We put these eight meme stocks through a rugged analytical test. Which are poised for growth and which have big downsides?

Every day the meme stocks dominate the financial media. And rightly so — they are illustrating the power of communications, as traders and investors seek to follow momentum to big profits.

It’s easy to dismiss the phenomenon, because it isn’t based on companies’ traditional measures of profitability or sales growth, ratios of share prices to earnings or sales, or even innovative products or services. But so much money is trading around these stocks that you should at least learn about what is going on.

Traders trying to understand the momentum and make quick gains will, of course, look at daily trading volumes and the immediate direction of share prices. But there are also measures of momentum among people communicating in Reddit’s WallStreetBets channel and other social media. One of these, called a “social sentiment analysis,” was developed by HypeEquity and described here by Thornton McEnery.

But you might also be interested in whether any of these stocks might make good long-term investments. Or you may want to see financial information and standard stock valuations for the meme stocks, as part of your arguments against them.

Read: AMC’s early loss is BlackBerry’s gain as meme stocks enter a BANG rotation

The meme stocks

In talk of meme stocks, there is an acronym, BANG. BlackBerry Ltd. BB,

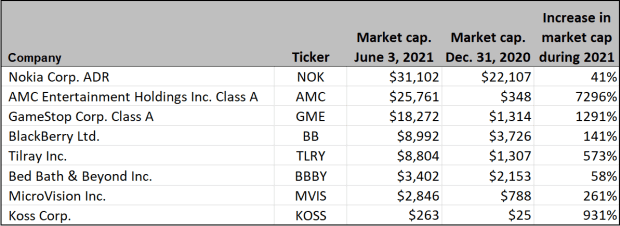

Here they are, sorted by market capitalization in millions of dollars:

AMC’s market capitalization is up more than sevenfold this year. All of the listed meme stocks’ valuations have rocketed, although only by double digits for Nokia and Bed Bath & Beyond BBBY,

The boards of directors of AMC and GameStop each took advantage of the excitement among traders and sold new shares to the public to raise billions of dollars. AMC announced and completed the sale of 11.55 million new shares June 3.

Short interest

What started this year’s meme-stock craze was an opportunity described on WallStreetBets to create short-squeezes on heavily shorted stocks.

Here’s a definition of short-selling and its risks:

- Short selling is when an investor borrows shares and immediately sells them, hoping to buy them back later at a lower price, return them to the lender and pocket the difference.

- Covering is when a person with a short position buys the shares to return them to the lender, hopefully to profit if the shares have gone down in price since they were shorted, or to limit losses if they went up after being shorted.

- A short squeeze is when many investors looking to cover short positions start buying at the same time. The buying pushes the share price higher, making short investors accelerate their attempts to cover, which sends the shares spiraling higher in a frenzy.

So you have unlimited risk if you short-sell stock — you never know how high its price might go. If you buy shares outright (that is, take a long position), you have only risked the amount you invested.

If you have shorted a stock and its price has gone the wrong way — up — your broker might make a margin call, which means you need to deliver cash to cover the broker’s risk. Short-sellers are told these rules by their brokers before entering short trades. But the margin requirements can lead to short squeezes when investors run out of cash. Brokers will force-sell the shares if the required cash margin isn’t maintained by the investor/trader.

So at the early stage of meme-stock mania, the WallStreetBets crew was able to buy shares of heavily shorted stocks as a group, which drove their prices higher and even led to covering (at losses) by professionals. The resulting short-squeeze made a lot of money for traders whose timing was right. And the buzz has continued since then as the meme stocks have bounced up and down.

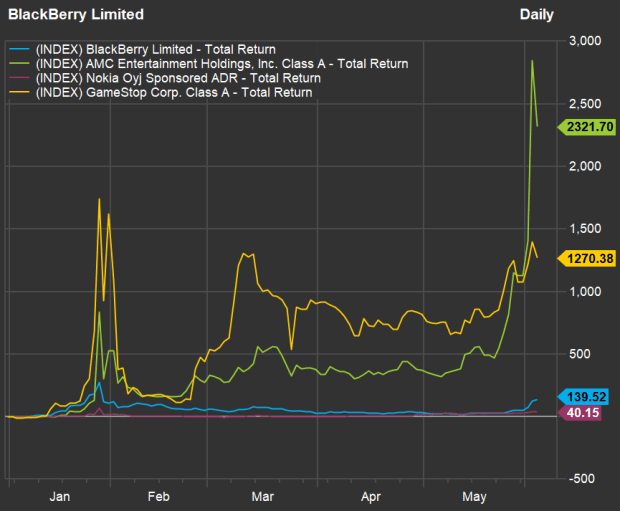

Here’s a year-to-date chart showing total returns for the BANG stocks through June 3:

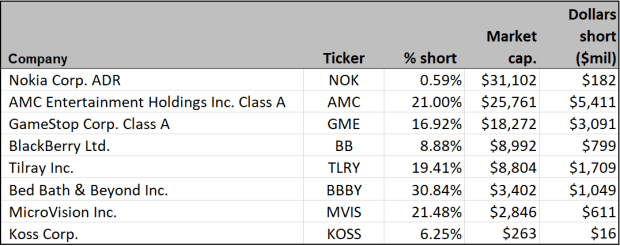

How much short interest is there now for this group of eight stocks? Here they are, ranked again by market cap:

FactSet’s data on short positions as a percentage of shares outstanding is updated twice a month, with the second update around the 25th day of the month.

