The release of state metal reserves is one of a number of attempts by Beijing to cool a stellar rally in commodity prices that has squeezed manufacturers’ margins.

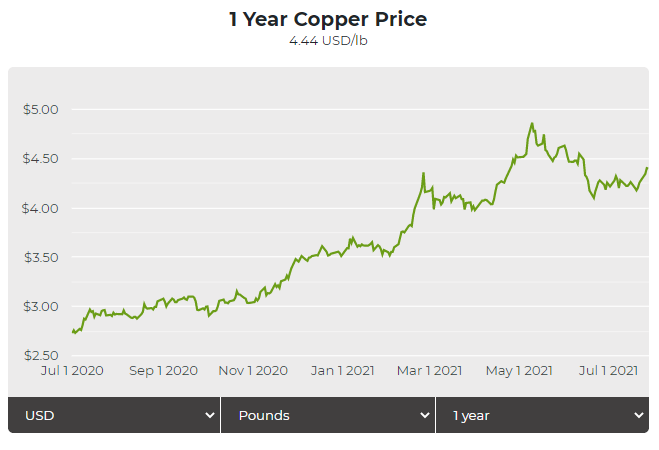

Click here for an interactive chart of copper prices

China announced it would release a total of 170,000 tonnes of metals, including copper, aluminum and zinc, from state reserves on Thursday to nonferrous fabricators.

A total of 30,000 tonnes of copper and 50,000 tonnes of zinc was open for public bidding on the platform operated by China Minmetals Corp.

Related read: Copper price: After China ban, Australia had no problem finding new concentrate buyers

The platform crashed several minutes after auctions started, but later resumed.

Goldman Sachs said in a recent note that copper prices are poised to grow as demand outpaces supply since the concentrate market is very tight, particularly in China.

The bank’s three-month, six-month and 12-month price targets for copper are $10,500 per tonne, $11,000 per tonne, and $11,500 per tonne, respectively.

(With files from Reuters)