The Covid-19 pandemic has disproportionately impacted the finances of many Black Americans, including student loan borrowers. Black college graduates owe an average of $25,000 more in student loan debt than white college grads, and over 50% of Black borrowers say their net worth is less than what they owe on student loans.

Now, a number of historically black colleges and universities (HBCUs) are stepping in to help alleviate that financial burden. With federal funding and private donations, these schools are wiping out current students’ account balances — including tuition and fees — and giving them a fresh start.

“We’re committing $5 million, assisting nearly 2,000 students with account balances,” said Clark Atlanta University President George T. French Jr. “The impetus, of course, was to help our students — and to make sure from a business, from a financial implication posture to make sure that we reduce our student debt, so that they could matriculate and graduate.”

Clark Atlanta University in Atlanta, Georgia, which has nearly 4,000 students in total, was one of the first HBCUs in the nation to use federal pandemic relief aid to clear balances for some of its students.

Clark Atlanta University President George T. French Jr. speaking with students

CNBC | Erica Wright

The school is not only cancelling outstanding tuition balances. Also, starting with the 2020 spring term through the current semester, “if you have a dining or a residence hall balance, it will cover that,” French said. “So whatever balances that you have that would restrict you from coming to school, we are removing those restrictions.”

“We are reinventing the college experience,” he said, “so that our students can graduate nearly debt free.”

During the pandemic, federal stimulus funds have enabled the U.S. Department of Education to make significant investments in under-resourced colleges and universities through the Higher Education Emergency Relief Fund, including more than $2.6 billion to HBCUs.

Autymn Epps is a 20-year-old junior at Clark Atlanta, majoring in business administration.

CNBC | Erica Wright

Autymn Epps, a 20-year-old junior at Clark Atlanta majoring in business administration, said she and her fellow undergrads were stunned when they heard the school had wiped out their unpaid student balances thanks to federal stimulus money.

“When I found out I was speechless,” said Epps, who is also student government president. “We were all surprised. We were like, ‘is this real? Is this happening?’ We were all just talking about how it was such a blessing.”

