that as they double down on their expectations for a 10%-plus stock market pullback.

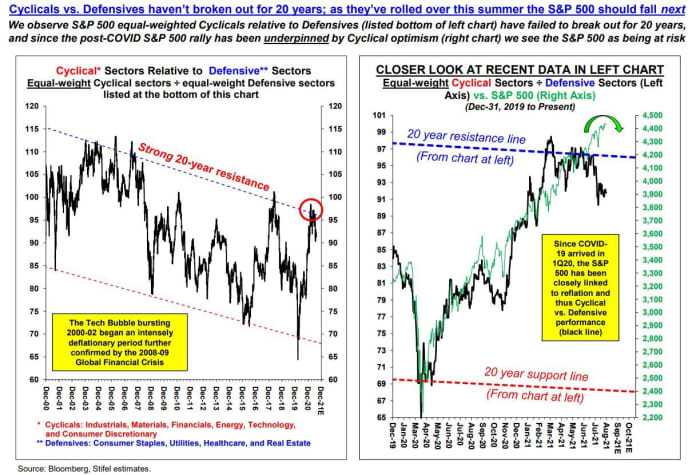

Back in June, the pair predicted that pullback in the second half of the year, suggesting investors bulk up on defensive stocks and steer clear of cyclical plays. They haven’t changed that opinion, saying fading cyclicals against defensives are a “canary in the coal mine” that has brought the likelihood of that correction forward.

“Equal-weighed cyclical sectors vs. equal-weighted defensives haven’t broken out for 20 years; as they’ve rolled over to a possible top this summer, the S&P 500 should fall next,” said the strategists, who provide the below chart:

“We see global cyclical indicators weakening in the next few months and slowing global liquidity reinforcing a ‘deflationary shock’ which tightens financial conditions and lowers the S&P 500 P/E ratio several multiples,” added Bannister and Carroll.

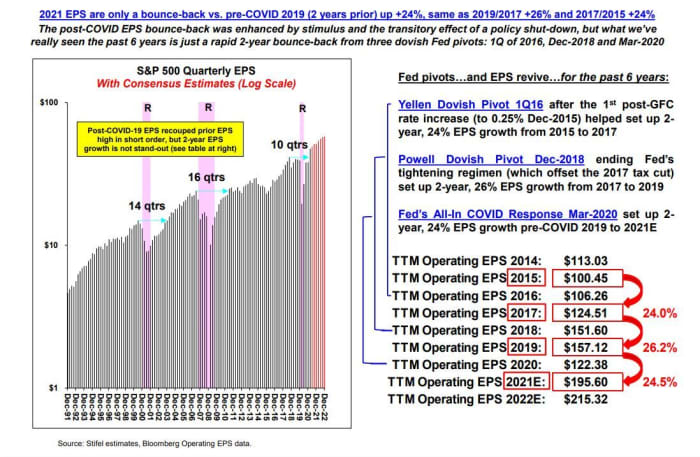

And they aren’t buying the strong earnings per share [EPS] argument. Two-year earnings growth of 24% is no stronger than that seen in 2017/2019 and 2015/2017, with each two-year block “boosted by a desperately dovish Fed pivot.”

Those looking out for slowing global liquidity, which at times has flattened the S&P 500, should watch bitcoin and copper for weakness, given they “symbolize market exuberance,” said the pair.

They also expect a stronger dollar may be undermining the recovery, with purchasing managers index manufacturing surveys weaker than the services side, which has historically aligned with a stronger dollar which we expect in the second half.

