Fresh off IPO, ‘biofacturing’ company Zymergen’s stock plunges about 70% after some really bad news

Less than four months after going public and being valued at more than $3 billion by Wall Street, Zymergen Inc. unleashed some bad news Tuesday afternoon, and was on pace to lose more than two-thirds of its market cap.

Zymergen shares ZY,

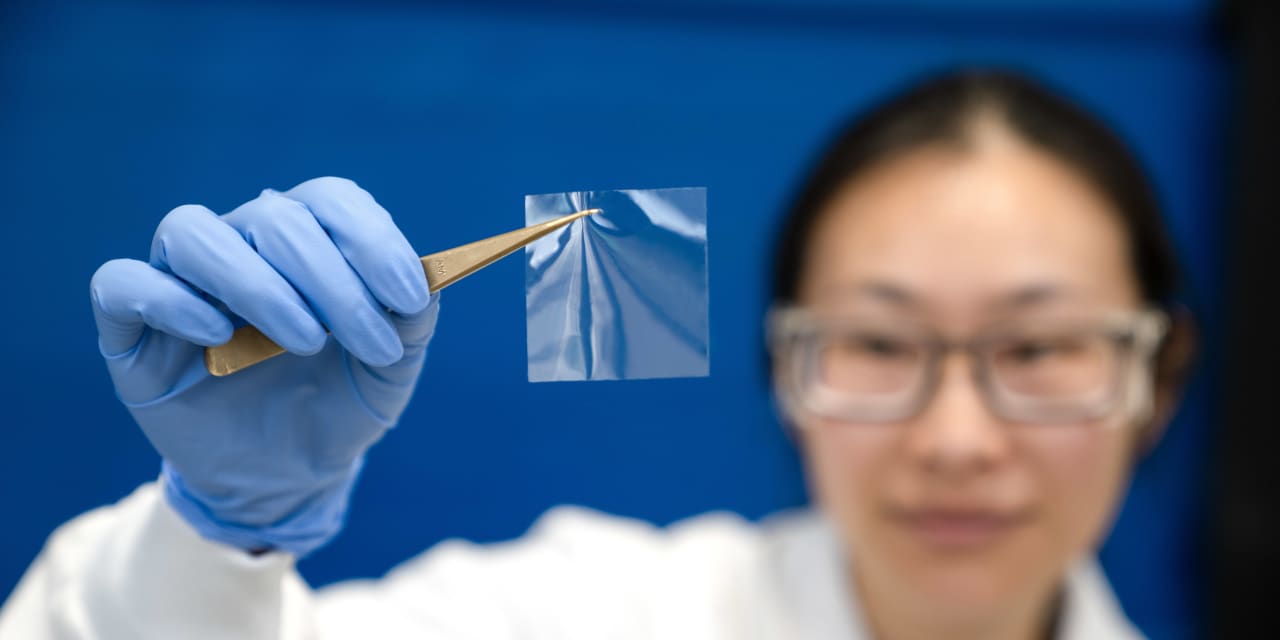

Zymergen is attempting to use natural, or “bio-based,” processes instead of chemicals in manufacturing processes. While going public, Zymergen had only one product, Hyaline, but executives expected that product would begin producing revenue this year while the company developed several new products for other industries, with a focus on electronics, consumer care and agriculture.

In a news release Tuesday afternoon, Zymergen revealed that partners who were using Hyaline in their manufacturing processes “encountered technical issues” that will delay the commercial ramp of the product. Executives also said that data on the market for foldable screens on gadgets like smartphones, part of its push into the electronics market, “indicate a smaller near-term market opportunity that is growing less rapidly than anticipated,” and suggested that would impact the company’s sales forecast.

Speaking of that forecast, Zymergen now expects no product revenue in 2021 and “immaterial” product revenue in 2022, and said executives are “developing a plan to reduce and align expenses with the change in the company’s revenue expectations.” Josh Hoffman stepped down as CEO and a member of the board, effective immediately, and former Illumina Inc. ILMN,

In its first earnings report as a public company in May, Zymergen executives “reaffirmed product pipeline expectations, beginning with Hyaline, which is in a 6-18-month qualification process with multiple customers and set to begin driving revenues in 2H21,” JP Morgan analysts said at the time. They had an overweight rating on the stock with a $40 price target.

“We are disappointed by these developments, and the board and management team are focused on resolving the underlying issues to ensure Zymergen moves forward as a stronger company with a compelling operating plan,” Flatley said in a statement.