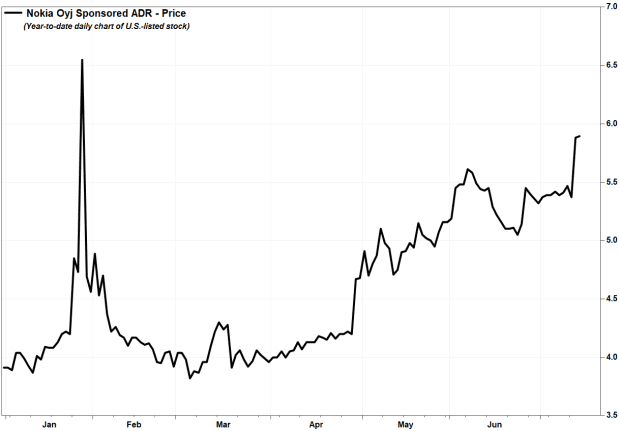

Nokia stock extends gains toward 6-month high after J.P. Morgan says it’s time to buy

Shares of Nokia Corp. extended the previous session’s surge toward a six-month high Wednesday, after J.P. Morgan analyst Sundeep Deshpande turned bullish on the networking equipment company, citing a “turnaround” in gross margin in its mobile networks business.

The Finland-based company’s U.S.-listed stock NOK,

On Tuesday, the stock shot up 9.5% on volume of 112.9 million shares after Nokia said it planned to increase its full-year financial guidance, following “strong” second-quarter results. Nokia is scheduled to release second-quarter results on July 29.

Deshpande raised his rating to overweight, one year after downgrading the stock to neutral. He raised his price target on the U.S.-listed shares by 81%, to $7.80 from $4.30. The stock hasn’t traded as high as $7.80 since April 2015.

He believes the positive trends Nokia has seen during the second quarter “is just the start” of an upgrade cycle, which will lead to upside to mobile network gross margin.

“We believe investors should position for the upgrade cycle that is likely to continue to play out over the next 12 months,” Deshpande wrote in a note to clients, with his new target implying a gain of more than 30% from current levels.

He noted that the consensus analyst expectation is for second-quarter gross margin in mobile networks to decline 1.26% from a year ago, even though it rose 2.2% during the first quarter, which is typically the worst quarter in the year for Nokia. Read more about Nokia’s first-quarter results.

Deshpande said he believes it is unlikely that gross margin in mobile networks declines, given that “more and more” equipment is now shipping.

“Thus, we now feel fairly confident that consensus gross margin for this division is wrong and that Nokia’s gross margin in Mobile Networks will be flat or increase year-on-year, with a related positive impact on operating profit,” Deshpande wrote.

Nokia’s stock has run up 50.6% year to date, while the SPDR Communication Services exchange-traded fund XLC,