The “dollars short” figure is of interest, as it gives some additional perspective to the short percentages. For example, 4.2% of Tesla Inc. TSLA,

In late January, when GameStop had a seemingly impossible 138% in short interest, Brad Lamensdorf, CEO of ActiveAlts in Westport, Conn., who runs long and short investment strategies, said a short percentage “over 30% to 40% is outrageously high.” At that time we listed 30 stocks in the S&P Composite 1500 Index that were shorted 25% or more. (Lamensdorf co-manages the AdvisorShares Ranger Equity Bear ETF HDGE,

But now, only four stocks in the index are short 25% or more, according to FactSet’s most recent data: Geo Group Inc. GEO,

So this year’s action with the meme stocks has had quite an effect on the stock market, quelling short-selling in general. That said, even with low short-interest numbers for Nokia and Koss Corp. KOSS,

Meme stocks’ fundamentals

To analyze the meme companies’ financial results and prospects, we will look back and then ahead. The coronavirus pandemic had an obvious brutal affect on AMC, as its theaters were all closed. It had reopened nearly all U.S. theaters with limited capacity by he end of March.

GameStop has been challenged for years by a fundamental problem for a videogame retailer: More content being sold online, even for console gaming systems, rather than through Blu-ray or other media that were sold at the stores.

So AMC and GameStop were obvious candidates for shorting until traders were able to group together via Reddit and online trading applications, including Robinhood, to cause the short-squeezes.

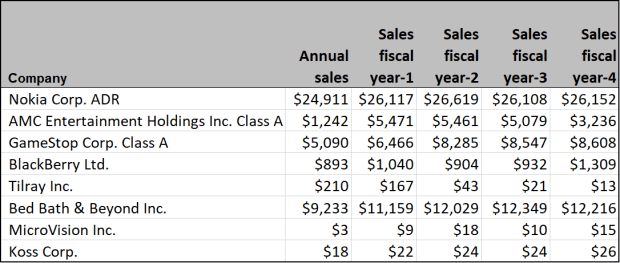

Five-year review

First, let’s look at the direction of all eight companies’ sales results over the past five full fiscal years. We’re looking at fiscal years because for several of these companies, fiscal years don’t match the calendar:

Even before the pandemic, AMC’s sales had declined during 2019. So did Nokia’s, although the company is putting up impressive sales numbers for one that makes mobile telecommunications devices and isn’t Apple Inc. AAPL,

Looking ahead — sales

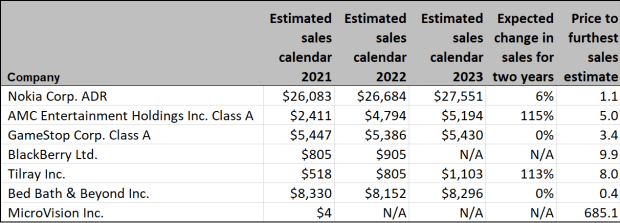

What if AMC and GameStop were able to put all that money they have raised to good use? Starting from a baseline of calendar 2021, to get past most of the effect of the pandemic in the U.S., here are sales projections going out another two years, where possible:

You may have noticed that Koss isn’t included in the sales projections table. That is because FactSet was unable to obtain any financial estimates, ratings or targets from analysts at brokerage firms for the company.

Among the companies for which we have estimates for 2023, AMC is expected to show a sales recovery to come close to pre-pandemic levels. Tilray Inc. TLRY,

The right-most column is a hybrid of market cap as of June 3 to the furthest-out sales estimate available. Nokia looks cheap, and Wall Street analysts concur, as you will see below. This company stands apart from the other meme stocks.

Putting those price-to-sales estimates into perspective, the benchmark S&P 500 Index SPX,

Looking ahead — earnings

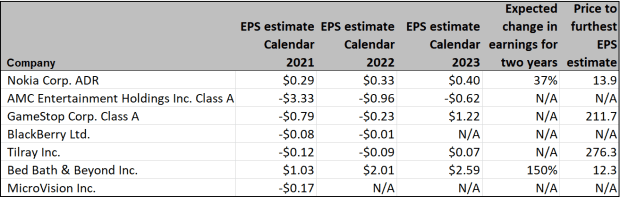

Let’s do the same exercise for earnings-per-share estimates going out to 2023, where possible:

For expected changes in EPS, we have “N/A” for most companies because the EPS estimates for AMC and BlackBerry are all negative, while estimates swing from negative to positive to negative for GameStop and Tilray. For the companies expected to remain consistently profitable — Nokia and Bed Bath & Beyond — the ratios of current price to 2023 EPS estimates are lower than the ratio of 18.4 for the S&P 500.

Wall Street’s ratings and targets

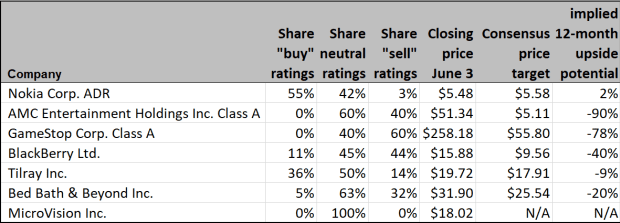

Analysts at brokerage firms tend to shy away from negative ratings. They also set 12-month price targets. Those can be considered too short for some long-term investors looking to invest in companies that compound sales and profit at decent rates over many years. But the 12 months can be an eternity for traders trying to jump on volatile meme-stocks for gains.

Here’s a summary of sentiment among Wall Street analysts for seven of the eight meme stocks listed above (again skipping Koss, for which no ratings or estimates are available):

Nokia stands out with majority “buy” or equivalent ratings. But the stock was a bit ahead of the consensus price target as of the close June 3.

For the other meme stocks, a focus on the daily buzz in Reddit and other social media may be your best way to gain insight into very difficult and risky trading.