This is the power source investors are overlooking in the push to net-zero emissions, Barclays says

The push to limit the damage from climate change has caused a huge pickup in the adoption of solar, wind and other renewable energy. The costs to operate are dropping, and storage costs also are falling. Of a sign of the way things are headed, BP BP,

The U.K. bank Barclays says investors are overlooking one key source in the push to decarbonization. “We believe that the current view of investors is that almost the entire gap of required carbon free generation output until 2050 will be met by building more renewables capacity. Nuclear energy, even though still a key part of the global generation mix, is not expected to see an increase in installed capacity,” says the bank in a new report released on Wednesday.

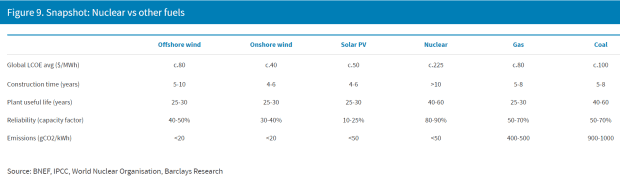

This may be a mistake, the bank argues. Nuclear, like other renewable energy, doesn’t generate direct carbon or greenhouse gas emissions. Unlike renewable energy, nuclear output isn’t influenced by weather conditions and seasonality. If renewable energy operates at a load capacity of about 25%, you have to build 3.5 times more capacity to match nuclear plants operating at a load of 90%.

Nuclear waste also is less than the expected volumetric annual waste from retired solar panels, wind turbine blades and lithium ion batteries. And importantly, nuclear power doesn’t need the storage solutions that renewable energy requires. Nuclear’s high capital costs could come down if their plants’ lives were extended or more plants were built, the report adds.

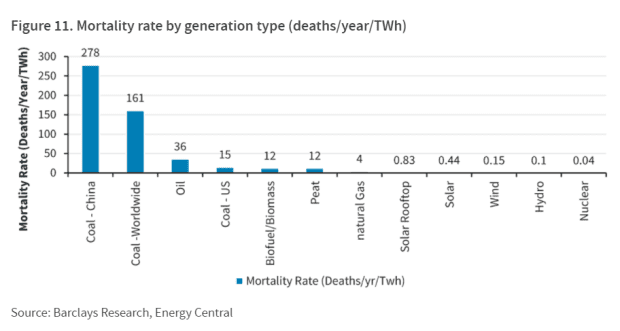

The big issue, of course, is safety, and there haven’t been solar or wind disasters on the par of Chernobyl or Fukushima Daiichi. Even there, though, the Barclays report argues nuclear is safer in terms of workers’ lives lost per year per terawatt hour. Furthermore, all the accidents have occurred in the earlier-generation plants. “Advanced nuclear reactors and proposed small modular reactors do not rely on power to drive safety systems. Instead, they depend on the laws of physics (gravity, convection, heat transfer) to protect the core in the event of an accident. These designs should provide even better safety statistics than the historical comparables,” the report says.

Investors are at odds on how they view nuclear power through an environmental, social and corporate governance lens. In France, the Barclays report notes, only one of the top five investment managers limits nuclear power investing, while four of the top five investment managers in Germany mention nuclear power in their ESG exclusion lists. The European Commission has yet to rule on whether nuclear power is considered green within its classification system. “When this decision is made, the market may feel there is more clarity on the role of nuclear in the green transition, which may help build a stronger consensus amongst investors still unsure about the nuclear power sector from an ESG perspective,” the report says.

Zoom tops forecasts

The meme stocks will be back in the spotlight, following movie-theater chain AMC Entertainment’s AMC,

Videoconferencing provider Zoom Video Communications ZM,

The Federal Reserve’s Beige Book collection of economic anecdotes highlights a quiet day of economic releases, and a number of Fed officials are due to speak. President Joe Biden is meeting Sen. Shelley Moore Capito, a West Virginia Republican, to discuss infrastructure spending plans.

The emails of top U.S. infectious-disease expert Dr. Anthony Fauci, obtained by The Washington Post and BuzzFeed, were dominating social media.

Euro slips and lira slumps

U.S. stock futures ES00,

Gold futures GC00,

Another boom for cannabis stocks?

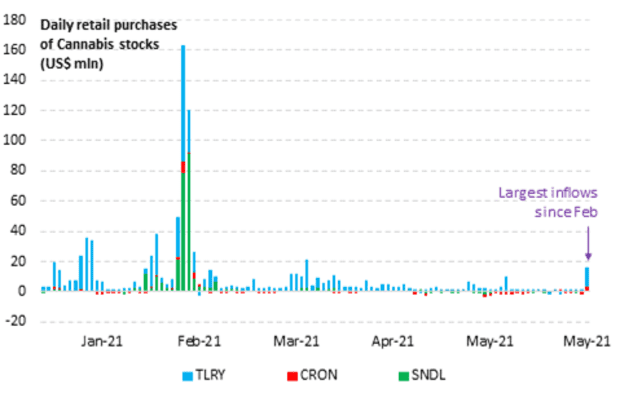

Inflows from individual investors to cannabis stocks have surged in recent days, amid the reintroduction of the Marijuana Opportunity Reinvestment and Expungement Act, which faces steep odds of success with Republicans having filibuster power in the U.S. Senate. Analysts at research firm Vanda point out that the last time meme stocks crashed, in February, individual investors quickly turned to the pot sector, and online retailer Amazon AMZN,

Random reads

Speaking of Amazon, it called its warehouse workers “industrial athletes” in a pamphlet it says was created in error.

A rare “ring of fire” solar eclipse is coming next week.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.