Gold price hits 4-week high following Powell’s dovish commentary

Powell’s comments helped ease concerns that faster-than-predicted US inflation data will see the central bank taper its monetary stimulus earlier than expected.

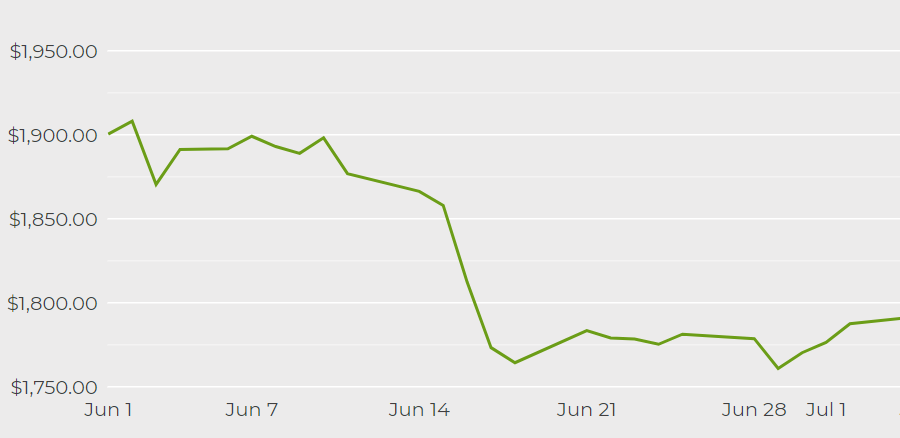

Bullion has been hovering around $1,800 an ounce since the beginning of July, after posting its worst month since 2016, as the Fed brought forward its forecasts for rate hikes amid concerns about inflation.

Spot gold jumped 0.8% to $1,822.54 per ounce by 11:35 a.m. ET Wednesday, its highest since mid-June. US gold futures also gained 0.8%, trading at $1,824.30 per ounce in New York.

[Click here for an interactive chart of gold prices]

Some investors view gold as a hedge against higher inflation, but a Fed rate hike would dull the metal’s appeal as it increases the opportunity cost of holding the non-yielding bullion.

“On the one hand, gold is getting boosted by inflation hedge, but on the other hand, rising market expectation for a rake hike at the end of 2022 is offsetting some of the price advances,” Xiao Fu, head of commodity market strategy at Bank of China International, told Reuters.

“So far, the Fed has been assuming that the noticeably higher inflation rates are only transitory and that they will normalise again next year,” Commerzbank analysts said in a note.

“However, with each higher figure, the risk increases that inflation will remain elevated for a longer period of time.”

Wednesday’s data showed prices paid by producers gained more than forecast in June, mirroring data on consumer prices on Tuesday. US consumer prices rose by the most in 13 years last month, causing investors to intensify their focus on the Fed’s messaging.

Another gauge on the state of the economic recovery will come from retail sales data on Friday. Powell will also appear before the Senate Banking Committee on Thursday.

(With files from Bloomberg and Reuters)