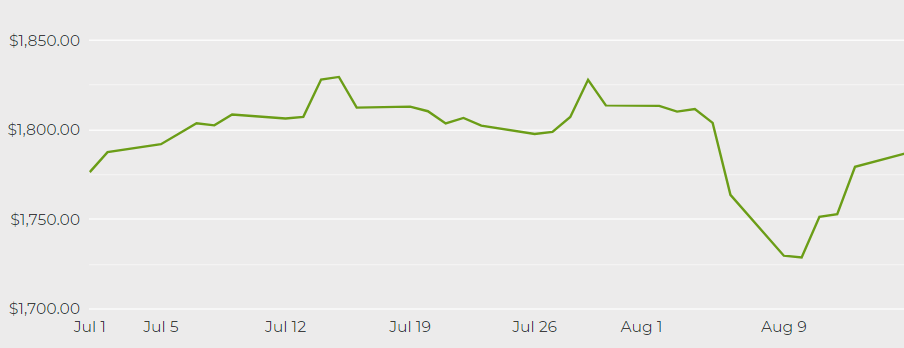

Gold price steadies ahead of Fed minutes

[Click here for an interactive chart of gold prices]

Traders are turning their focus to the Fed minutes due Wednesday afternoon and next week’s Jackson Hole symposium, which may offer clues on the timing of the central bank’s tapering.

In a town hall meeting Tuesday, Fed Chair Jerome Powell flagged that the pandemic is “still casting a shadow on economic activity,” but didn’t discuss the outlook for monetary policy or make specific comments on growth and the risks from the delta variant.

Bullion had slipped Tuesday, snapping four days of gains amid mixed US economic data and lingering concerns over the global recovery as the coronavirus delta variant spreads.

“The biggest positive in gold’s corner may be that the market has likely accounted for coming asset purchase reductions,” said James Steel, chief precious metals analyst at HSBC Securities (USA) in a Bloomberg interview.

“While this does not argue that gold will go higher, it supports the notion that gold may not go much lower. We think gold may be stalled in front of $1,800 an ounce,” he added.

(With files from Bloomberg)