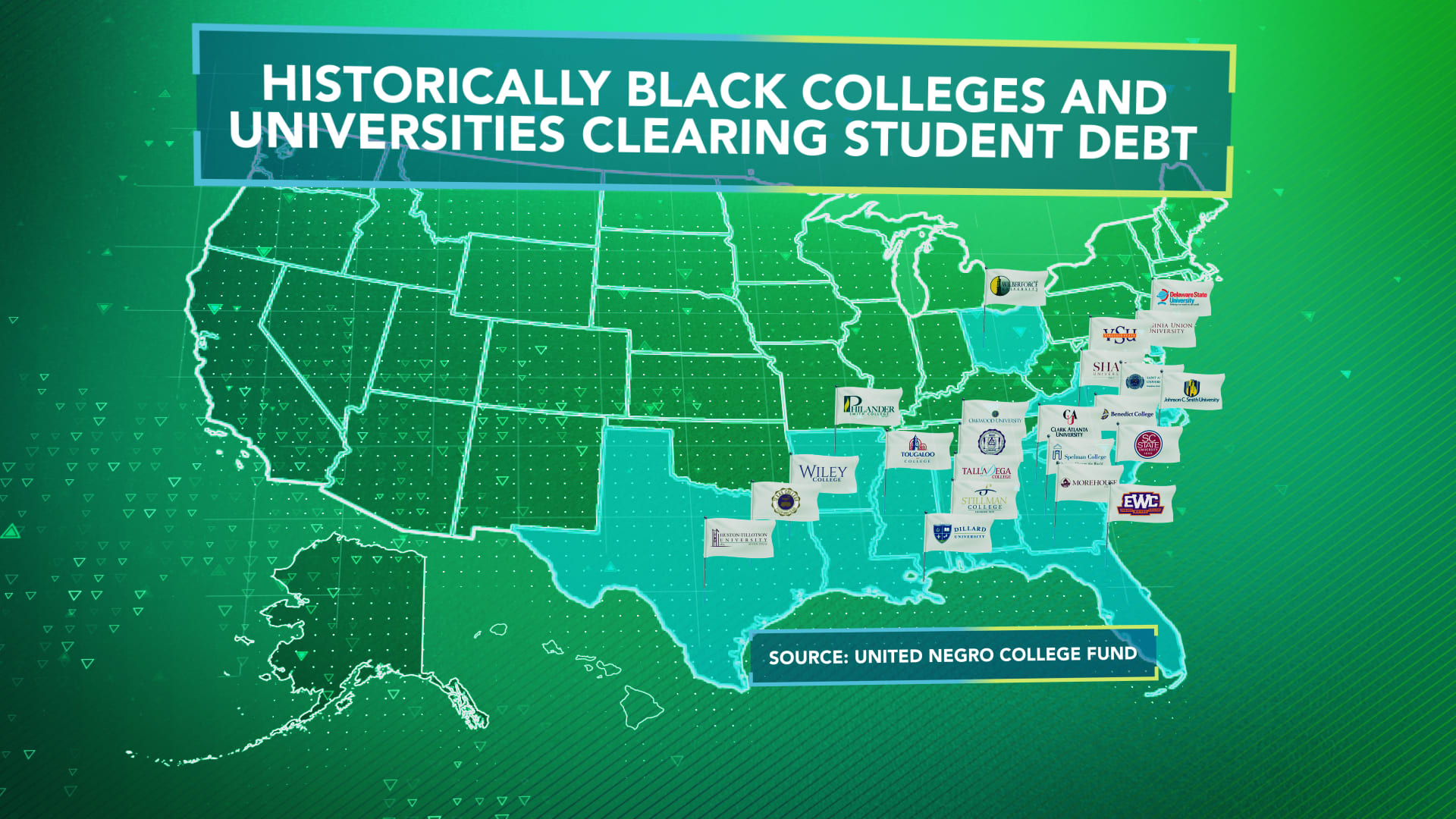

Historically Black colleges and universities clearing student debt

CNBC | United Negro College Fund

Clark Atlanta and other schools, including Ohio’s Wilberforce University, Hampton University in Virginia and Louisiana’s Grambling State University, have sparked a movement that is currently sweeping across the U.S. More than 20 historically black colleges and universities have cleared all or part of money owed for tuition and fees — and experts say that number could grow.

More from Invest in You:

You can still tap free money for college — here’s how

Black women make nearly $1 million less than white men during their careers

There are six more months free of federal student loan payments. Here’s what you can do with the extra money

“HBCUs provide these wraparound services, this culture of caring about their students, not just treating them like a number or bill payers, and because of that history and that culture, when the finances occurred from Congress in the Coronavirus stimulus packages that allow institutions the ability to pay off student debt and student fees, HBCUs stepped up to the plate,” said Lodriguez Murray, senior vice president for public policy and government affairs at the United Negro College Fund [UNCF], which helps fund scholarships for Black students.

“I wouldn’t be surprised if more institutions choose to utilize the funds to positively impact their students, because we’re still in the grips of this pandemic,” Murray said.

Many HBCUs, including Clark Atlanta, have seen an outpouring of support from private donors as well. French said, along with other donations, his school received a $15 million gift from philanthropist MacKenzie Scott, the former wife of Amazon founder Jeff Bezos, and $1 million gift from the Chan Zuckerberg Initiative, an non-profit organization owned by Facebook founder Mark Zuckerberg and his wife Priscilla Chan.

Yet it is the federal pandemic stimulus money that has directly impacted the majority of Clark Atlanta students who have had their student loan debt cancelled. “I’m looking at all of these students who have no prior account balances and their heads are lifted and they’re smiling as they begin a new year,” French said. “It makes me feel tremendously gratified on the inside.”

Many students are simply relieved by the unexpected financial assistance that has come at just the right time. “A lot of students were contemplating…how they were going to come up with thousands of dollars,” Epps said. “With that announcement, that definitely allowed some students to just breathe.”