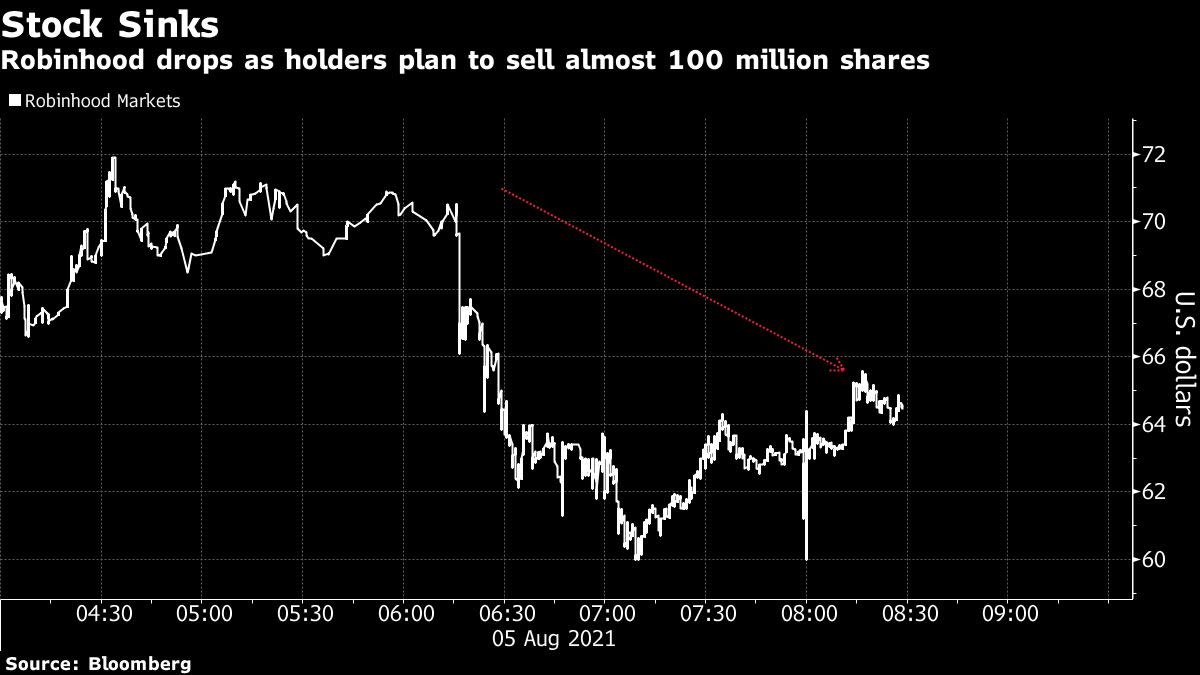

Robinhood Tumbles as Holders File to Sell 98 Million Shares

(Bloomberg) — Robinhood Markets Inc. tumbled as much as 15% in premarket trading Thursday after shareholders filed to sell nearly 100 million Class A common shares less than a week after its initial public offering.

None of the proceeds will be received by the company, with the selling stockholders getting all of the funds from the sales, according to a filing with the U.S. Securities and Exchange Commission. The listed sellers are some of Robinhood’s biggest investors and together combine to hold more than one-third of the firm’s current outstanding shares.

The largest of those holders, Venture capital firm New Enterprise Associates, plans to trim its roughly 10% stake by about 3.9% or 2.9 million shares. Other sellers named in the filing include entities affiliated with Amplo, Andreessen Horowitz, ICONIQ Capital and Ribbit Capital.

The move comes just a day after shares in the zero-fee trading platform soared 50% as a flood of retail traders joined larger investors, such as Cathie Wood’s flagship ARK Innovation exchange-traded fund, in buying the stock.

Read more: Robinhood Surges as Retail Traders Join Wood to Power Rally

Individual investors were a key driver of Wednesday’s volatility with Robinhood being the fourth most traded stock on the day across retail trading platforms, according to data compiled by Vanda Securities Pte. Retail traders exchanged $467 million worth of shares with $50.5 million in net purchases, the data show.

The spike in interest from individual investors despite Robinhood’s underwhelming IPO is a departure from companies like Coinbase Global Inc. or DiDi Chuxing Inc., which saw huge retail demand that quickly waned, according to Vanda’s Ben Onatibia. “After a poor listing, retail demand is surging, something extremely rare with IPOs,” he said in an email.

Shares fell more than than 8% on their first day of trading last week after Robinhood priced its IPO at the low end of its expected range. Since then, they’ve has gone on to rally for four straight days, including Wednesday’s surge that at one point reached as much as 82% and ballooned Robinhood’s market capitalization to a peak of $65 billion.

(Updates to include details on sellers in third paragraph, retail trading activity and pricing throughout)

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.