Rio Tinto’s expansion at the Amrun project will drive bauxite production in the country over the coming years, Fitch says. The Amrun project achieved first production in December 2018 and ramped up operations to the full production rate of 22.8mn tonnes per annum (mtpa) in April 2019.

Metro Mining resumed production at its Bauxite Hills mine in April 2021 after having to cease shipments earlier than expected in September 2020 amid covid-induced market conditions. The timeline for the firm’s stage two expansion at Bauxite Hills will be determined by the outlook for the global economy and long-term offtake agreements, which appear promising, Fitch asserts.

In March 2021 Mitsubishi Corporation reached an agreement to acquire a 30.0% stake in Glencore’s Aurukun bauxite project.

An early-stage development, Mitsubishi plans to reach a final investment decision on the mine during 2022. While bauxite accounts for less than 5.0% of Australian mining value, the country is the global top producer, accounting for an estimated 29.6% of total global output as of 2020, Fitch notes.

Australia will remain a top bauxite exporter to China, although the country may lose some market share over the coming quarters to returning Indonesian supply. Fitch forecasts Australian bauxite production growth to average 4.0% y-o-y in 2021, following 4.8% growth in 2020 as impacted mining firms recover from the covid-19 global pandemic.

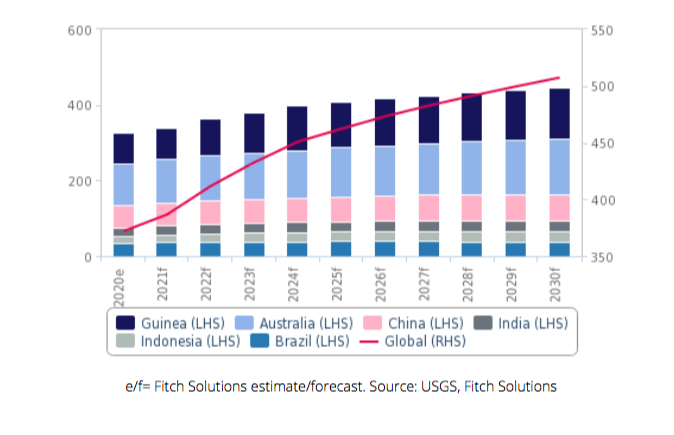

Australia and Guinea to drive growth

Guinea

Guinea’s bauxite sector will see solid production growth over the coming years, driven by a healthy project pipeline and substantial resource base, Fitch says.

Guinea sits on top of the world’s largest bauxite reserves, estimated to be 7.4bnt as of 2020. The country’s bauxite production totalled 82.0mnt in 2020, according to USGS estimates, overtaking China’s position as the world’s second-largest bauxite producer, accounting for more than 22.0% of global output.

In 2017, France’s Alliance Minière Responsable signed a deal with Société Minière de Boke to exploit bauxite near the Boke region. The deposit contains an estimated 430mnt of bauxite, and the mining company aims to produce between 6mnt and 10mnt of bauxite per year with production set to begin in 2022.

In June 2021, the SMB-Winning Consortium inaugurated its ore export railway, which forms a key part of the consortium’s USD3bn Boffa-Boké Project. The USD1bn railway spans 84-mile railway from SMB’s Santou II and Houda blocks to port facilities at Dapilon.

In June 2021, the SMB-Winning Consortium inaugurated its ore export railway, which forms a key part of the consortium’s USD3bn Boffa-Boké project

In August 2018, Alufer Mining completed the development of and began production at the Bel Air project in Guinea, planning to produce 5.5mtpa of bauxite, which will ramp up to 10.0mtpa over a 15-year period.

The firm also holds a 100% interest in the Labe project, which boasts a 2.5bn JORC resource placing it in the top three largest bauxite deposits in the world, Fitch says.

Although it is a longer-term project due to the infrastructure needs, the Labe deposit offers Guinea bauxite production strong future growth potential. As of Q321, Alufer has completed an engineering concept study and has an environmental and social impact study underway.

Emirates Global Aluminum’s $1.4 billion bauxite project by subsidiary GAC began exports in August 2019 and will produce 12.0mnt annually. Also in August 2019, Rio Tinto completed a $700 million expansion at the Sangaredi bauxite mine, which increased annual production from 14.0mnt to 18.5mnt, and Aluminum Corporation Of China began exporting bauxite from its Boffa mines in January 2020.

The Chinese aluminium producer aims to produce 12.0mnt of bauxite per year from the project. In February 2020, Terracom acquired Anglo African Minerals and its three Guinean bauxite developments: FAR, Somalu and Toubal. Terracom will initially prioritise the development of the FAR project, which is expected to produce 3mtpa for the first year and a half before ramping up to 5mtpa.

More recently, in January 2021, Australian firm Lindian Resources signed a memorandum of understanding with Chinese construction company China Railway Seventh Group (CRSG) concerning the creation of an infrastructure development plan for Lindian’s Guinean bauxite assets: the Woula, Lelouma and Gaoual projects.

Later in March 2021, CRSG visited Lindian’s sites in Guinea. Fitch forecasts Guinea’s bauxite output to rise from 84.5mnt in 2021 to 133.8mnt in 2030. This represents an average annual growth of 5.1% during 2021-2030.

(Read the full report here)