Iron ore price up amid signs of resilient demand in China

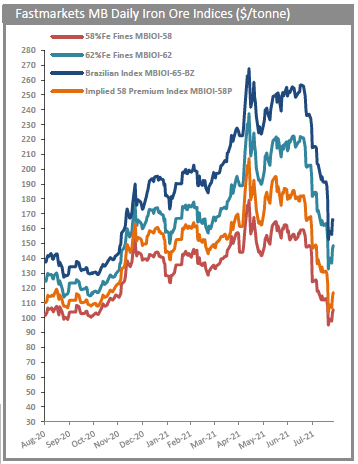

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $148.66 a tonne, up 1.4% from Tuesday’s closing.

Iron ore’s January 2022 contract on China’s Dalian Commodity Exchange ended daytime trading 1.9% higher at 802.50 yuan ($123.90) a tonne, off a session high of 829 yuan, its strongest since August 18.

China’s central bank chief vowed this week to stabilize the supply of credit and boost the amount of money supporting smaller businesses and the real economy after both credit and economic growth slowed in July.

In China, “people are hoping for some further stimulus targeting the infrastructure sector, as real estate and manufacturing are looking bleak,” Erik Hedborg, principal analyst at commodities consultancy CRU Group, said in a note.

China’s ongoing steel production restrictions and covid-19 curbs weighed heavily on iron ore in recent weeks.

Prices have fallen more than 30% from the record peaks in May, and a further drop was possible, according to analysts Erik Hedbord and Richard Lu at CRU.

“CRU forecasts iron ore prices to decline further towards the end of the year, as we see a more balanced market with Chinese demand likely to stabilise for the rest of the year, while seaborne supply continues to improve,” they said in their latest market insight.

Iron ore producers in Australia, the biggest supplier to top steel producer China, have been struggling to keep production elevated, though the analysts said shipment volumes usually improve in the last quarter.

(With files from Bloomberg and Reuters)