Gold price fails to capitalize on falling bond yields

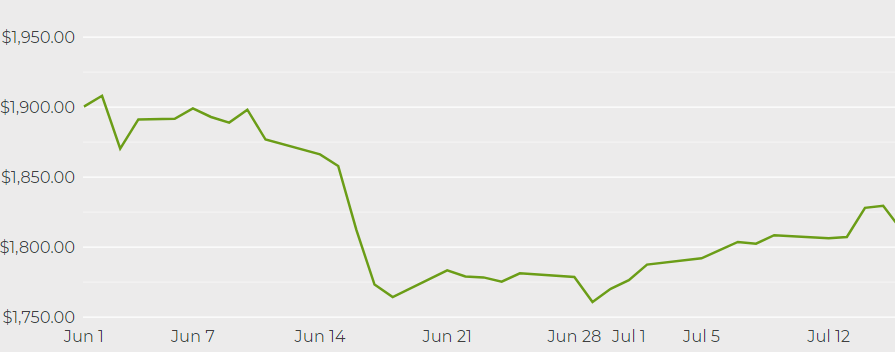

[Click here for an interactive chart of gold prices]

Meanwhile, US stock-index futures and European equities both gained as markets stabilized following Monday’s rout, which saw the S&P 500 fall the most in two months.

Benchmark 10-year treasury yields touched more than a five-month low Tuesday, reducing the opportunity cost of holding non-interest bearing gold.

The precious metal has jumped about 4.3% from more than a two-month low hit last month, but is down about 4% since the start of the year.

New waves of covid-19 are challenging previous optimistic assumptions about the pace of the global economic recovery, giving investors a reason to think about havens like gold.

The US on Monday warned citizens against travel to the UK and Indonesia, while hospitalizations in Texas rose the most since April and Southeast Asia reels from a wave of infections.

Anything which forces central banks to prolong their stimulus will be welcomed by gold. In June, the metal endured its worst month since 2016 after the Federal Reserve brought forward its forecast rate hikes amid fears about inflation.

However, Commerzbank previously said in a note that gold’s recent weakness would likely only be temporary, and it would recover noticeably as soon as the headwind of an appreciating dollar abated.

“A lot of people in the gold market have taken their eyes off the ball this year, but if we get more bad news on the covid front and equities remain weak, you could get just that flight-to-safety buy in a market that can wake up pretty quick,” Bob Haberkorn, senior market strategist at RJO Futures, told Reuters.

(With files from Bloomberg and Reuters)