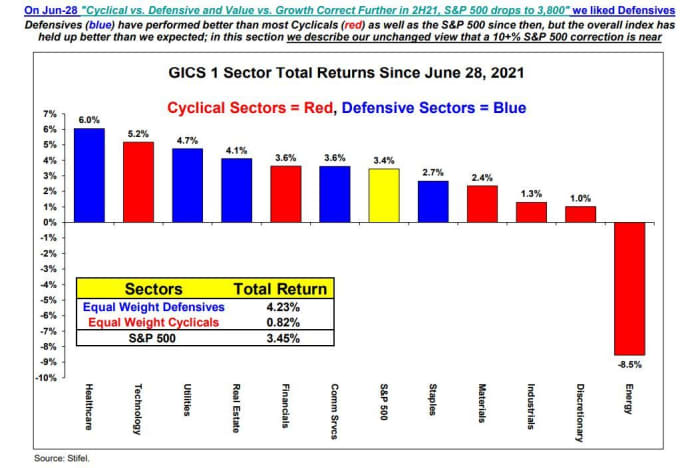

Bannister and Carroll admit markets have held up better than they expected since June 28, but with cyclicals clearly on the losing side.

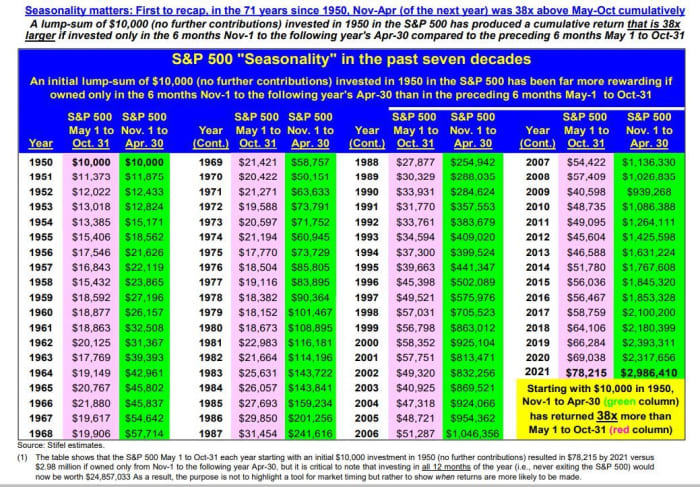

But to get you ready for what is likely to be a better seasonal run, they offer up this chart that shows how much more rewarding it is to sit out the May to October period.

Inflation and White House complains about OPEC

Americans have been paying higher prices for months, and don’t expect Wednesday’s data to show any shift. Forecasters expect July consumer price inflation to rise 0.5% in July. The federal budget for July is also ahead and Kansas City Fed President Esther George is also due to speak around 12 noon Eastern.

Oil prices CL00,

And Southwest Airlines shares LUV,

China electric-car maker Nio NIO,

Read: Wall Street’s pandemic weirdness on display with this week’s earnings batch

Cryptocurrency platform Coinbase COIN,

And decentralized-finance (DeFi) platform Poly Network is pleading with hackers to return more than $600 million in stolen cryptocurrency. It could be the biggest crypto heist ever.

Two high-profile security software groups, NortonLifeLock NLOK,

The Federal Trade Commission is reportedly probing a tie-up between ride-share giant Uber Technologies UBER,

The markets

Oil is on the move, but stock futures YM00,

The chart

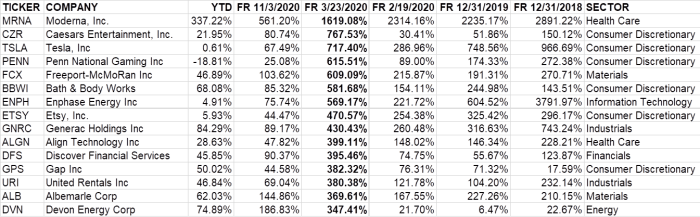

Here’s some more factoids from S&P Dow Jones Indices’s Silverblatt, who notes that since March pandemic low, at least 272 stocks have at least doubled in price, led by a 337% gain for COVID-19 vaccine maker Moderna MRNA,

The average gain is 127.86%, with the median 105.76%.

Random reads

‘River Dave’ is saying goodbye to his hermit days forever

Why teen climate activist Greta Thunberg hasn’t bought anything new in three years

The ancient Persians knew how to keep cool in heat waves

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.