Stocks, Futures Fall as Traders Await Fed Signals: Markets Wrap

(Bloomberg) — U.S. stock-index futures fell and Treasuries climbed amid concern the economic recovery from the pandemic is faltering and investor nervousness in the run-up to the Federal Reserve’s Jackson Hole symposium in late August.

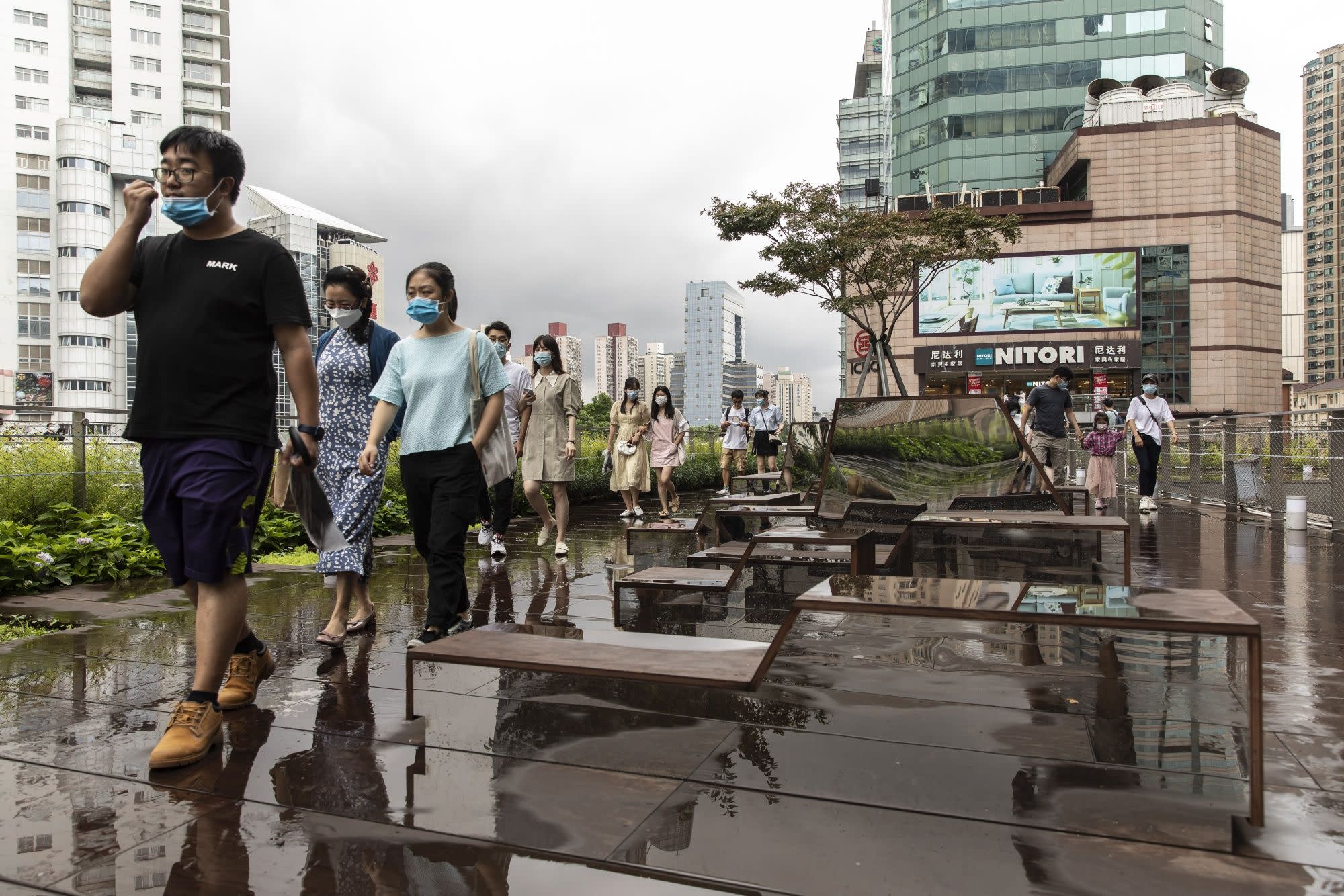

September contracts on the S&P 500 Index declined 0.3% after the underlying gauge notched up another record high on Friday. Ten-year U.S. yields slid three basis points and the dollar rose. Chinese stocks gave up gains as the country’s retail sales and industrial output data showed activity slowed more than expected.

Investors are awaiting a town hall by Fed chair Jerome Powell on Tuesday for clues on whether a recent string of strong economic data qualify as “further progress” for the central bank to consider tapering stimulus. Speculation about an announcement at the Jackson Hole meeting deepened even as data Friday showed U.S. consumer confidence plunged to a near-decade low.

“Shares remain vulnerable to a short-term correction with possible triggers being the upswing in global coronavirus cases, the inflation scare and U.S. taper talk,” said Shane Oliver, head of investment strategy and chief economist at AMP Capital.

In addition to Powell’s town hall, traders will be monitoring the Federal Open Market Committee’s latest minutes this week as conflicting views on whether high inflation will prove persistent spurs volatility in Treasuries.

Equities in the U.S. and Europe hit records last week, bolstered by vaccine rollouts. But the delta variant remain a threat. Also, dominating the headlines is the alarm in Congress as the Taliban take control of Afghanistan in the vacuum left by departing U.S. and NATO forces.

European stocks fell, breaking a 10-day streak without a loss, as energy and commodity stocks dragged the benchmark Stoxx Europe 600 Index the most.

Elsewhere, crude oil dropped for a third day as the continued spread of the delta variant hurts prospects for global demand, just as drilling data from the U.S. points to increased activity. Bitcoin was trading around $47,400.

Here are some events to watch this week:

U.S. Federal Reserve Chair Jerome Powell hosts a town hall discussion with educators TuesdayChina’s top legislative body, the National People’s Congress Standing Committee, begins a four-day meeting in Beijing TuesdayU.S. retail sales are due TuesdayReserve Bank of Australia minutes are scheduled to be released TuesdayReserve Bank of New Zealand policy decision and briefing by Governor Adrian Orr WednesdayFOMC minutes released WednesdayBank Indonesia rate decision and Governor Perry Warjiyo briefing Thursday

For more market analysis read our MLIV blog.

These are the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.6% as of 8:11 a.m. London timeFutures on the S&P 500 fell 0.3%Futures on the Nasdaq 100 fell 0.2%Futures on the Dow Jones Industrial Average fell 0.4%The MSCI Asia Pacific Index fell 0.7%The MSCI Emerging Markets Index fell 0.5%

Currencies

The Bloomberg Dollar Spot Index rose 0.1%The euro was little changed at $1.1790The Japanese yen rose 0.2% to 109.33 per dollarThe offshore yuan was little changed at 6.4802 per dollarThe British pound fell 0.1% to $1.3849

Bonds

The yield on 10-year Treasuries declined two basis points to 1.25%Germany’s 10-year yield declined one basis point to -0.48%Britain’s 10-year yield declined two basis points to 0.55%

Commodities

Brent crude fell 1.4% to $69.58 a barrelSpot gold fell 0.2% to $1,775.48 an ounce

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.