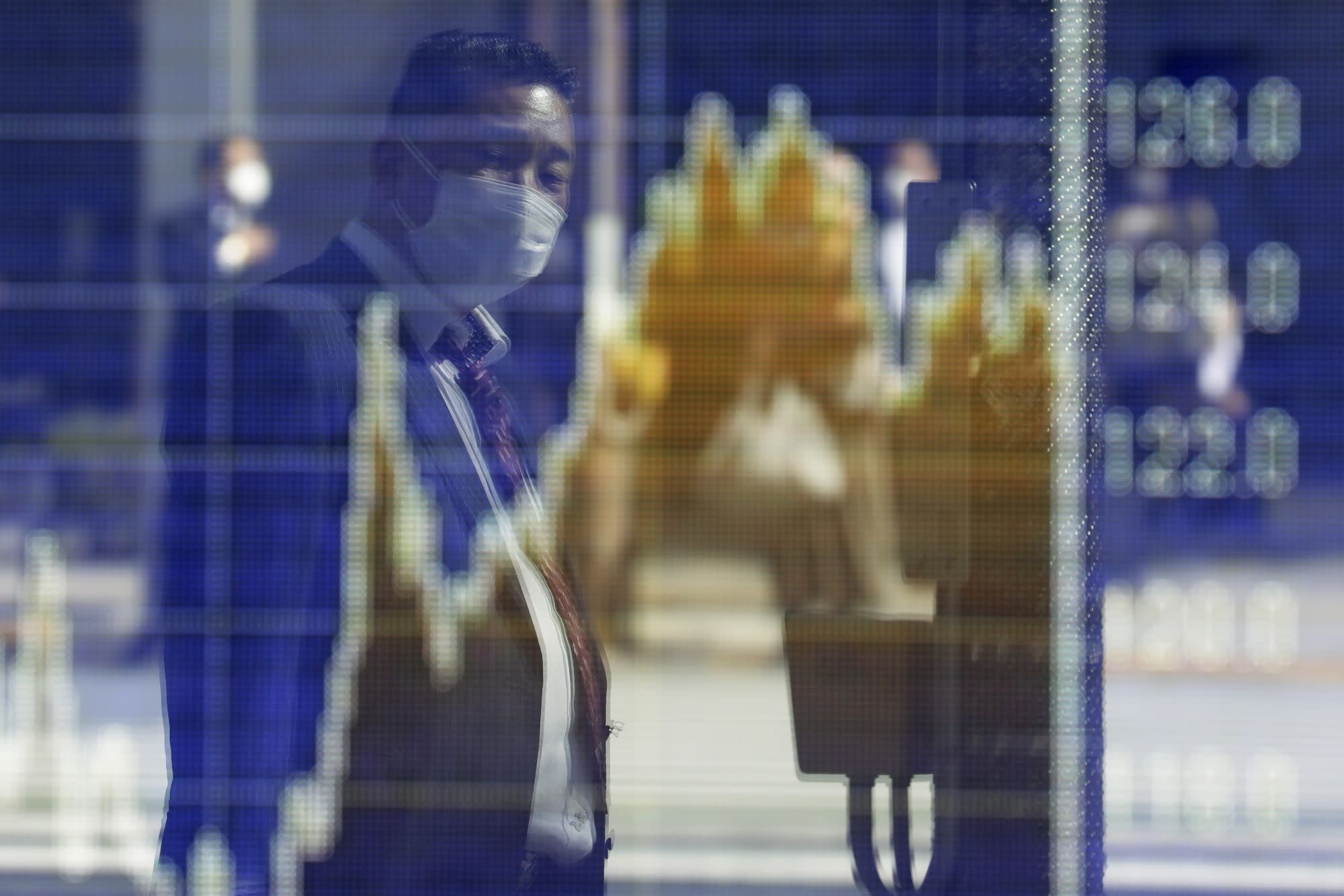

Stocks Drop as Reflation Trade Continues Unwind: Markets Wrap

(Bloomberg) — Stocks fell for a fourth day, extending a bout of volatility ignited by surprise hawkishness at the Federal Reserve that may be exacerbated Friday by the mass expiration of stock options. Commodities such as copper slumped while the dollar touched a two-month high.

The Dow Jones Industrial Average was on pace for its worst week since January as investors step back from trades tied to expectations for hot economic growth and inflation. The tech-heavy Nasdaq 100 dropped from a record high. Yields on shorter-maturity Treasuries jumped after St. Louis Fed President James Bullard said on CNBC that the central bank has started discussing scaling back the pace of pandemic bond-buying.

“The reverse rotation is continuing,” said Giorgio Caputo, senior fund manager at J O Hambro Capital Management. “At a certain point, a hawkish Fed isn’t good for anyone, even technology shares.”

Markets that are clearly benefiting from the reopening are seeing a pullback, with copper on course for its worst week since the start of the pandemic.

Oil fell for a second day, with Brent crude slipping from this week’s 2018 high. An advance in the dollar this week has made commodities that are priced in the U.S. currency more expensive, driving declines across the complex. The Bloomberg Dollar Spot Index rose for a sixth trading session.

Some volatility may be possible later when options and futures on indexes and equities expire, an event known as “triple witching.”

European shares fell the most in a month, with the longest streak of gains since 1999 brought up short by the Fed’s hawkish tilt.

Read: Stock-Market Doldrums Face Shake-Up With Friday’s ‘Witching’

For more market commentary, follow the MLIV blog.

These are some of the main moves in financial markets:

Stocks

The S&P 500 fell 0.9%, more than any closing loss since May 12 as of 9:51 a.m. New York timeThe Nasdaq 100 fell 0.6%The Dow Jones Industrial Average fell 1.2%, falling for the fifth straight day, the longest losing streak since Jan. 27The Stoxx Europe 600 fell 1.3%, more than any closing loss since May 19The MSCI World index fell 0.9%, more than any closing loss since May 12

Currencies

The Bloomberg Dollar Spot Index rose 0.3%, climbing for the sixth straight day, the longest winning streak since March 23, 2020The euro fell 0.4% to the lowest since April 5The British pound weakened 0.6%, falling for the fourth straight day, the longest losing streak since April 9The Japanese yen fell 0.2% to 110.42 per dollar

Bonds

The yield on 10-year Treasuries was little changed at 1.50%Germany’s 10-year yield was little changed at -0.20%Britain’s 10-year yield was little changed at 0.77%

Commodities

West Texas Intermediate crude rose 0.3% to $71.27 a barrelGold futures were little changed

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.