Average daily output stood at 2.8 million tonnes last month, according to Reuters calculations based on the NBS data, slipping 11% from 3.13 million tonnes per day in June.

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $163.52 a tonne, up 0.6% from Friday’s closing.

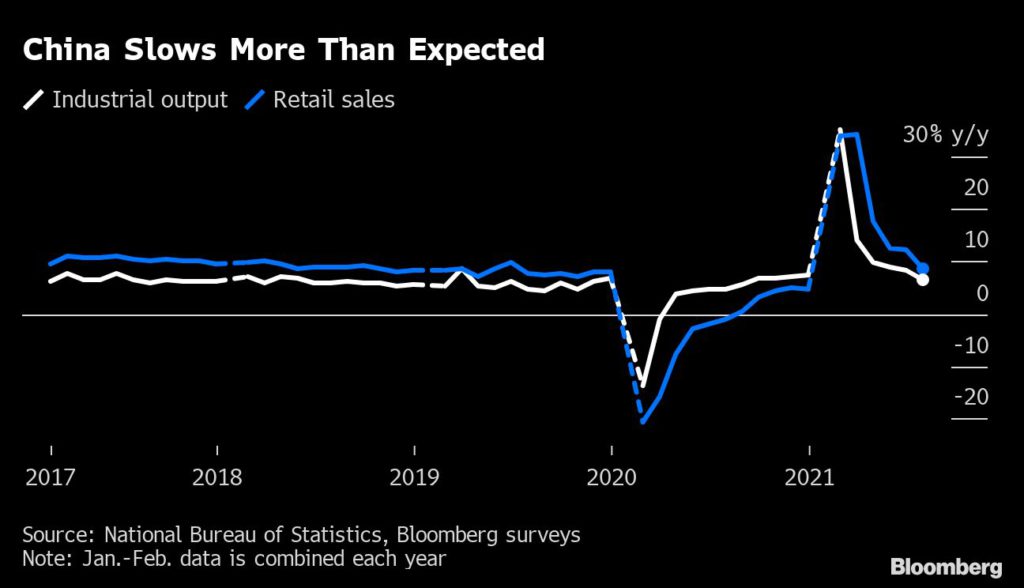

Chinese industrial production in July increased 6.4% y/y vs median estimate of 7.9%

Since late June, Beijing has dispatched inspection teams to local governments and mills to check that cuts in steel capacity and output are being implemented, shutting down outdated blast furnaces and limiting production at more heavily polluting plants.

“(We) should focus on reducing crude steel output at companies with poor environmental performance, high energy consumption and outdated technology and equipment… and to ensure 2020 crude steel output falls from a year earlier,” the China Iron and Steel Association said in a statement.

The association and analysts expect steel demand in China to cool in the second half of the year due to slowing construction activity and still-tight semiconductor supplies that are constraining manufacturing and metals demand in the auto sector.

In the first seven months of the year, China made 649.33 million tonnes of steel, up 8% from the same period a year earlier, the statistics bureau said.

“We are seeing the stacked effect of China’s de-carbonization efforts and uncertainty from covid and global chip shortage,” said Tommy Xie, head of Greater China research at Oversea-Chinese Banking Corp.

Confidence

China’s economy slowed more than expected in July, adding to signs that the global recovery is coming under pressure as the delta virus variant snarls supply chains and undermines consumer confidence.

Retail sales were hit by tough new virus restrictions introduced toward the end of the month to contain fresh outbreaks. Flooding in central China and weak auto sales due to a chip shortage hurt manufacturing, while a slowing property market and environmental policies reduced output of steel and cement, hitting commodity demand.

Retail sales rose 8.5% y/y vs median estimate of 10.9%. Industrial production increased 6.4% y/y vs median estimate of 7.9%.

Fu Linghui, a spokesman for the National Bureau of Statistics said China will maintain a “stable recovery” in the second half of the year, with the main indicators staying “within a reasonable range.”

“We continue to expect a notable growth slowdown in the second half as Beijing leaves little space for dialing back its unprecedented tightening measures on the property sector,” said Lu Ting, chief China economist at Nomura Holdings Inc.

(With files from Reuters and Bloomberg)